Agriculture is the backbone of Kenya’s economy, contributing 26 percent of the Gross Domestic Product (GDP) and another 27 percent of GDP indirectly through linkages with other sectors.

The sector employs more than 40 percent of the total population and more than 70 percent of Kenya’s rural people.

Despite its important role, various challenges have hindered the sector’s growth forcing the country to rely on imports of some products to bridge the local deficit.

Most farmers name access to credit as the main hindrance to their expansion. To address this, lenders such as Co-op bank have stepped up with various loan products tailor-made for each type of agriculture.

Some of the Co-op bank financing options available for farmers are:

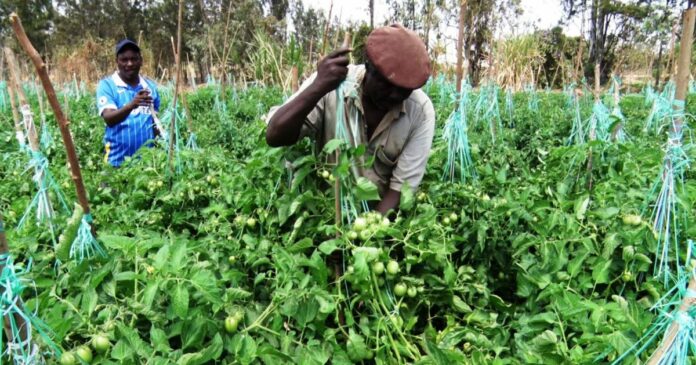

Horticulture & Floriculture Loan

This solution supports fruits, vegetables, and flower value chain players by financing working capital and farm development.

It enables the farmers to purchase land, develop the land by installing infrastructure for irrigation, greenhouses, solar energy, etc.

This specific loan also gives farmers the capacity to buy assets that enhance production such as refrigerators/ cold rooms.

Requirements:

- Duly completed loan application form

- Have an account with a Co-op bank (new or existing)

- 12 month Bank Statement

- Audited books of account for last 3 years and management account where applicable

- Cash flow projection

- Minimum Financing: Ksh 100,000

Maximum Financing: Dependent on repayment ability

Meet dairy farmer producing over 40 litres of milk daily from 2 cows on cheap feeds

Cotton Loan

This finance service is for the various cotton value chain players such as cotton farmers, ginneries, and textile millers and ranges from farm development finance to working capital and CAPEX.

Requirements:

- 3- year historical production records

- 1- year yield production projection

- Audited Books of accounts for the last 3 years

- Borrowing powers (for Co-operative societies only)

- 12-month Bank Statement

- Cash-flow projections

- Resolution to borrow for C0-operative societies & companies.

- Minimum Financing: Ksh 50,000

Maximum Financing: Dependent on society’s repayment ability.

Dairy Loan

This product is targeted to dairy farmers, dairy companies and dairy groups all over the country.

The loans offered under this program are:

-

- Dairy Farm Input Finance: this enables farmers to buy animal feed, fertilizer for pasture, livestock drugs and Al services to boost milk production

- Supply Chain Finance: To facilitate timely payment for milk delivered by farmers and other creditors on time.

- Dairy Processing Plant Financing: To facilitate establishment and refurbishment of dairy processing plants

Requirements:

-

- Have an account with Co-op Bank (new or existing) Milk supply contract with a dairy processor

- 3 years’ experience in dairy farming/processing

- Milk proceeds payment should be through your Co-op bank account

The Minimum financing is Sh5,000 while maximum financing is dependent on repayment ability.

Cereal Farmers Loan

This finance service is for farmers in cereals production, e.g., rice, maize, sorghum, wheat, barley, and all pulses.

The solution facilitates farmers in the purchase of farm inputs and equipment, which includes tractors, combine harvesters, threshers, driers, storage equipment, and store constructions.

Requirements:

-

- Have an account with Co-opBank (new or existing)

- Bank statement for the last 1 year

- Audited books of account for last 3 years and management account where applicable

- Cash flow projection

The minimum financing is Sh50,000 while maximum financing is dependent on repayment ability.

To access these cheap loans, Visit any Co-op Bank branch countrywide.