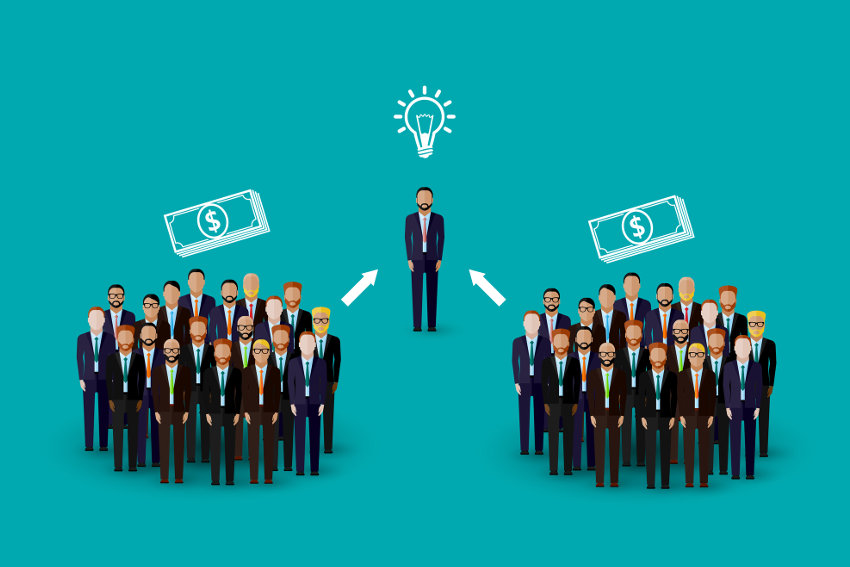

Equity crowdfunding is a mechanism that enables groups of investors to fund startup companies and small businesses in return for equity .This form of investment is now a larger source of capital for startups than traditional venture capital companies. Furthermore, the market has been doubling year on year.

Here are 5 key benefits of equity crowdfunding for startups and investors.

1. Access to capital

startups cannot prohibit themselves from discussing capital investment with potential investors. This will force them to be limited to personal networks to raise finance. Equity crowdfunding allows entrepreneurs to raise funding online from accredited investors.

2. Costs

Crowdfunding has a lower barrier of entry for startups compared to traditional funding routes. Many crowdfunding platforms charge nothing to start your campaign, and if you raise funds through the platform you only pay a small fee.

Top 10 institutions that offer business funding in Kenya

3. It’s not just about the money

Investors can drive long-term engagement, loyalty, and advocacy. Entrepreneurs can now utilize the power of the crowd for feedback, comments and ideas, which are especially important during the startup stage. In other words, investors bring expertise, but the crowd brings customers and fans.’

4. Spreading the risk

Equity crowdfunding investors are a large pool of investors investing at lower levels, lowering the overall risk.

5. Democratizing and decentralizing

Over the past years asset prices have grown much higher than wages for the majority of people in the country. Giving people an opportunity to invest in the future companies would open up the private equity market to millions more people.

Equity crowdfunding democratizes and decentralizes private investment. This is because it offers lower barriers to entry for startups. In addition it brings greater liquidity and asset choices for investors.

It is already a major source of alternative investment for startups and entrepreneurs around the country. It will continue to grow and offer an increasing share of new business funding in the future