Internet advertising in Kenya has overtaken television, newspapers, magazines, music and radio market segments as business models shift to meet consumers online – where many people spend much of their time and money.

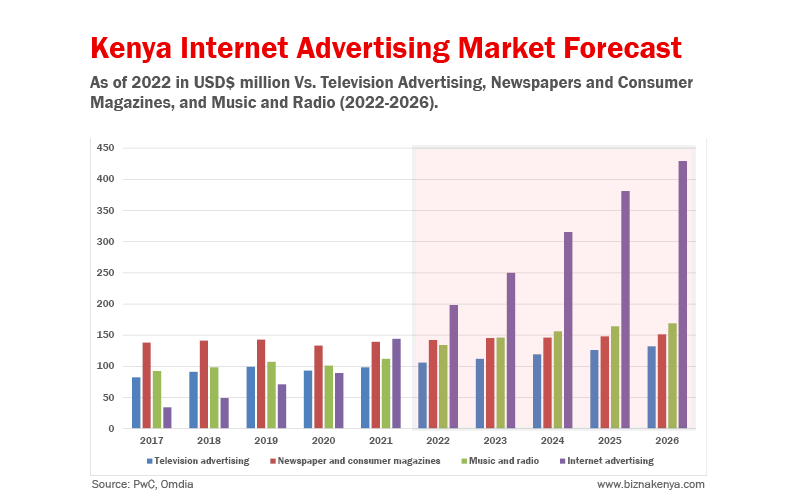

According to the latest PwC Africa Entertainment & Media Outlook Report, internet advertising expenditure in the country rose to $144 million in 2021 from $89 million in 2020.

In comparison, television advertising for 2021 rose to $98 million from $93 million a year earlier. Newspaper and consumer magazines revenues stood at $139 million last year from $133 million in 2020.

On the other hand, music and radio revenue stood at $112 million in 2021 from $101 million a year earlier.

This marks the first time ever that internet advertising has overtaken the three formerly dominant market segments that have been severely impacted by the fast adoption of e-commerce in the country.

The steady shift in consumer attention to digital platforms has forced advertisers to prioritise digital advertising to reach prospects that are increasingly consuming less of traditional media.

Biggest casualty

Print advertising is arguably the biggest casualty of the evolving consumer behaviours – with revenues for newspapers and consumer magazines expected to lag behind music and radio next year.

“Music and radio will overtake newspapers and consumer magazines in 2023, driven by gains in traditional radio advertising revenue,” the PwC report said.

READ: 7 Pros and cons of radio advertising

Video games will also outdo newspapers and consumer magazines next year.

Internet advertising, which includes ads that appear on desktop and laptop computers, tablets, smartphones, and other interconnected devices, offers a wider reach at a fraction of traditional media such as TV and newspapers.

Thanks to its powerful targeting options, digital advertising ensures that an advertiser reaches the right people at the right time.

It also makes it easier for advertisers to track conversions.

“The ability of online (advertising platforms) to provide measurable business outcomes for advertisers has been a motivating factor and will likely continue to drive growth,” PwC said in a different report.

$430 million

Internet advertising in Kenya is expected to hit $429 million in 2026, just $23 million below the combined revenues of TV, newspapers, and radio which are projected to hit $132 million, $151 million, and $169 million, respectively.

This will be driven by the mobile advertising sub-segment, as is the case globally, although locally it is the mobile search that will see the largest gains over the next five years.

READ: 5 Things to consider before starting an online shop

However, local publishers are not necessarily benefiting from this growth, with most of the digital ad spend being assigned to global publishers – mainly Google parent company Alphabet Inc., and Facebook parent Meta Platforms.

A growing share of digital advertising budgets are also being assigned to display and search advertising that appear on retailers’ e-commerce platforms.

Amazon, for example, has already positioned itself as the world’s third largest advertising platform – eating into the Google-Facebook ‘duopoly’ that currently takes up the bulk of digital advertising outside of China.

READ: The rise of e-commerce in Kenya

Regional e-commerce giant Jumia is also competing for a share of the local internet advertising spend with its sponsored products strategy that allows vendors to promote their products on its e-commerce platform.