Usione simba amenyeshewa ukadhani ni paka! This was the saying that summed up the 2023 KCB Group financial results. In that financial year, KCB Group recorded a decline in profit after tax from Sh40.83 billion in the year 2022 to Sh37.46 billion.

This decline represented a dip of 8.3 percent in a year in which Kenya endured a battered economy. In fact, it was in the first quarter of 2023 that the country recorded the worst currency exchange of over 160 to the US dollar. That year, the banking giant skipped paying dividend to shareholders for the first time in 21 years.

For many people, shareholders in particular, this performance appeared disconcerting at first. This changed when KCB Group chief executive officer Paul Russo took to the podium. It quickly became clear that Simba had just survived one of the most turbulent financial years that any other ordinary cat in the economic Mara would not have survived.

That year, Kenya experienced a record spike in non-performing loans. The ratio of gross non-performing loans to gross loans increased to 14.8 percent by December 2023. This was the highest level since 2007. Inflation edged up to 7.7 percent in 2023 from 7.6 percent in 2022, driven by core inflation, fuel inflation, and cost-push inflation. The Kenya shilling depreciated by 24 percent year on year in 2023.

At KCB, operating expenses jumped by 60.9 percent to Sh116.79 billion from Sh72.57 billion. At the same time, the stock of non-performing loans (NPLs) increased from Sh161.2 billion from Sh208.3 billion.

But not even these could break Simba who still managed to return close to Sh40 billion in net profit with revenues of Sh165.2 billion and total assets that crossed the Sh2 trillion milestone to stand at Sh2.17 trillion. In self-preservation, KCB Group retreated away from the annual dividend payout to preserve capital for its main arm, KCB Bank Kenya.

“We believe that KCB Kenya’s capital is not where we would want it to be and it is for this reason that the board has decided not issue any dividend. This year, we want to conserve capital. We want to set up KCB Bank Kenya to be able to deliver extremely rapid growth in 2024,” said Mr. Russo.

According to Mr. Russo, the KCB Group had to do a clean up that included dealing with legacy issues such as non-performing loans which required making tough calls for a better future.

“We had a fairly good run in the 12 months in the wake of difficult economic times, with most of the business lines achieving strong organic growth. We have extended a helping hand to our customers through our loan book to support them to navigate and accomplish their ambitions,” said Mr. Russo.

“Our focus remained on robust cost management to give us room to invest in initiatives to drive growth and put the group on a strong pedestal for better growth in 2024, supported by strong capital and liquidity buffers.”

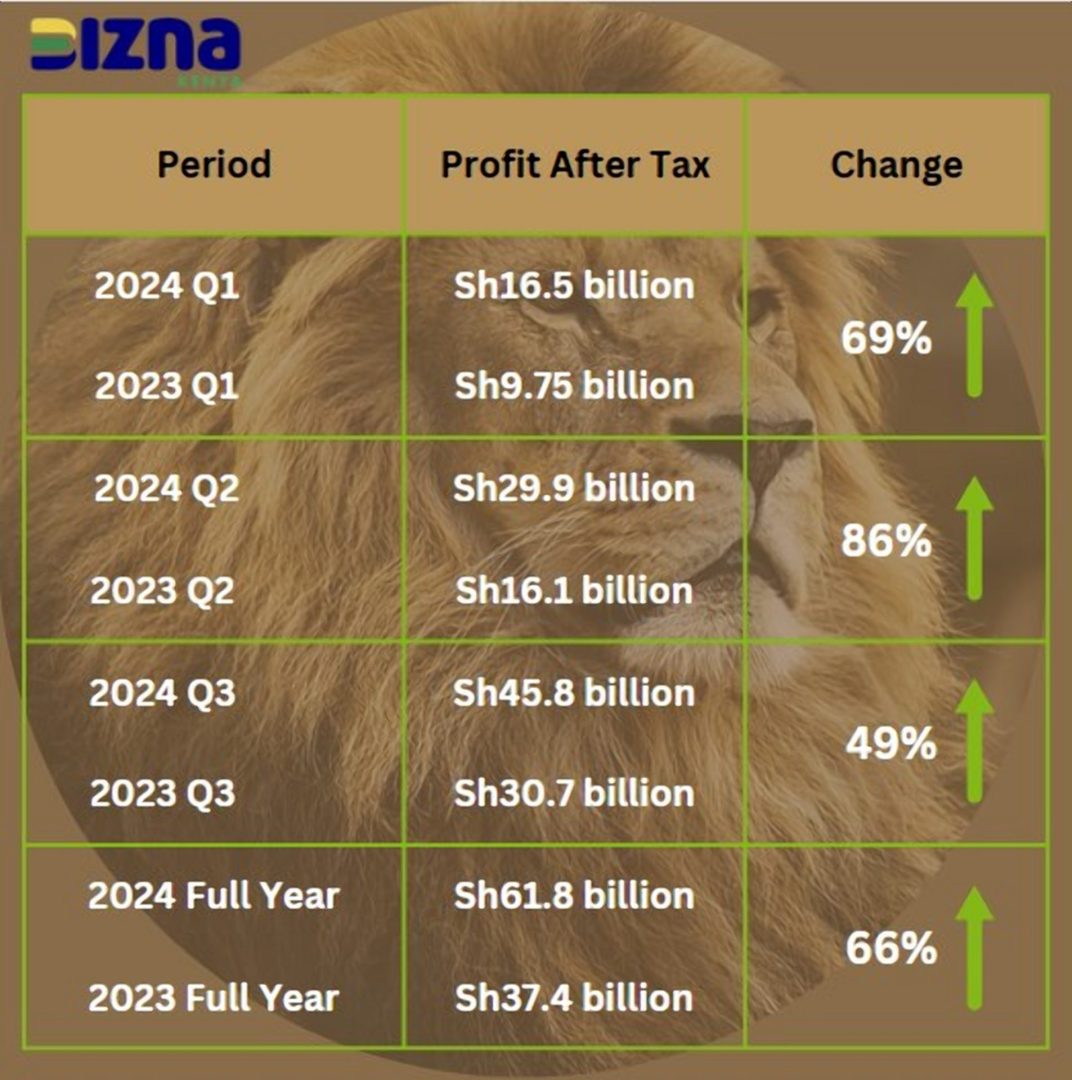

The tide turned in the first quarter of 2024 when Simba ruffled its mane and roared a Sh16.48 billion in the first quarter of 2024. This was a 69 percent jump in profitability from the Sh9.75 billion that the bank had recorded in a similar period the previous year.

According to economic and financial markets analyst Anthony Mwaura, this performance was a clear indication that 2024 was the year KCB Group would establish its dominance and vindicate its position as the regional powerhouse by both assets and profitability.

“For a tier one bank, the Q1 profit jump by over two thirds was the first impression of what would ultimately become a highly successful financial year for the lender,” says Mwaura.

“Mark you, this result came with an asset base of Sh2 trillion, a stabilizing local market, and regional subsidiaries that were sufficiently independent of their big brother KCB Bank Kenya. Businesses outside of the KCB Bank Kenya contributed 17.9 percent of the pre-tax profits and 13.1 percent of the total assets.”

These sentiments are echoed by Mr. Russo. According to the KCB chief, the bank had delivered a strong growth in revenue from new business lines, deepening of digital channels and innovative customer value propositions.

“We are well positioned to power the strong projected GDP growth across the region in 2024, driven by agriculture, tourism and services sectors,” he said. “Our investments in the regional businesses, continued to bear fruits. As we continue to expand, our operational resilience remains a cornerstone of our growth and expansion strategies.”

An analysis by Bizna Kenya on the financials for year 2023 shows that the roar by KCB’s Simba in Q1 was just beginning. In the second quarter of the 2024 financial year, KCB Group announced a jump in profit after tax of 86.4 percent to Sh29.9 billion from Sh16.1 billion in the same period the previous year.

During the half year period, the lender saw total assets increase by 6 percent to Sh1.97 trillion while customer deposits increased by 1.3 per cent to Sh1.49 trillion. Shareholder funds increased by 14.1 per cent to Sh241 billion. The balance sheet expanded 6 per cent to Sh1.98 trillion up from Sh. 186 trillion. As a result, KCB remained the most profitable financial institution in East Africa, and the largest by asset size.

“We delivered a commendable first half of the year, inspired and driven by the goodwill and confidence from our customers and commitment by our staff,” said Mr. Russo.

After missing out on dividend payout in the full year 2023, the 2024 half year results came with an icing on the cake. The group paid out an interim dividend to its shareholders of Sh1.50 per share.

This meteoric rise continued in the third quarter of the year when KCB Group announced a 49 percent rise in net profit for the first nine months to September. This was equivalent to Sh45.8 billion from the Sh30.7 billion net profit that had been recorded in the same period the previous year.

According to Mwaura, this result was realized despite the bank’s non-performing loans rising to Sh215.3 billion and net loans going up 0.5 percent. “The two main contributors to the Group’s non-performing loans were KCB Bank Kenya and the National Bank of Kenya,” Mwaura explains. However, Mwaura tells Bizna Kenya that all parameters pointed to a record-breaking full year performance.

“We can now see that the bank has become the first in Kenya to independently make over Sh60 billion in full year net profit. This sums up what was a financial year of sustained growth for a bank that has become synonymous with sustainability,” he says.

The group’s full year 2024 profit after ax grew by 64.9 percent to Sh61.8 billion from the previous year’s Sh37.46 billion. At the same time, the banking group’s balance sheet closed the year at Sh1.96 trillion while total revenues grew by 24 percent to stand Sh204.9 billion.

“Our performance illustrates our determination over the past three years to build an organization for the future that is anchored on delivering value for our customers, shareholders and all stakeholders,” says Mr. Russo.

The icing on the cake is for the shareholders, who will now get a final dividend payout of Sh1.50 per share to bring the dividend payout for the full financial year to Sh3 per share.

The dividend announcement was pure music for Edwinah Otieno who holds 93,000 KCB shares. Last year, she received Sh139,500 from the interim dividend. She is now set to receive another Sh139,500 to bring her total dividend gain for the year to Sh279,000.

“The full dividend is equivalent to KCB Group paying me Sh23,250 every month for the whole of the 2024 financial year. That is a good passive income, especially considering that the share prices have gained by close to Sh30 per share since the dip of 2023,” she says.

Edwinah adds that she is planning to reinvest her dividends in the shares, pointing to her confidence in the current trajectory of the bank.

Mr. Russo’s sentiments are echoed by Mwaura who projects that KCB Group is highly likely to become the first banking institution in East and Central Africa to cross the Sh100 billion net profitability. “This is a milestone that is realistically possible within the next four to five years,” he says.