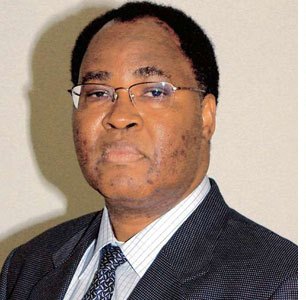

Stanley Murage, the former State House operative is leading a consortium of investors who are negotiating to acquire an 80 per cent stake in troubled Rift Valley Railways (RVR) for Sh. 13.3 billion.

This stake is currently held by Cairo-based Qalaa Holding. However, the 15 per cent stake in RVR held by Uganda’s Bomi Holdings is not for sale.

Murage is pushing for the deal through the project management firm Armstrong & Duncan, which he chairs. The consortium is betting on a multi-pronged strategy to turn around the loss-making RVR, including funnelling their existing customers to use the railway operator’s services as well as expectation that some of the crude oil coming from the region’s wells will come through.

Additionally, the consortium led by Murage has offered to provide an initial $50 million (Sh.5.1 billion), with capital expenditure and maintenance to take up Sh.1.7 billion, financing legal liabilities (Sh.1.6 billion), plugging operational cash flow deficits (Sh.1.2 billion) and urgent operational continuity (Sh.512 million).

Sh. 4 billion has been offered to purchase rolling stock like wagons for use in expanding RVR’s operational capacity to handle more cargo destined for all countries in the East African region.

Another Sh. 4 billion has been set aside for investment in the business over the remaining years of the concession, which runs until 2031.