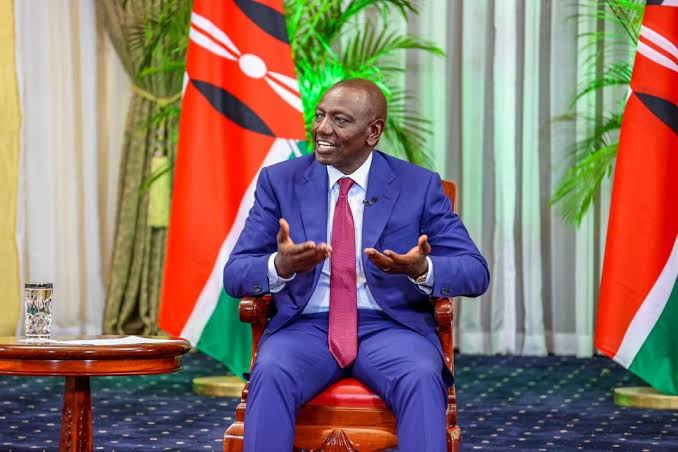

The government of President William Ruto has collected Sh. 11.83 billion from the affordable housing tax in two months.

This has been revealed by a National Treasury document that was tabled before the National Assembly’s Finance Committee by the by Controller of Budget (CoB) Margaret Nyakang’o.

The document shows that the National Treasury collected Sh. 7.9 billion in August and Sh. 3.93 billion in September.

The report indicated that the National Treasury did not remit any exchequer funds to the housing fund in the month of July.

According to estimates from the National Treasury, contributions will increase by 40.8 per cent to hit Sh. 89 billion in the 2026 – 2027 financial year. This will be an increase from Sh. 63.2 billion that is estimated to be collected in the current fiscal year.

The estimates that are contained in the draft Budget Review and Outlook Paper further indicate that the housing fund tax contributions will stand at Sh. 70 billion in the 2024 to 2025 fiscal year and Sh. 78 billion in the 2025 to 2026 fiscal year.

The affordable housing tax mandates employers and employees to remit 1.5 per cent of gross salary to the taxman.

KRA: Items you must declare at customs when arriving or departing Kenya

This tax is one of the most controversial laws that have been implemented by the government of President William Ruto.

The Cabinet Secretary, Ministry of Lands, Public Works, Housing and Urban Development through a Public Notice dated 3rd August, 2023 appointed Kenya Revenue Authority as the collecting Agent of the affordable housing tax.

With effect from 1st July, 2023, all employers were required to deduct the affordable housing tax from their employees’ gross salary and remit together with the employers’ contribution at one point five per centum (1.5%) of the employee’s gross monthly salary by the employee, and one point five per centum (1.5%) of the employee’s monthly gross salary by the employer.