Co-operative Bank of Kenya on May 27, 2022, virtually held its 14th Annual General Meeting. This was the third time the meeting was being held virtually following amendments to the law governing annual general meetings.

The overwhelmingly successful meeting was attended by over 16,000 shareholders from across the globe. Shareholders hailed and welcomed the dividend payment by the banking group that is scheduled to hit their accounts from the 17th of June 2022.

The shareholders were appreciative of the Board of Directors’ divided policy that balances between the need for additional capital and shareholders immediate interest for earnings.

They particularly commended the Group’s Board for the Sh. 100 billion retained earnings that the bank has accumulated for future growth through this policy.

Speaking at the meeting the Co-op Bank Group managing director and chief executive officer, Dr. Gideon Muriuki pointed out to the shareholders that the bank was confident of a good performance in the current 2022 full year.

Dr. Muriuki estimated that bank will surpass the over Sh. 22 billion profit that it registered in 2021. “Already in the first quarter of 2022, the bank has registered a profit before tax of Sh. 7.8 billion which is an indication of better days ahead,” he said.

Co-op Bank net profit grows to Sh. 5.8 billion in Q1 of 2022

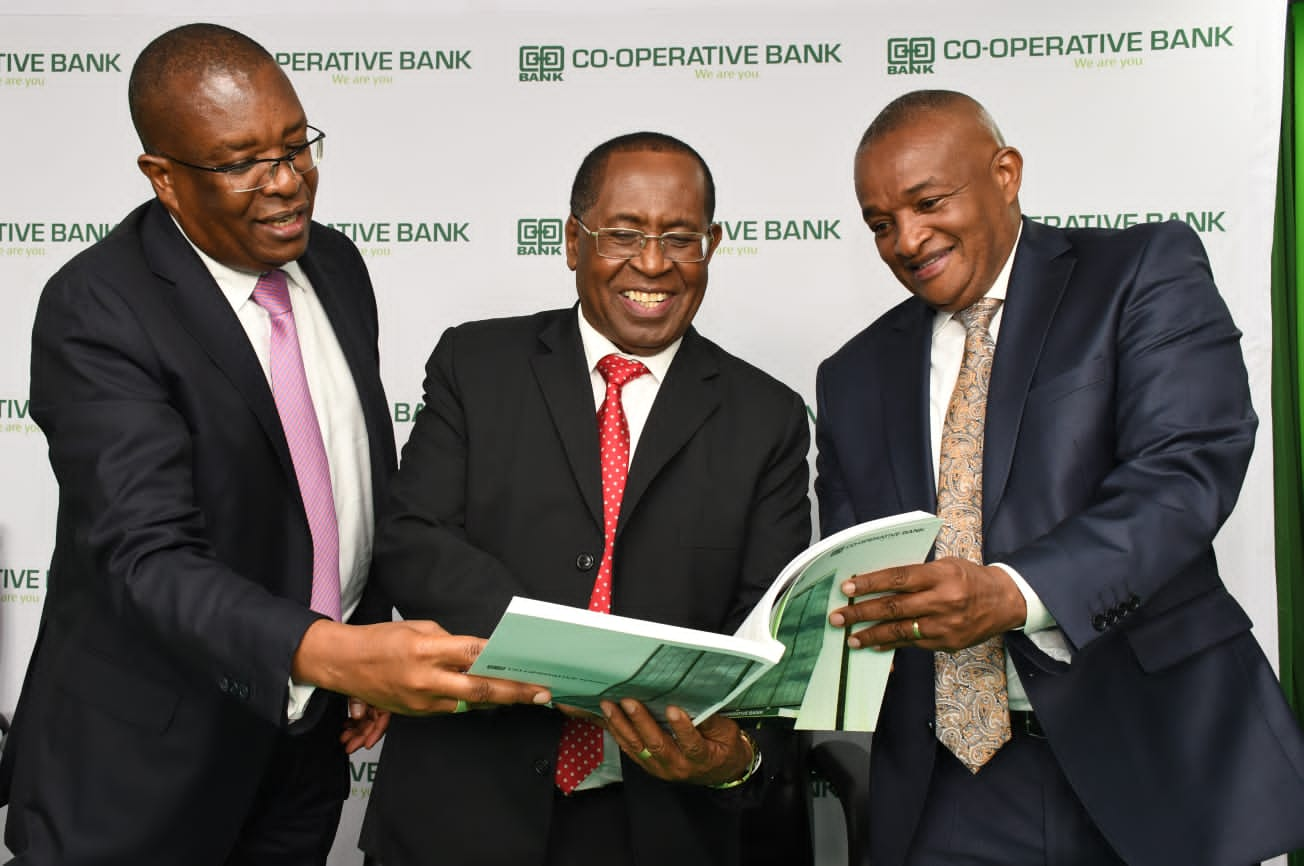

The meeting was chaired by the Co-op Bank Chairman John Murugu. It was also attended by the Vice Chairman Macloud Malonza among other board members who attend virtually.

The 14th Annual General Meeting was held a day after the lender announced that its net income grew by over two thirds in the first quarter ended March 2022. The bank made a net profit of Sh. 5.8 billion in the review period, up from Sh. 3.4 billion the year before.

Awesome. Here are more pictures of the event: https://www.co-opbank.co.ke/2022-agm-photos/