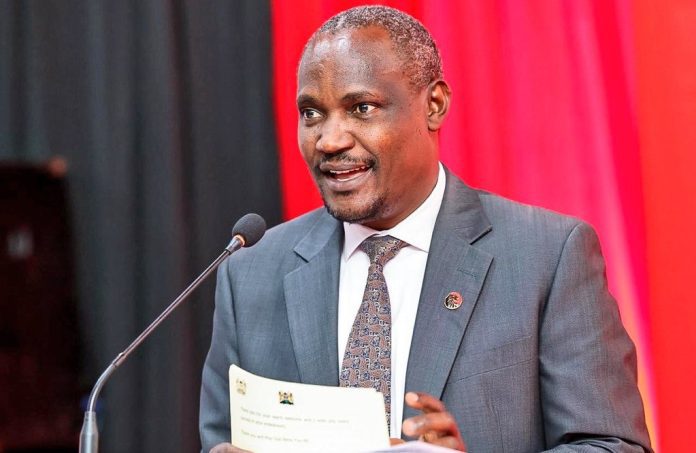

The National Treasury has announced that it is planning to sell Safaricom shares in a bid to raise more money from targeted privatization of State assets. This has been revealed by the Cabinet Secretary for the National Treasury John Mbadi.

“There is talk that if we could offload more of our ownership of Safaricom, where we could likely get up to Sh149 billion through privatization in the 2025/26 financial year,” Mr. Mbadi was quoted by a local business newspaper.

If the plan goes through, this will be the second largest sale of the government’s stake in Safaricom since the 2008 Initial Public Offer by Safaricom.

In the 2008 Safaricom IPO, the government was looking to raise Sh50 billion by selling 25 percent of its stake. This saw the State sell off 10 billion shares, followed by the listing of 40 billion ordinary Safaricom shares.

The IPO attracted a huge demand, resulting in an oversubscription of up 363 percent with bids worth Sh231 billion, and a 669.7 percent subscription in the local retail pool. The number of new investors nearly doubled to 1.5 with over 700,000 new CDS accounts opened.

While the over-subscription was indicative of a more mature local market and virtually improved all parameters of the local market performance, the oversubscription was bad news for many retail investors. The government announced that each retail investor would only get 21 per cent of the shares they applied for. The listing of the shares saw Safaricom regularly account for between 15 to 25 per cent of the total equities turnover and market capitalization.

Equity sacks scores of employees over suspicious M-Pesa, bank accounts

Although Mbadi has not declared how the expected sale of the government’s stake will be conducted, there is speculation that the sale could be done as a secondary IPO or it could be sold to high net worth investors in block.

The expected sale is expected to generate a scramble from investors, due to Safaricom’s continue profitability. For instance, in the full year ended March 31, Safaricom recorded a 10.8 percent growth in net profit to Sh69.8 billion. The company’s total revenues increased by 11.2 percent to Sh388.7 billion.

Currently, Safaricom shares are trading at about Sh20 per share on the Nairobi Securities Exchange. The counter has a 52-week high of Sh20.25 per share and a low of Sh14.10 per share. The government’s stake of 34.9 percent is estimated to be worth around Sh280.5 billion.