Restructured Loans in Kenya: Have you checked the status of your the loan you applied for restructuring? Well, some Kenyans have been complaining online that they are finding their restructured loans have been accumulating thousands in interest.

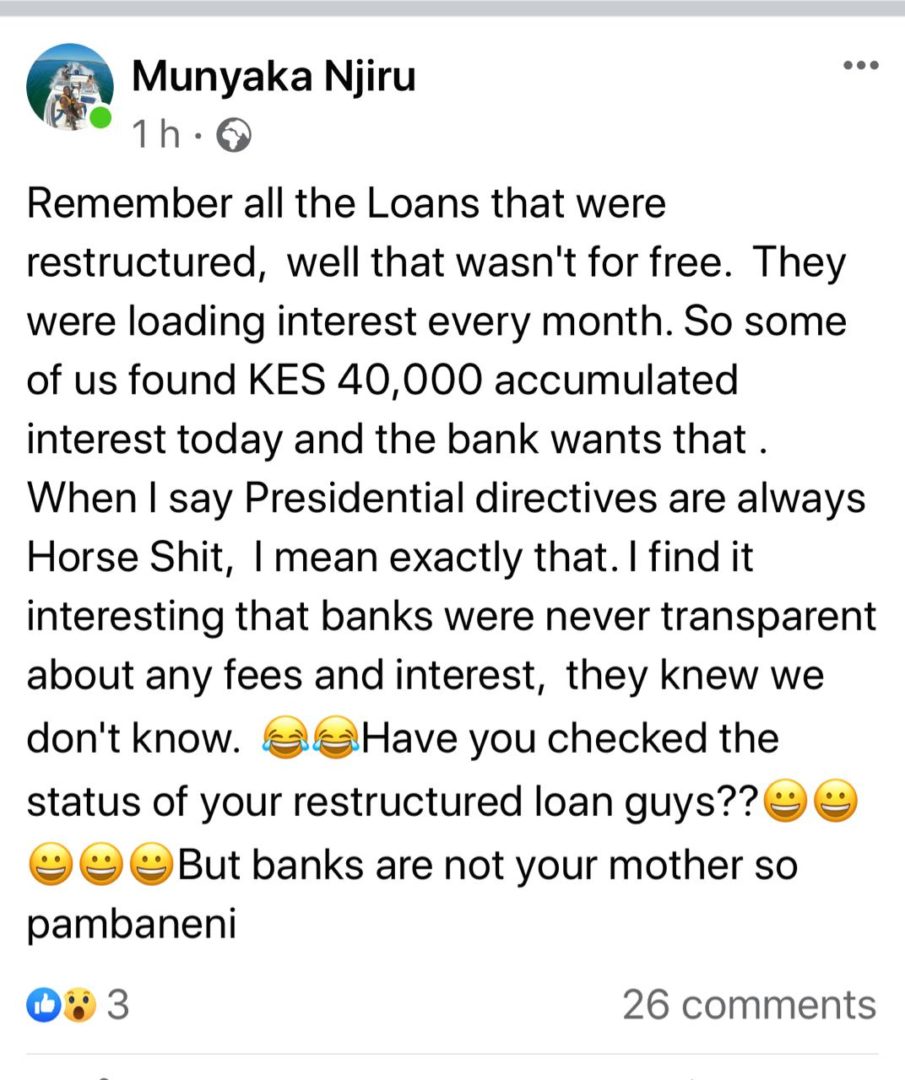

This rude awakening means that they will pay more for the loans that banks restructured. One of these alarm posts was made by a social media user identified as Munyaka Njiru. “Remember all the loans that were restructured, well that wasn’t for free. They were loading interest every month. So some of us found Sh. 40,000 accumulated interest today and the bank wants that,” he posted.

Value vs cost: What you should look at when buying a plot in Kenya

By July this year, banks had restructured loans amounting to Sh. 844.4 billion. This was equivalent to of 29 percent of their total loan book. By end of June lenders extended the repayment period of personal and household loans worth Sh. 240 billion. This is an equivalent of 30 percent of the gross lending to this segment.

The Central Bank of Kenya (CBK) allowed banks to offer relief to their borrowers in March. However, despite advocating for the restructuring of the loans, the government did not extend any financial relief. To caution themselves against the losses, it is claimed that some banks have resulted to topping the restructured loans with interest. Restructured Loans in Kenya.