If you have not filed your tax returns for the 2024 income year, you have until midnight today to do so. This is after the Kenya Revenue Authority (KRA) extended the tax return deadline by 2024 hours from June 30 midnight to July 1 midnight.

“Tumefungua service lane! 24-hour extension up to tomorrow, 1st July 2025, midnight to file and pay your returns! We have extended our working hours tomorrow to serve you better,” KRA said in a brief statement.

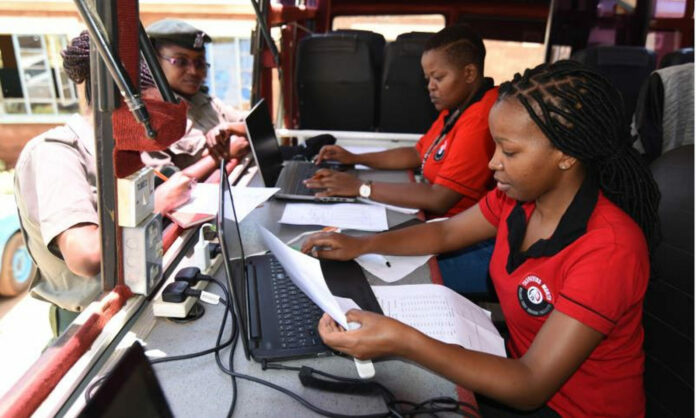

Although the extension came as a relief to many Kenyans who had not filed their returns, some taxpayers expressed frustrations with the iTax system which they lamented was experiencing heavy downtime.

“I visited your filing outlet from 9am to 6pm. The system failed to operate and I had to return home without being assisted. How can a system fail for almost two hours, come back on then fail again for another extended period after only five people have been served?” said Sheila Ominde.

Apart from filing returns on the traditional iTax platform, KRA has this year made it possible for Kenyans with nil returns to file through their eCitizen accounts.

According to KRA Deputy Commissioner for Taxpayer Services Patience Njau, as of early June 2025, only about 2 million people had filed nil returns on iTax. On the other end, about 12 million Kenyans had filed nil returns on eCitizen.

“We are working on improving the iTax portal but we realized that even if we simplify it as much as possible, just the fact that it is a tax portal scares people away. On eCitizen, it is very simple. The KRA platform is designed for tax services, not for the normal citizen and that is why most people struggle with it,” she said.

READ MORE: High Court suspends KRA’s new CRSP values for used vehicles

How to file Nil returns on eCitizen:

- Start by visiting the eCitizen portal, log in with your normal eCitizen credentials, and then go to eCitizen KRA. You will require your national identification number and a phone number or access to you registered email address through which a one-time password (OTP) shall be sent for verification and access to your dashboard.

- After logging in, select KRA services and navigate to the tax filing section. In the section, choose Nil returns if you had no taxable income for the year. Confirm that your details, including your KRA pin and personal details, are correct.

- After confirmation of your personal details, click submit, and you will receive a confirmation message.