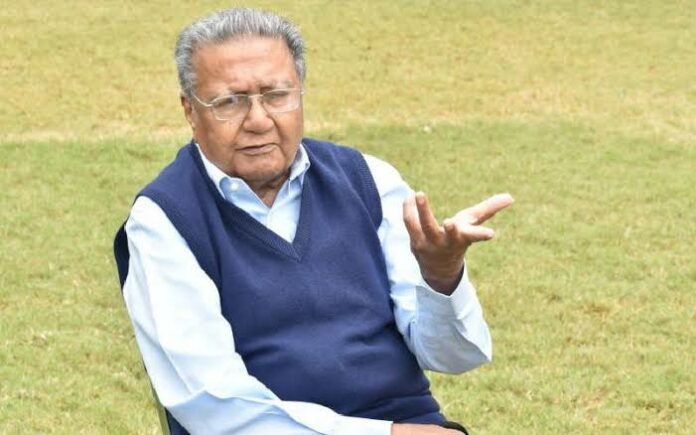

Businessman Manu Chandaria has received back a company that had been repossessed over non-payment of a Sh. 6.6 billion debt.

This debt was taken by Kaluworks Limited, a manufacturing firm that is part of Manu Chandaria’s Comcraft Group.

As at 2019, Kaluworks was indebted to among other lenders I&M Bank, first published notices for auction of the company’s assets in 2019.

The company also owed NCBA and Bank of Baroda loans, in addition to hundreds of millions of shillings in a commercial paper whose repayments it defaulted on.

The banks had loaned the money to Kaluworks because Chandaria had allegedly presented himself as the face of the company.

Chandaria is the chairman of Comcraft Group, a conglomerate with multiple businesses across Africa and beyond of which Kaluworks is a member. The industrialist is also a long-serving chairman of the Kaluworks board of directors.

In 2021, Kaluworks Limited. It was placed under receivership over a Sh. 4.3 billion debt by the NCBA Bank.

Following the takeover, NCBA appointed a receivership manager Pongangipalli Rao, to run the company in a bid to turn it around and recover the billions owed.

Now, NCBA and other lenders such as Co-op Bank who are owed money by the company have opted to return the firm to Chandaria’s Comcraft Group after balking at having to inject Sh. 750 million to revive the company amid hurdles in getting a buyer for the firm.

Kaluworks’ shareholders have agreed to pay the bankers Sh. 1.2 billion to lift the receivership, while NCBA and Co-op Bank have given up on a portion of the debt. Co-op Bank was owed Sh. 4.9 billion.

The consent filed in court indicates that NCBA has agreed to an 88 percent write-off of its loan while Co-op Bank accepted to lose 55 percent of the Sh. 9.1 billion loans.

“The settlement entails write-off of 55 percent by Co-op and 88 percent by NCBA, which both banks have approved,” the settlement cites.

Kenyans to pay Sh. 3,000 to replace old plates with digital number plates

Under the settlement plan, Comcraft Group will inject Sh. 150 million to revive the business, offer NCBA Sh. 580 million and Sh. 628.4 million to Co-op Bank.

“It was agreed that out of the capital injection of Sh. 1.2 billion an amount of Sh. 580 million will be paid to NCBA in full payment of NCBA debts whereas a balance of Sh. 680.4 million will be paid to Co-op bank.”