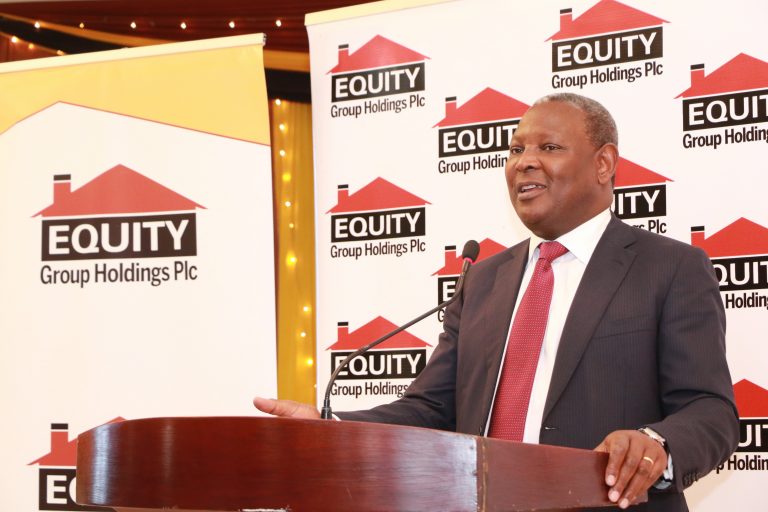

After two years of depressed growth in traditional banking business, Equity Group has bounced back to organic growth registering a year on year 13% growth in loan book. “We have learned to operate with interest capping as a new norm despite the associated challenge of risk pricing”, said Dr. James Mwangi, Managing Director and CEO, Equity Group Holdings Plc while releasing the 1st quarter results.

The Group registered a 15% growth in total assets to reach Kshs.605.7 billion driven by growth of 12% on customer deposits. “Intermediation engine has bounced back with growth in deposits intermediated to loans,” said Dr. Mwangi.

Interest income grew by 7% while non funded income registered a 7% growth rate. Profit before tax grew by 6% to Kshs.8.8 billion up from Kshs.8.3 billion the previous year. The 7% growth on interest income was on the strength of 13% growth in the loan book, overcompensating the reduction in lending rate from 14% to 13%.

Non-funded income contribution to total income bounced back to 41% up from 38% recorded the previous year. Non-funded income growth reflected increased transactional activities and uptake of various fees and commission services, including merchant banking commission which grew by 15% driven by increased market share to 42% of visa acquiring business up from 38%. Forex trading income grew by 22% supported by increased dollar flow from Diaspora remittances that grew by 27% to reach Kshs.30.9 billion

Bond trading income grew by 92% to Kshs.450 million while unrealized capital gains on mark to market on government securities grew by 110% to Kshs.1.42 billion up from Kshs. 680 million due to declining yields. Mobile banking income grew by 15% to Kshs.282 million reflecting the growth in digital business.

The Kenya banking subsidiary bounced back pushing regional subsidiaries contribution to the Group profits to 18% down from 20% contribution the previous year despite the regional subsidiaries increasing their total Group asset contribution to 26% up from 25% and increasing their total Group deposits and loan contribution to 25% up from 24%. The improvement in profit contribution by the Kenya subsidiary was driven by improved cost income ratio that declined from 42.5% to 41.8% despite the reduction of lending rates from 14% to 13%.

Digitization has seen 93% of loans disbursed being accessed through the mobile channel while 97% of all cash-based transactions happened outside the branch with mobile and agency channels taking the lion share. Digitization supported reduction of staff costs in the Kenya subsidiary for the 1stquarter from Kshs.1.7 billion to Kshs.1.6 billion. While holding the group staff costs at Kshs.2.6 billion. Digitization of customer journey has eased customer experience leading to growth of digital payment transactions by 94% and supporting growth of customers to 13.6 million and customer deposit growth of 12% to Kshs.428.5 billion up from Kshs.382.4 billion, driving the group balance sheet up by 15% to Kshs.605.7 billion.

The Group recorded an NPL ratio of 9% against Kenya banking sector NPLs ratio of 13% with a Group NPL coverage of 78.7%. During the quarter under review the Group asset quality deteriorated marginally from 7.6% to 9% driven primarily by Tanzania subsidiary that experienced shock.

The Group management has announced a strategic partnership and collaboration with Safaricom to catalyze participation of Kenyans in integration of the corporate economy and the informal economy particularly in the government led initiative of stimulating the real economy by prioritizing and massively investing in low cost housing, manufacturing, food security, agro-processing and health. The collaboration will see the two strong brands collaborate in using their eco-systems and value chain and networks to converge finance and technology through business and enterprises.

The Group has also announced plans to acquire four subsidiaries of the London listed Atlas Mara in Rwanda, Tanzania, Zambia and Mozambique. The transaction once it is closed would allow the Group to double the size of its operations in Rwanda and Tanzania while entering and establishing presence in the Southern Africa (SADC) region. The Group would have presence and footprint in the Eastern, Southern and Central Africa regions covering the trade routes of Beira-Lusaka-Lubumbashi route, Dares salaam-Dodoma Mwanza-Kigali route, Mombasa-Nairobi-Kampala-Kigali and Juba route, and the Mombasa-Moyale-Addis Ababa-Juba trade routes a strategy that aligns with the African continental free trade area initiative.

The market has positively responded to the strategy with Equity Group holdings registering a market capitalization of Kshs.157 billion as at 31stMarch, Kshs.22 billion higher than the next largest bank in market capitalization in the Nairobi Stock Exchange.

In pursuit of its ambition of shared prosperity, social and impact investments, the Group’s spend through its corporate foundation has topped to Kshs.35 billion with 87% of the funding being on the popular and highly impactful Wings to Fly program and Equity Leadership Program, which have seen 16,168 needy kids access free secondary education of whom 12,256 scholars have transitioned to university education with 496 students attending leading global institutions. As well, 1,739,478 young people or 20% of Kenyan youth and women have also benefitted from free 13 weeks’ financial education, FIKA-Financial Education for Africa.