Picturing yourself in retirement may be difficult. Retirement may feel so many years away that you can’t even fathom the idea of ever being able to retire. Or possibly you’re middle-aged and feel that retiring someday is completely impossible.

For a lot of people, retirement just doesn’t resonate as a concept. If that applies to you, try thinking of financial freedom or financial independence as synonymous with the word retirement. Many people have absolutely no desire to stop working. However, those same people are looking for financial freedom and financial independence. They want to be able to choose what they do, when they do it, and for how long. You may be one of these people.

Every financial situation can be improved with proper planning. When it comes to retirement planning, you have the following four options:

>Spend less now and save more.

>Work longer.

>Die earlier (but that’s not really a planning strategy!)

>Get better net, after-tax returns on your investments.

To some degree, you have influence over the first three variables. For many people, the most palatable retirement solution involves a combination of all three of the variables mentioned.

The first step in retirement planning is to determine what matters most to you and your spouse or partner. Spend a moment now, reflect on your lifestyle in retirement, and think about how it will change from the lifestyle you enjoy today.

>What are you doing?

>Where are you living?

>What activities are you enjoying?

How do you spend your time?

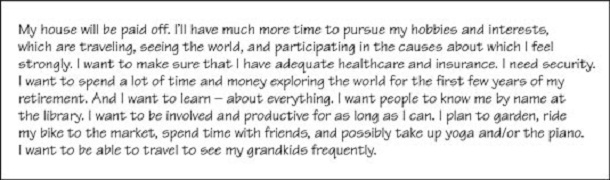

Review the What Retirement Looks Like to Me statement; then create your own.

As you reflect on your lifestyle in retirement, list issues that involve money — maybe earning money and definitely spending money to support your desired lifestyle in retirement. This information is necessary to determine how much money you’ll need in retirement and how much you’ll need to save to achieve financial independence.