Controversial billionaires in Kenya: Julius Nyerere described Kenya as a country of 10 millionaires and 10 million paupers to signify the high level of inequality in the Kenyan society – It was in the early 70s but even now, the figures could have only changed but Kenya remains a largely unequal society, thanks to corruption and plunder of public resources for selfish gain. Apart from that, some of the most renowned billionaires in Kenya are also some of the most controversial. Take a look at some of the controversial billionaires in Kenya:

1. Former Nairobi Governor Evans Kidero

He is considered as one of the richest politicians and with a tangible investment portfolio in the media, real estate, banking and agriculture. But controversy seems to follow him wherever he goes. While working as the chief executive officer of the now moribund miller, Mumias Sugar, Kidero was accused of swindling the company billions of shillings through fraudulent transactions. A parliamentary draft report recommended his prosecution.

During the 2013 General Elections, he was accused of bribing a supreme court judge Philip Tunoi with Sh. 200 million to rule in his favour after Ferdinand Waititu challenged his win in court. Mr. Kidero currently has a court case that has also thrown him into the limelight over controversial claims.

2. William Kabogo

The former Kiambu governor is not new to controversy. Although his investments are said to be in real estate, agriculture and dairy farming, allegations about his real source of wealth have often been made, including illegal dealings. None of them, though, has ever been prosecuted in a court of law.

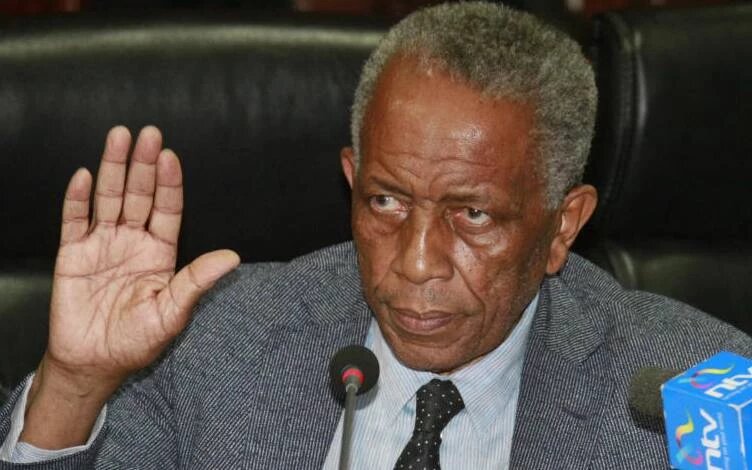

3. Cyrus Jirongo

He was at one point a billionaire and influential politician. Today is just a broke political shadow of his former self. Jirongo made billions due to his close links with the late president Daniel Arap Moi. He is reported to have had investments in real estate and agriculture. He has once went public saying that he made his first million before attaining the age of 30. He was one of the six individuals that were mentioned in the collapse of Dubai Bank. Jirongo was also entangled in a row with Central Bank of Kenya after the regulator threatened to sell his 1,000-acre land in Nairobi’s Ruai estate over a Sh 20 billion loan. CBK was acting on behalf of the collapsed Postbank Credit.

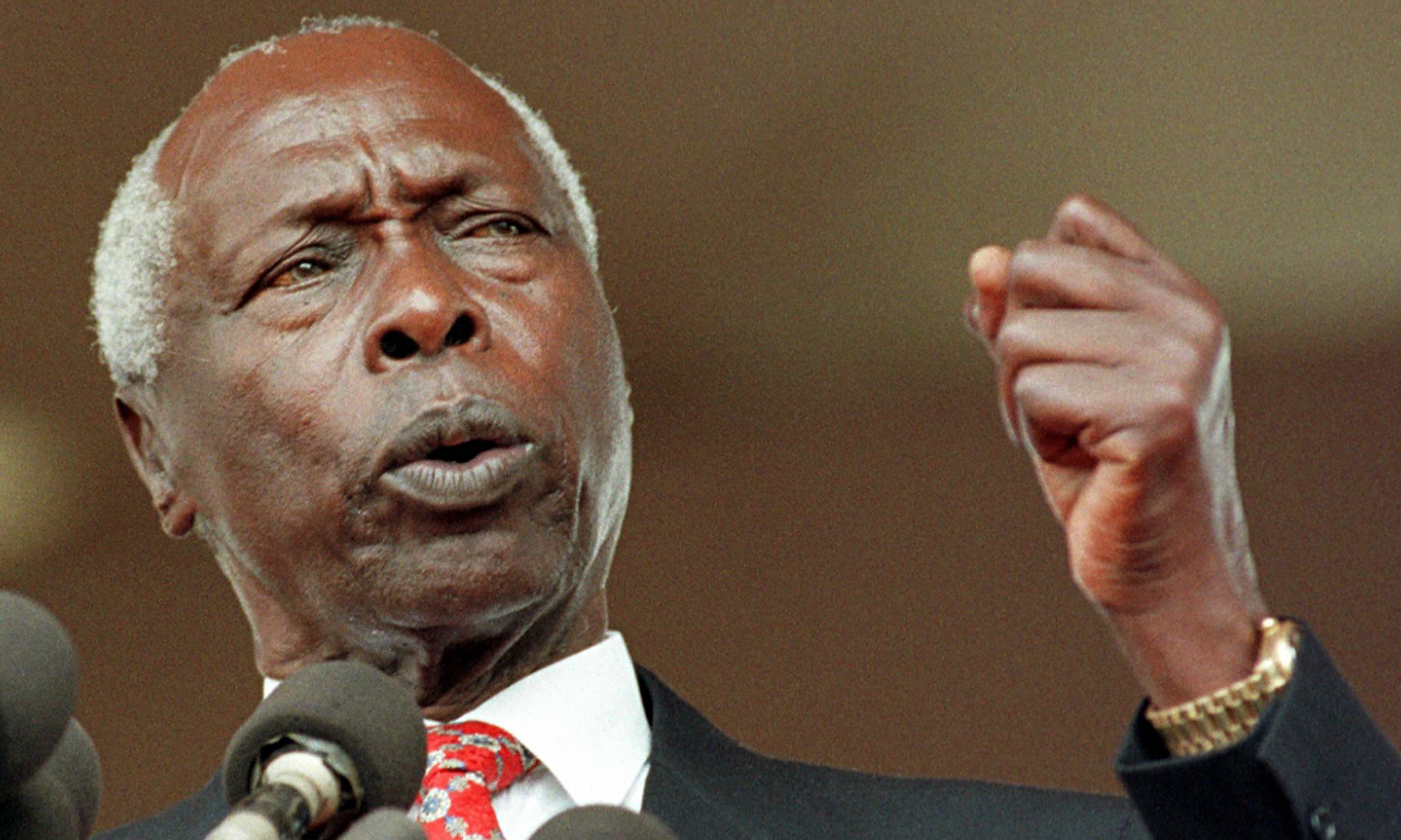

4. The late president Daniel arap Moi

There is no doubt that the late president was a billionaire. You can read about how he made his wealth here ( The legal and suspicious ways Moi family’s multi-billion empire was built ). But he was also a controversial leader who was accused of presiding a dictatorship, sinking the country to unimaginable levels of corruption, and theft of public resources.

5. Humphrey Kariuki

He moved from being awarded as a top taxpayer by the Kenya Revenue Authority (KRA) to a wanted man with a Sh. 41 billion tax bill. When in his mid-30s, his businesses were getting plaudits from the movers and shakers in the country. This was at a time when the country was gripped by tension caused by the clamour for multiparty democracy, and mass protests and teargas-filled political rallies in Kamukunji was the order of the day. Businesses were suffering. Liquidity hitches were the order of the day and the shilling was losing ground against major currencies. But the businessman had a respite of sorts — he was getting paid in dollars, for this was the time he was supplying foods and beverages to various foreign missions. A decade later, he was in government crosshairs following a deposit of Sh. 2 billion into his bank account at the now defunct Charterhouse Bank. Kariuki went to court to challenge a decision to freeze his account. At the time, all banks and financial institutions were required by the Central Bank of Kenya (CBK), an institution that Kariuki worked for, to disclose any transactions above $500,000, which was then Sh. 39 million. Documents from the Registrar of Companies showed that Crucial Properties, the company that received the Sh. 2 billion at Charterhouse Bank, was registered in 1996.The main shareholders then were Gilbert Thinji Nguru and Helen Njambi Nguru.The firm remained dormant until 2000 when the two directors wrote to Charterhouse, informing the bank that the company’s board had incorporated Kariuki as a director and signatory to the account at Charterhouse. A few days later, some $24.9 million was deposited in the account.In an affidavit, Kariuki said he was summoned to the CBK on January 30, 2001 for an urgent meeting, believing he was about to be asked to invest in Treasury bills, only to be questioned about the source and his intentions for the money. “I told them it was not their business and that their questions were irrelevant and in bad faith,” his affidavit from the time reads. He said the CBK officials then turned unfriendly “becoming arrogant to the point of seeming drunk”.Two decades later, a similar scene is at play. This time, Kariuki is being sought over a tax bill.

6. Peter Munga

The former Equity Chairman is at the heart of a deal that saw the government of Mauritius lose billions. Munga was behind the secretive purchase of some 452.5 million shares of Britam Holdings from the government of Mauritius. This secretive purchase left Mauritius with a Sh. 3.9 billion loss. This loss and Munga’s role in the deal were revealed by the Port Louis commission of inquiry which investigated the share transactions. The commission found out that the then Mauritius’ Minister of Financial Services, Good Governance and Institutional Reforms Roshi Bhadain assisted Munga in purchasing these shares at a price of Sh. 7.1 billion in 2016. He has previously been accused by a local investor of conning them millions in a shares deal. Munga was accused by Joseph Muturi of conning him Sh. 150 million.

7). Francis Mburu

He has been caught up in various scandals and legal suits. These have been both against private citizens and the national government. In 2021, Mburu lost a parcel of land worth billions of money to a company that is associated with Mombasa Governor Ali Joho. He lost the land after a court of law determined that he had acquired it irregularly.

Additional reporting adapted from The Standard.