By Bizna Brand Analyst

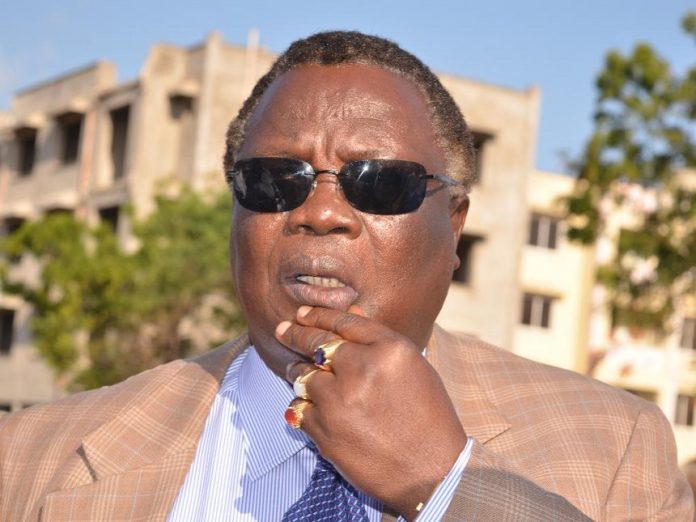

Just in case it might have passed you, Central Organisation of Trade Unions (COTU) Secretary General Francis Atwoli is embroiled in a legal tussle with Western Kenya politician Cyrus Jirongo over a Sh110 million debt. Or rather a ‘soft loan’ as they call it. Now you know the real definition of the haves and the have nots.

In a lawsuit, Mr Atwoli claimed that he gave Jirongo a friendly loan to the tune of Sh100 million which was supposed to be paid back within 50 days at an interest of Sh10 million. The agreement made on August 10, last year.

So Mr. Jirongo hasn’t paid back. What does this scenario teach us?

-

Debt destroys friendships

Debt destroys friendships. Your impression of your friend will forever-after be tinted by the memory of that loan, whether it was repaid promptly or not. When he walks into the room, some part of you will always hear a giant sucking sound. If you’re being asked to loan money to friends or family, it’s likely because they cannot get credit from an actual lender. And there’s probably a good reason that person can’t get a loan from a bank or SACCO.They have no means to pay back. I assume that Jirongo and Atwoli used to be very good friends. That’s why a loan as big as 100 million was agreed upon in the first place. But from here on, that friendship will definitely never be the same.

2. The gap between the rich and poor is really big in this country

It’s amazing that there are people out there with some spare Sh 100 million to give out without feeling a pinch. Wow. The average middle class doesn’t even make that much in a lifetime. There are lanes in this world.

READ: Bonfire Adventures Exploited The Sh 100 Wedding Couple For PR Purposes

3. Soft loans no matter how big or small create financial strains on the lender.

While most borrowers assume that the loans they took put no financial burden on their friends or family, it’s actually the opposite. If you can’t make a gift of the money, don’t make the loan. It’s not worth putting your own finances at risk to help someone else. The reason Atwoli wants the money back is because he now wants to do some things but doesn’t have the money to do them.

It’s thus better to avoid lending money to friends. After all, you don’t want a loan to a friend or family member to leave you unable to pay your own bills on time or make ends meet. Then, you could find yourself in the same situation as the friend who asked for money. So if you find yourself in such a position, you might have to tell your friend that you want to help but aren’t in a financial position to do so.

4. Even the rich have poor financial habits.

Both Atwoli and Jirongo seem to have poor financial habits. If you have no qualms with giving a loan of Sh 100 million, the person you are giving it to will also assume that you don’t really need the money that much. As a result, payment will be a push and pull game. Further, if you don’t mind borrowing that kind of money, then you are a pretty excessive risk taker. Something which qualifies as a bad financial habit. I can imagine that deals such as these go on frequently among the rich. We even saw it with Wetangula and Mungatana not so long ago.

5. Being a boss in public service remains one of the most lucrative jobs in Kenya.

We’ve always relied on assumptions but Atwoli has proved that bosses in the public service sector have tons of money. Some time back, he had talked about running for a political seat but then changed his mind. He probably realized that he won’t make as much money being a politician as he is making in the public sector.

Someone get me a government job right now. There are people I need to lend millions.