Across Africa, a quiet economic force is shaping families, stabilising currencies, and seeding the next generation of businesses. It doesn’t sit in boardrooms or appear on stock tickers. It flows through mobile money, digital wallets, and bank corridors. It lives in sacrifice, ambition, and the courage of Africans working thousands of miles from home.

It is the power of diaspora remittances — and Kenya stands right at the centre of this continental transformation.

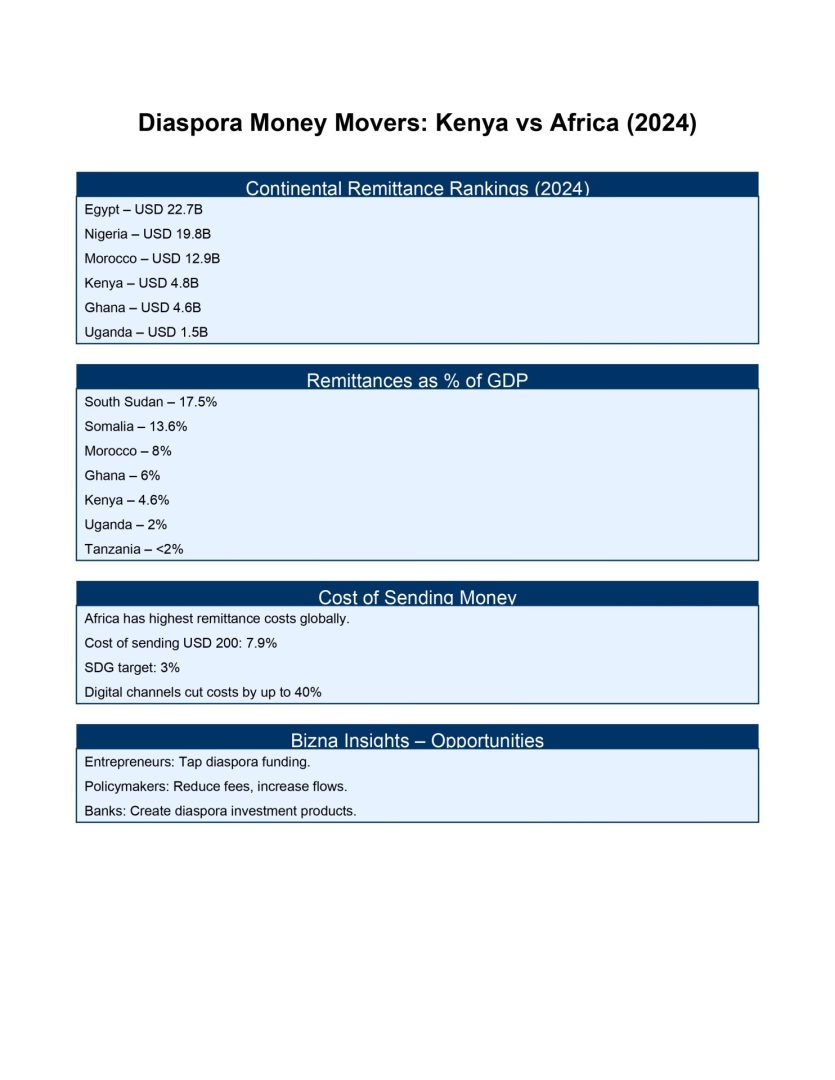

Kenya recorded USD 4.804 billion in remittances over the past 12 months, a figure that positions the country among Africa’s top players and cements the diaspora as one of the economy’s most dependable engines. While Egypt (USD 22.7B) and Nigeria (USD 19.8B) dwarf the field, Kenya’s real advantage is not the size of the cheque — it’s the quality of the ecosystem.

Where other countries rely on legacy banking corridors, Kenya runs on digital rails. M-Pesa. Wave. Pesapal. Chipper Cash. Fintechs that make borders feel irrelevant. That’s why more than 53.7% of Kenya’s remittances come from the United States — a wealthy diaspora with high disposable income and deep emotional ties. Technology has turned loyalty into liquidity.

But step back and you’ll see the broader African map — a continent where remittances mean different things to different nations. Somalia and South Sudan depend on remittances for survival, with inflows representing over 13%–17% of GDP. Morocco channels its USD 12.9B into infrastructure and long-term savings. Ghana receives around USD 4.6B, balancing both consumption and investment.

Kenya sits at a strategic crossroads: less dependent than the fragile sub-Saharan states, but not yet as industrialised as North Africa. This gives the country a rare advantage — the ability to convert remittances from household lifelines into engines of enterprise.

And the opportunity is massive.

Diaspora dollar remittances keep Kenya moving: CBK records a new high

A digitally empowered diaspora. A hungry SME sector. A young population with entrepreneurial fire in its belly. And financial rails that are API-ready for innovation.

Diaspora capital can — and should — fund the next century of Kenyan business growth. From micro-SMEs in Gikomba to real estate developments in Syokimau, from manufacturing clusters in Thika to digital startups in Westlands, the capital is there. What’s needed now is intentionality.

Kenya must create clearer tax incentives for diaspora investors. Banks must design diaspora-only savings and investment products with meaningful returns. Counties must open structured diaspora investment desks. And entrepreneurs must package their businesses not just for local consumers, but for global Kenyan investors looking for reliable opportunities.

This is how we shift from remittance consumption to remittance capitalization.

This is how we convert a diaspora of passion into a diaspora of prosperity.

And this is how Kenya can stand tall — not just as an East African remittance leader, but as a continental example of how a nation can transform emotional connection into economic transformation.

The billion-dollar river is flowing. The only question is: how much of it will Kenya channel into growth, innovation, and generational wealth?