Kenyans will from Tuesday pay more for beer, juices, water, second-hand cars and motorcycles after the Treasury set the date for application of new taxes on the goods.

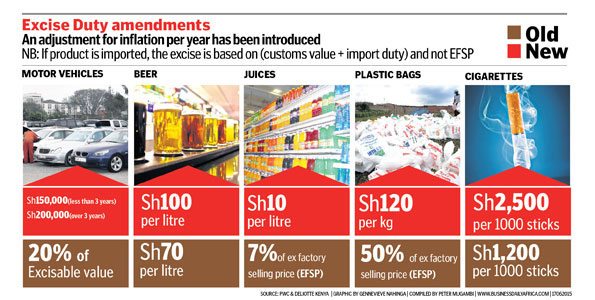

Second hand motor vehicles that are less than three years old from the date of first registration will attract a duty of Sh150,000 a unit while those more than three years old will attract an excise duty of Sh200,000 a unit.

Beer is up Sh30 per litre, kerosene by Sh5.75 a litre, bottled water up by Sh7 a litre, juice is up Sh10 a litre while a charge of Sh10,000 will apply on motorcycles. Plastic shopping bags will go up by Sh120 a kilo. A litre of diesel will now cost Sh3.7 more, while that of petrol will go up by Sh10.3. Spirits, liqueurs and other spirituous beverages of alcoholic strength exceeding 10 per cent will attract an excise tax of Sh175 a litre.

“In exercise of the powers conferred by section 1 of the Excise Duty Act, the Cabinet secretary for the National Treasury appoints December 1, 2015 to be the date the Act shall come into operation,” said Mr Rotich in the gazette notice.

The rise in the cost of the goods coincided with an increase in the cost of living for the month of November.

Figures released on Monday by the Kenya National Bureau of Statistics (KNBS) showed inflation rose to 7.32 per cent year-on-year in November from 6.72 per cent the previous month, driven by a jump in food prices.

KNBS said the food and non-alcoholic drinks index also increased by 1.08 per cent between October and November.