If you have taken or plan to take expensive or unmanageable loans to please your parents or relatives, since you believe they are your responsibility, then it is time to stop and think again.

Also, if you are shouldering the financial weight of your siblings and even village mates, and yet you are also struggling yourself, it is time you reviewed your decisions. Your village mates are not your responsibility.

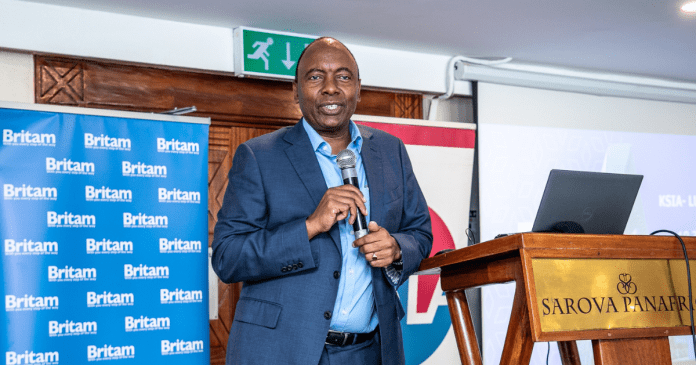

These are the words of Tom Gitogo, the Group MD and CEO of Britam Holdings Plc, who spoke during a virtual session organized by Abojani Investment on Tuesday, April 15.

Tom Gitogo, weighed in on the burden of “black tax” and how financial responsibility should be balanced when supporting family.

Don’t borrow recklessly for non-essential expenses

He urged individuals to be prudent in their financial decisions, cautioning against borrowing, especially from predatory lenders, for non-essential expenses.

“As we were brought up by society, it was ingrained in us, a sense of obligation that every villager in your village is your responsibility. In all honesty, it is not your responsibility. You have enough challenges in your own life. You are also struggling to make it in life.”

While he acknowledged the importance of supporting parents, Gitogo emphasized that it should be done within one’s means.

Good debt vs bad debt: The simple guide to smarter borrowing

“You did not drop from the sky. You would really, feel guilty if you’re not looking after your parents. It is actually even a religious responsibility that you have. But take care of them in a way that you can afford. Again, don’t borrow from Shylocks to take your parents on a holiday to Masai Mara, for example. That’s foolish. Your parents shouldn’t be struggling with an ailment if you can do something about it. But siblings who have chosen the path of drinking everything that comes their way, they are not your responsibility,” stated Gitogo.

The power of passive income

Shifting the conversation to financial growth, Gitogo stressed the importance of building passive income as a long-term strategy.

He defined passive income as money that continues to accumulate on the side while an individual focuses on their main career or business.

“A good example is if you have shares. Say, for example, you have bought Britam shares. As the value of Britam shares goes up, the value of your investment in Britam also grows,” stated Gitogo, adding that rental income was another source of passive earnings.

Preparing for financial independence in later years

Gitogo stressed that passive income should be built as early as possible to ensure financial security in old age.

“The ideal situation is one where you build a growing passive income because it becomes your employer. When you are too old to work or tired from your business, ideally, you shouldn’t be very active economically in your late 60s, 70s, or 80s. So your passive income, the income you have been building over time becomes your employer, but don’t let passive income distract you to a point that it is risking your main job. If it does, then it is time to review.”

I have KSh 1 million loan from 52 apps, my salary is KSh 55,000

Making informed investment decisions

Gitogo advised individuals to invest in areas they understand or where they have expertise.

“If you’re not a good investor, there are quite a few opportunities that outsource the stress. You can go for options like unit trusts. Passive income does not mean you shouldn’t spend money on it, whether it is on financial advisors or other resources, especially if it is in a totally new area you have no idea about,” he explained.

The discipline of spending less than you earn

Gitogo emphasized that financial security begins with discipline—the ability to spend less than one earns.

“You cannot start investing if you do not adopt the discipline of spending less than you earn. You spend what is left after investing, not invest what is left after spending. The trick to building wealth is time and compound interest,” he said, noting that young people often disregard retirement savings because they see it as too far away.

However, he explained that consistent small investments over time could yield significant returns in the future.

Financial maturity and the importance of planning for the future

Gitogo underscored the need for individuals to mature financially and start investing, not necessarily when they feel ready, but when they reach life stages that demand financial planning.

He used the example of school fees for children, urging parents to start saving early rather than waiting until their children enter secondary school or university.

“It is widely accepted, especially in Africa, that a good education gives children a strong start in life. So why wait until they are entering secondary or university before scrambling for school fees? It doesn’t make much sense,” he said.