Develop your budget with the money you have available after government deductions from your pay cheque, but before voluntary deductions (e.g. RRSPs, pensions or other savings).

If you have expenses such as high debt payments, childcare, school expenses or giving, you will need to reduce your spending in other areas to accommodate these higher expenses.

This guideline is only a starting point. Based on your income and family circumstances, your allocations may be very different.

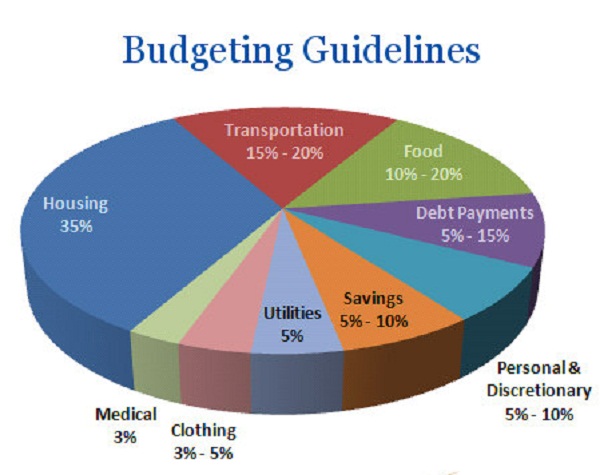

Breakdown of Budgeting Categories

Housing: 35%

mortgage / taxes / strata / rent/ insurance / hydro

Utilities: 5%

phone / cell phone / gas / cable / internet

Food: 10 – 20%

groceries / personal care / baby needs

Transportation: 15 – 20%

bus / taxi / fuel / insurance / maintenance / parking

Clothing: 3 – 5%

for all members of the family

Medical: 3%

health care premiums / specialists / over-the-counter

Personal & Discretionary: 5 – 10%

entertainment / recreation / tobacco/alcohol / eating out / gaming / hair cuts / hobbies

Savings: 5 – 10%

Plan to save money for expenses that don’t occur every month, as well as for your future. Then you’ll have a little extra available when you need it.

Debt Payments: 5 – 15%

Many people find that their budget is quite tight because their monthly debt payments are closer to 25% of their net income.