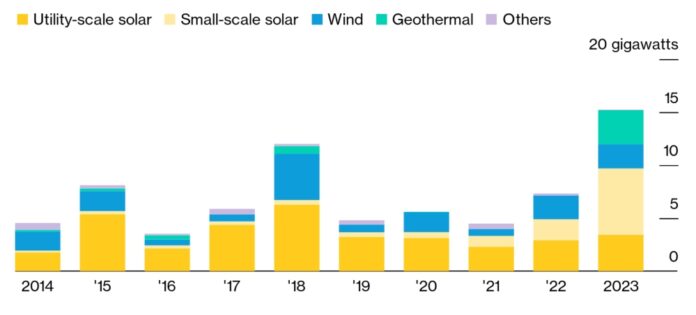

The African Union has committed to bring 300 gigawatts of renewables online by 2030 – more than quadruple the 72 gigawatts the continent had last year – to reach its decarbonization and energy access goals. The Africa Power Transition Factbook 2024, produced by BloombergNEF (BNEF) with support from Bloomberg Philanthropies, finds that the target means annual deployments will need to jump from 8GW today to 32.5GW per year for the rest of the decade.

Progress has been made. Africa’s installed renewable energy capacity has doubled over the last decade. However, neither country-level targets nor BNEF’s deployment forecast are aligned with the African Union’s 300GW goal. BNEF’s 2030 forecast for wind and solar additions falls 43% short of the necessary build, and even the upper range of country-level targets misses it by 35%. This points to a major delivery gap, as the continent looks to expand energy access.

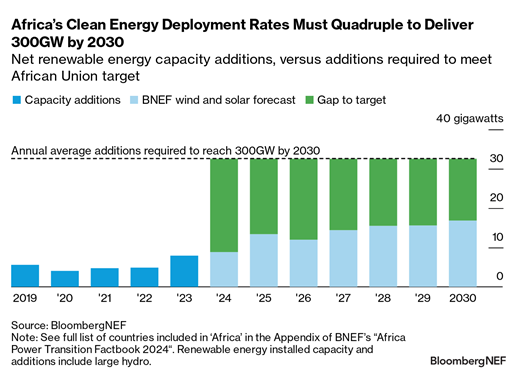

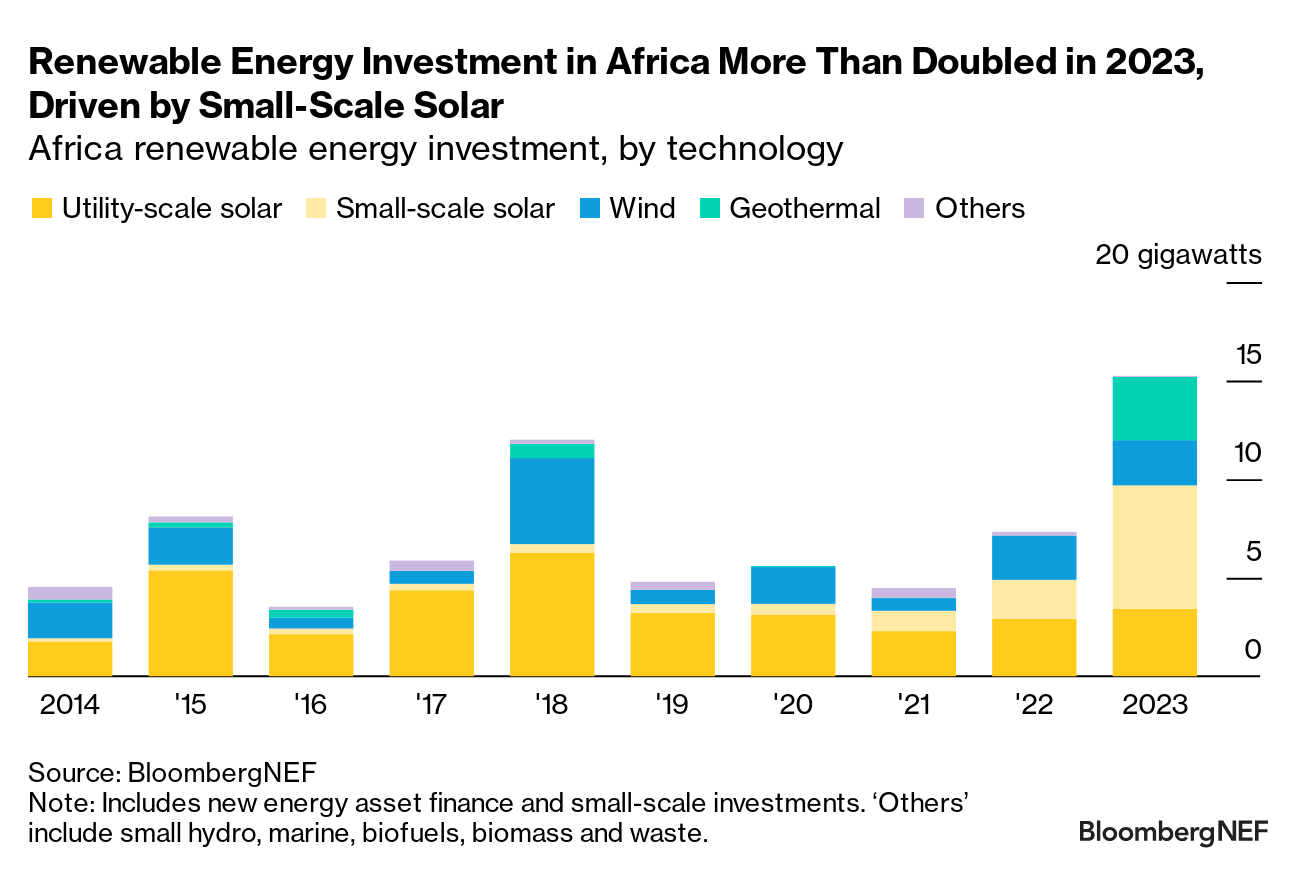

There are reasons for optimism: African markets hit a record year for renewable energy investment in 2023. The $15 billion tracked last year by BNEF – more than double the previous year’s figures – represents 2.3% of the global total, although that still falls below the region’s 3% share of global electricity generation.

The growth could be indicative of improved investment conditions in some parts of the region. Over half of the investment was driven by a small number of utility-scale wind, solar and geothermal projects reaching financial close in Egypt, Morocco, Kenya, Niger and South Africa. Wind and solar dominated activity, while a record $3.2 billion of geothermal investment also went to two new plants in Kenya.

Small-scale solar was an even stronger growth driver. Investment in the technology more than tripled to $6.3 billion in 2023, when it drove 41% of total renewable energy investment across the continent. A key factor was the technology’s fivefold growth rate in South Africa, catalyzed by a removal of generator licensing thresholds in January 2023 and the introduction of tax incentives for businesses investing in renewables in March 2023, as well as power outages.

Nigeria and Morocco also led growth in small-scale solar, contributing to the $2 billion in 2023 in small-scale solar investment in the North and West regions, up from $0.7 billion in 2022. Nigeria’s decision to end a longstanding subsidy on imported gasoline for consumers in mid-2023 increased the costs of using gasoline for private power generators and has helped the case for small-scale solar. Morocco reported increased imports of solar modules in 2023 that BNEF expects primarily served the commercial and residential segments.

Sheafra: What Kenyans should know about common currency that may save economy

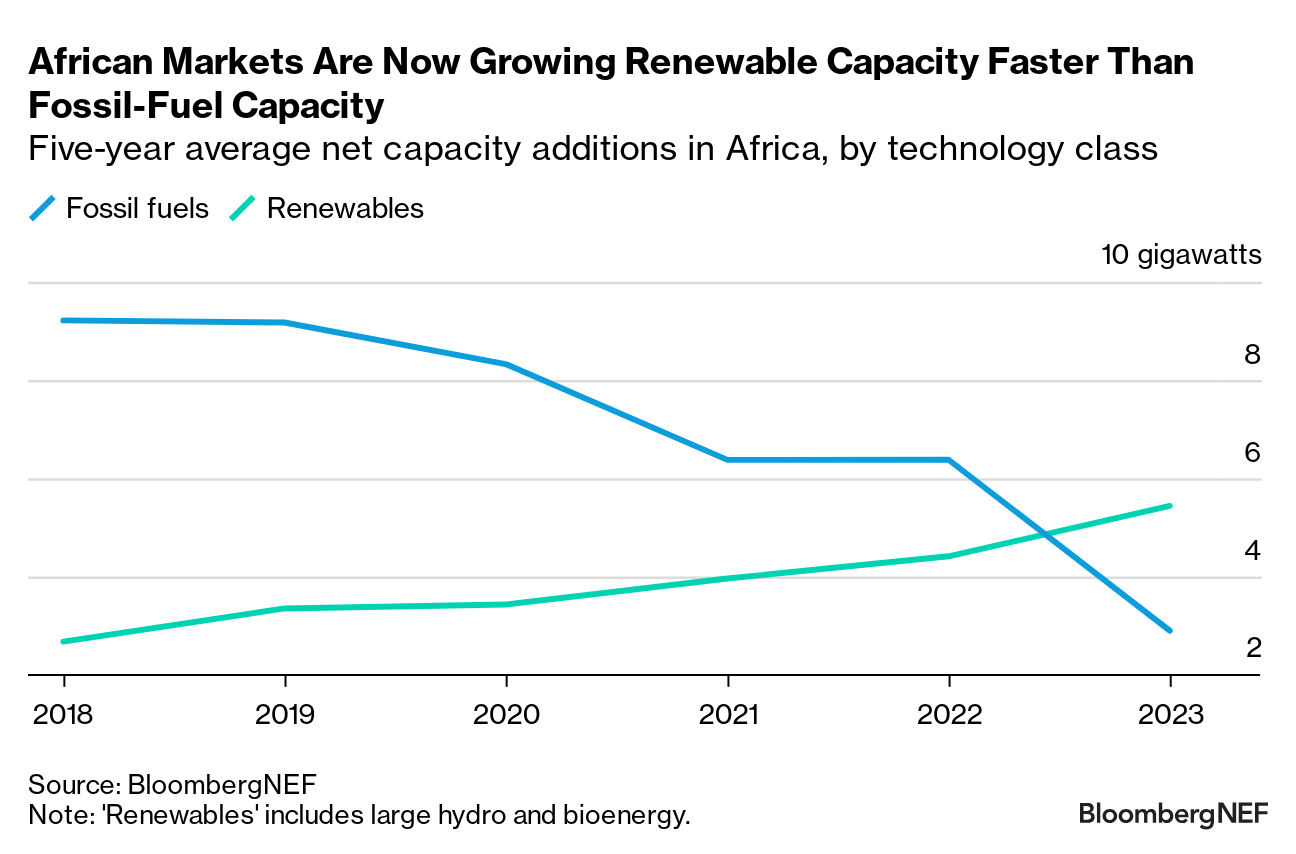

African markets are also adding renewable energy capacity at a faster rate than fossil-fuel capacity. The continent added 7.9GW of renewable energy capacity in 2023, more than triple the net additions of fossil fuels last year.

Importantly, the rate of net fossil-fuel capacity additions has dropped to an average 3GW over the last five years, down 70% compared with the five years prior. Still, coal and gas account for two-thirds of Africa’s annual power generation, and a third of the region’s fossil-fuel capacity is less than 10 years old, built to serve rising electricity consumption.

The challenge extends beyond simply adding more renewable capacity than fossil fuels, as only a handful of African markets are driving renewable energy capacity additions at scale today. South Africa, Morocco and Egypt currently host more than two-thirds of the region’s installed wind and solar capacity, and they remain key growth drivers.

Emma Champion, Head of Regional Energy Transitions at BloombergNEF and lead author of the report, said, “Many markets still lack a clear route-to-market for developers to build large-scale projects: less than 60% of African countries have a renewables auction or tender program in place, and even fewer award contracts regularly. The absence of clear policy and the enabling environment to attract renewable energy investment in such regions could risk derailing the African Union’s 2030 ambitions.”