Kenyans living abroad who need assistance returning home might face challenges due to upcoming changes at the State Department of Diaspora Affairs.

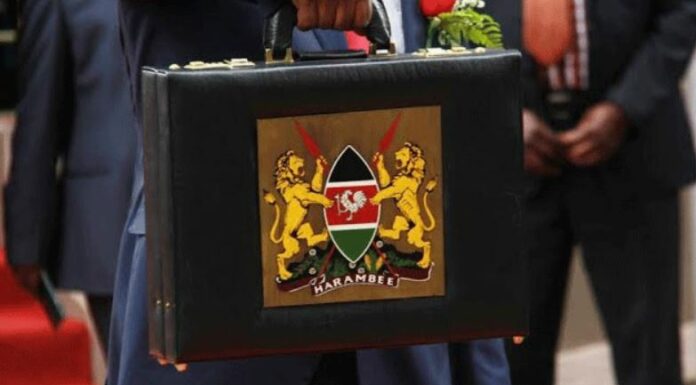

These changes are a result of recent government budget cuts ordered by President William Ruto.

He mentioned that the ministry, through Principal Secretary for Diaspora Affairs Roselyn Njogu, had informed the Defence, Intelligence & Foreign Relations Committee in Parliament that due to current budget cuts, the ministry would not be able to offer some of its services.

Roselyn Njogu, speaking on behalf of the president, urged the MPs to aid in bringing back the budget to its feet.

For instance, the Principal secretary showed that with the change in budget, it would be hard to provide mobile consular services.

“Roseline Njogu, PS State Department for Diaspora Affairs sought support from the Defence Committee to reinstate funding for critical programmes including the repatriation of distressed Kenyans, Diaspora welfare rights and mobile consular services,” the National Assembly communicated in a statement.

The State Department of Foreign Affairs also revealed that its development budget has been slashed by 100 per cent.

Foreign Affairs PS Korir Singoei, who also appeared before PAC, said the cuts will touch expenditure financing that includes the refurbishment of foreign missions.

The PS added that the other project set to be affected by the slash is the construction of the ministry’s headquarters.

“According to documents reviewed by MPs, the Foreign Affairs State Department’s development budget has been cut by 100% affecting the implementation of key ongoing projects including the refurbishment of Mission properties abroad and construction of the Ministry Headquarters,” the National Assembly’s statement communicated.

Europe leads in Kenya’s foreign debts, CBK data reveals

The total amount cut in the new budget estimates submitted is Sh. 156 billion, with the development expenditure taking a cut in Sh. 122 billion and supply in recurrent expenditure being cut by Sh. 34 billion.

Other affected sectors include the Executive Office of the President, which had a budget pegged at Sh. 5.4 billion but was reduced to Sh. 3.6 billion in the new estimates; this translates to a significant reduction amounting to Sh. 1.8 billion.

As much as Sh. 2.1 billion will be taken away from the Office of the Deputy President, with the new allocation after the reduction standing at Sh. 2.6 billion instead of Sh. 4 billion.