Imagine you are a corporate that receives many cheques in a day. Typically, it would take dedicated resources to receive, capture, store, and ship the cheques to the bank! Now, imagine there was a solution that would enable you to scan the cheques and transmit them to the bank for processing through secure channels and in real time!

Well, this is not a farfetched imagination because this solution actually exists, and is currently benefiting hundreds of corporate clients in the East African region.

The solution dubbed Amali was developed by a seasoned banking systems developer and a director of the company, known as Kemboi Chesaro. Built for the African market, Amali seeks to deliver convenience, security, and timeliness in cheque handling and processing.

Amali was recently shortlisted for the Global SME Finance Awards’ Product Innovation of the Year prize. The awards were held during the Global SME Finance Forum in Madrid Spain in early November this year.

Timely solution

According to Tonnie Mello, the Managing Director of Donnell Incorporated Limited, Amali is a solution whose time has come.

“We are grateful that Amali is meeting real needs in the market and reducing cheque management costs for banks and corporate clients,” he says, adding that Amali will soon be launched in other markets across the continent. “We are in discussion with partners in other parts of Africa with a view to deploying the system in those markets early next year,” he says.

With the ability to provide remote cheque capture, Amali is likely to disrupt the cheque processing segment in the banking industry.

Apart from serving as a testament to Kenya’s leading role in innovation and technology, Amali has been a boon to Donnell Incorporated Limited, which has now been launched unto the global business map.

How Amali works

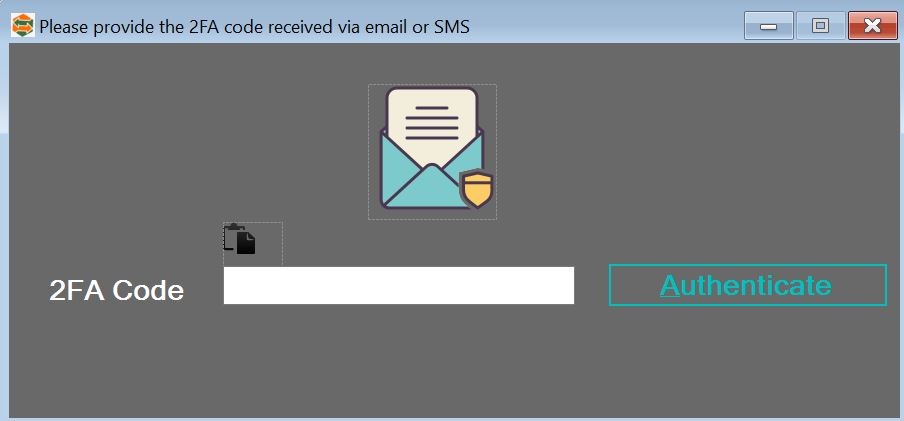

But how does Amali work? According to a layout seen by Bizna Kenya, Amali is a web-based interface that is positioned at the bank. The bank engages corporate clients and sets them up to access the service via a secure link. The clients are then issued with special scanners which they use to scan and forward cheques to the bank for processing.

If the scanning meets the set guidelines and requirements, the system automatically forwards the cheques to the bank for processing. Upon receipt, the cheques are queued into the bank’s clearing system. The transaction is either effected or reversed based on whether the cheque was cleared or not. Interestingly, in both outcomes, Amali will automatically notify the client on the outcome of the transaction.

“We noticed that there was a need by the banks for an integrated system that would manage cheque capture and transmission processes seamlessly,” says Chesaro, who has worked in the banking sector for 12 years. “We discovered, too, that they also needed an easy-to-use, secure and stable system that does not require round the clock support.”

Prior to being launched, Amali was subjected to multiple tests locally and internationally to ensure that it met the requisite global banking standards.

“We are humbled to have achieved this. We continue to enhance the product in order to make it a global force in the management and processing of bulky cheques,” says Chesaro.

Already, Amali is being used by numerous businesses in Kenya. Take Muhesh Singh, a wholesaler based along Dar es Salaam Road in Industrial Area. Cheques that come through his daily business transactions are processed in real time via Amali.

“We thought the bank was pulling our leg when it first informed us about this solution. It was too good to be true,” he says. “But we called their bluff and asked them to come and install it. They came and installed the scanner and trained our staff on how to scan and transmit cheques.”

Since then, business transactions have gotten easier. “We are now more confident that we chose the right banking partner,” he says.

Mr. Singh’s sentiments are echoed by Esther Kilonzo an importer of machinery and equipment. “We previously had multiple problems with cheques but were helpless because cheques are the preferred mode of payment for most clients due to the huge amounts involved,” she says. Now, Amali has alleviated her cheque hindrances. “What used to take hours and even days to handle now happens in real time and it has saved us a lot of money,” she says.