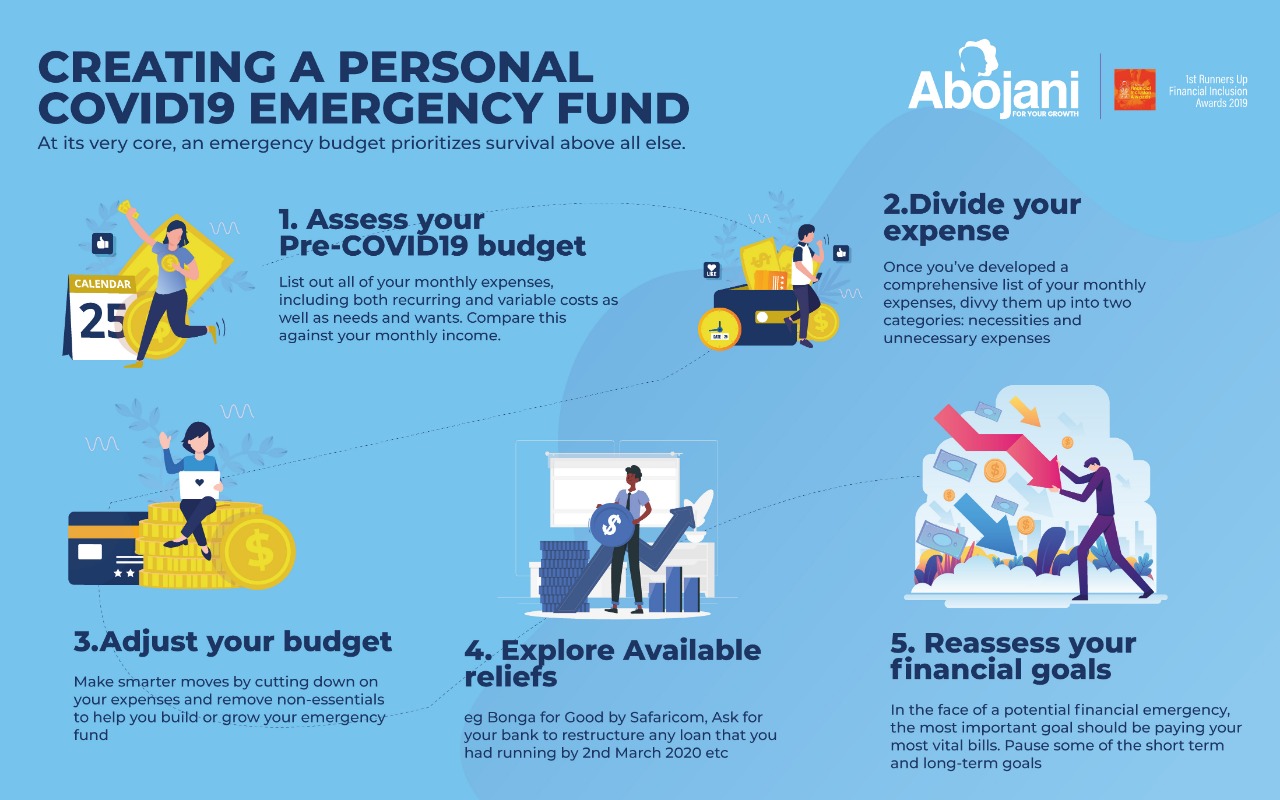

Budgeting During a Crisis: BY Abojani Investments: During times of great uncertainty, keeping your finances in order is essential. Though there is no universal answer to how to handle financial hardship, there are a number of viable ways you can prepare for one.

Step-by-step guide to create an emergency budget to help you weather the financial impacts of coronavirus:

At its very core, an emergency budget prioritizes survival above all else. Though similar to your average weekly or monthly budget, an emergency budget is one that eliminates all unnecessary expenses and solely accounts for your basic needs and financial responsibilities. It includes the basic and essential bills that you have to pay to keep you afloat.

1). Assess you preCovid-19 budget

List out all of your monthly expenses, including both recurring and variable costs as well as needs and wants. Compare this against your monthly income. This comparison will give you an accurate look at how you’ll need to modify your spending to accommodate your basic needs while allocating residual income towards future spending or an emergency fund.

2). Divide your expense

Once you’ve developed a comprehensive list of your monthly expenses, divide them up into two categories: necessities and unnecessary expenses

Necessities: Also commonly referred to as fixed expenses, necessities include everything that ensures your basic needs are met, for example rent mortgage, household items such as groceries.

Non-essentials: These are unnecessary expenses when we are on a low budget or on survival model. They include eating out, paid gym etc.

3). Adjust your budget

With an understanding of how your finances are divided up amongst needs and wants, you can make smarter moves by cutting down on your expenses and remove non-essentials to help you build or grow your emergency fund. Lower some of the fixed expenses as well.

4). Explore Available reliefs eg Bonga for Good by Safaricom.

You can also ask for your bank to restructure any loan that you had running by 2nd March 2020.

5). Reassess your financial goals

In the face of a potential financial emergency, the most important goal should be paying your most vital bills. For most, this likely means that any other goals will need to be paused for the foreseeable future to fully prioritize making ends meet for as long as possible until your regular income stream is restored.