Jubilee Holdings Limited (JHL) has embarked on an ambitious journey to increase insurance penetration in the region built around a focus on customer insurance needs at different levels of income and through the provision of a range of value-added services that complement the core services currently offered to Jubilee’s over 1.9 Million lives insured.

This strategy is inspired by the desire to take leadership in addressing the diverse insurance needs of the citizens of East Africa across the full spectrum of demographics and local needs to develop more regular engagement through unique value propositions that deliver enhanced customer experiences. This will be provided through the development of a new and wider range of products, health management apps, customer care packages and distribution options that will increase accessibility for all their clients.

“In this direction, Jubilee Insurance in Kenya has recently introduced several new medical insurance products including J-Senior for individuals over the age of 60, J-Inue for lower and middle income families looking for protection from increasingly higher medical bills at a cost of less than a cup of coffee a day, and Msafiri, that provides immediate hospital care in the event of an accident for bus travelers at a cost of shs25 per trip. The latter two products are fully digitized with customers required to fill no tedious paper forms and can securely buy the products straight from their mobile phones”

Through the development and use of mobile technologies and advanced data analytics capabilities, JHL has created a raft of solutions to enable customers to have seamless access to core services while saving on costs in the long run. Key among this has been the roll-out of “Maisha Fiti”, a wellness program that enables customers to mitigate health risks while incentivizing them to lead a healthy lifestyle.

In addition, the launch of “Recover in Style” which provides hair and make-up services to Jubilee patients who are hospitalized and home insurance under Home Fibre is aimed at taking care of JHL customers and providing services that go beyond the financial needs and into the realm of delivering superior customer experiences. “What we are creating is a path of product innovation that involves embedding a range of value-added services within the insurance product, thereby enabling us to become true partners that go beyond providing financial assistance to our customers,” noted the Jubilee Insurance Regional CEO, Dr. Julius Kipng’etich.

“We are keen on humanising insurance, by placing people over policies in everything we do. We are passionate about helping East Africans protect themselves and their loved ones today and helping them plan for a financially secure tomorrow. With a strong competitive differentiation and consumer value addition, we are looking at enhancing loyalty through attractive value propositions that improve the wellbeing of our customers and society at large,” Dr. Kipng’etich added.

Through its Corporate Social Responsibility initiatives, JHL has impacted communities across the five markets it has a presence in. These include the Ear Operations and the Eye project, provision of limbs through the Jaipur Foot project, the Live Free Painting competitions, and the School Renovations. The impact of these projects is that we have continued to try to support communities through investments that increase access to equitable and innovative opportunities.

Despite operating in an extremely challenging environment, Jubilee Holdings Limited was able to record growth in Gross Written Premiums (GWP), insurance results and PBT for the year ending December 31st 2018. JHL’s overall GWP, including Deposit Administration contributions, increased to KShs 34.8 billion (2017 – KShs 33.8 billion), whilst pre-tax profit increased 4.8% to KShs 5.41 billion (2017 – KShs 5.16 billion), supported by a strong contribution from insurance results at KShs 2.9 billion (2017 – KShs 2.7 billion).

Official data indicates that 19 out of 40 Insurance Companies made losses and the industry as a whole, including JHL made a profit of 4 billion. Without JHL’s PBT of 5.4 billion, the industry made a loss of 1.4 billion

The Group’s total assets increased by 9% to KShs 114 billion from KShs 105 billion and total shareholders’ equity and reserves increased 11% from KShs 23.6 billion to KShs 26.1 billion. JHL’s long term business of KShs 14 Billion, included Individual Life growth of 19%. The Group continues to implement the strategy to increase insurance penetration, particularly in Uganda and Tanzania where the insurance penetration is less than 1% of GDP and where JHL’s life business grew by more than 50% in each country.

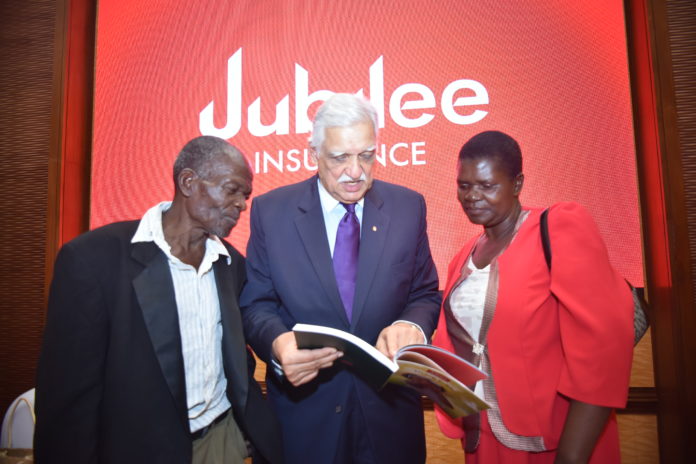

“As a result of our strong balance sheet, reliability on payment of claims and a consistent and firm stand against corruption, we have maintained our position as the market leader. Jubilee’s growth in Uganda and Tanzania has strengthened our portfolio and demonstrated our business resilience and agility to adapt to the market forces during tough times. Our eighty years of experience, lowest expense ratio in the industry and conservative approach to investments continue to guide our day-to-day operations” said Mr. Nizar Juma – Chairman, Jubilee Holdings.

JHL’s maintained its regional market leadership in medical business and posted a growth of 4% from KShs 9.5 billion to KShs 9.9 billion, with underwriting profit of KShs 753 million. In Kenya, once again Jubilee Insurance outperformed and posted excellent underwriting results, whilst the industry as a whole, excluding Jubilee Kenya, posted an underwriting loss of KShs 1.9 billion.

“In Kenya, we continue to develop systems to monitor and track medical services rendered and the quality and cost of services received using biometric identification of members and electronic and real-time transmission of claims. With this enhanced use of technology, it makes it more difficult for fraudsters to falsify claims” commented Dr. Kipng’etich.

JHL’s General business grew marginally to KShs 10.8 billion, partly as result of reduced regional spending on major infrastructure projects. However, countering market trends, JHL’s underwriting profits grew by 14% to KShs 609 million from KShs 534 million with strong contributions from the Uganda, Tanzania and Burundi operations. “JHL has continued to have a strong focus on the quality of its insurance portfolio and with improved customer focus, coupled with strong systems and controls within the business, we are confident this will yield further improvement in results over time” added Dr. Kipng’etich.

During the year, the Boards of JHL and Jubilee Insurance Kenya approved the split of the Kenya subsidiary into three separate companies specializing in Medical, General and Life businesses respectively. The Insurance Regulatory Authority (IRA) has encouraged the operation of short-term and long-term companies as separate entities as a matter of public interest.

Jubilee Holdings Board has declared a final dividend of Ksh 8.00 per share for a combined interim and final dividend of Ksh 9.00 per share.