How to invest in treasury bills in Kenya: Treasury bonds are instruments that the government uses to borrow funds from the public. The loan that we give the government is referred to as a bond. The interest rate on a bond is referred to as a coupon, and is paid every six months.

Treasury Bills are similar in their function. They are also a vehicle that the government uses to borrow money from the public, usually to finance short-term debt such as salaries. In a business, this is similar to what we call ‘working capital finance’.

The difference between Treasury Bills and Treasury bonds is in how they are structured. Treasury Bills are issued for only short periods of time given that the funds are used to finance short-term expenditure.

They are issued for three months, six months and one year. The official terms used are actually 91 days, 182 days and 364 days. In contrast, Treasury bonds are issued for a minimum of one year to 30 years.

SEE MORE: Best cars under Sh. 500,000 to buy in Kenya (Updated 2019)

How to invest in treasury bills in Kenya: How it works

So what is the difference between investing in a one year Treasury Bill and a one-year Treasury bond? Say you had Sh100, 000 that you could place in either Bills or bonds, and they were both yielding 10 per cent in interest per year.

A Treasury bond will give you your Sh100, 000 back plus your interest of Sh10, 000 (less any applicable taxes) at the end of the year. Well, with a Treasury Bill, your interest will be paid to you differently. The concept used is called discounting.

Before we get too wrapped up in the technical term, let’s use Mary as an example.

Mary goes into a shop to buy a sweater. The price of the sweater she wants to buy is Sh2, 000. However, they don’t have it in stock now and she will only receive it in two weeks’ time. Mary uses that fact to negotiate.

She is happy to pay in full for it now, as long as she gets a discount. Mary therefore pays Sh1, 800 now for the sweater, receiving a Sh200 discount. In two weeks she will receive a sweater worth Sh2, 000.

This is similar to how Treasury Bills work; the value of the Treasury Bill you are investing in is Sh100, 000. However, you will pay approximately Sh90, 000 upfront, and at the end of the year, you will receive Sh100, 000. So what has happened here?

If you want to receive Sh100, 000 at the end of the year, the interest that is due to you is deducted from the investment you need to make upfront.

You are investing in a Treasury Bill worth Sh100, 000 and paying approximately Sh90, 000 today. The Sh10, 000 discount you have received is in consideration for the fact that you are going to give your money to the government for a year, just like Mary got a Sh200 discount for leaving her money with the store for two weeks. You are being compensated for the opportunity cost of your money.

The Sh100, 000 ‘investment’ is referred to as the face value of the Bill. The discount you receive depends on the amount of time you invest for. The longer you invest, the higher the discount. If you invest in a six-month Treasury Bill as opposed to one year, you will receive approximately Sh5, 000 as the discount.

Safe investments

Treasury Bills are safe investments, so you cannot use them if you want extremely high returns; Treasury Bills provide a way for you to park your money in the short term. If you have money sitting in an account and do not need the funds for at least three months, it is worth investigating the return you would get if you went the Treasury Bill way.

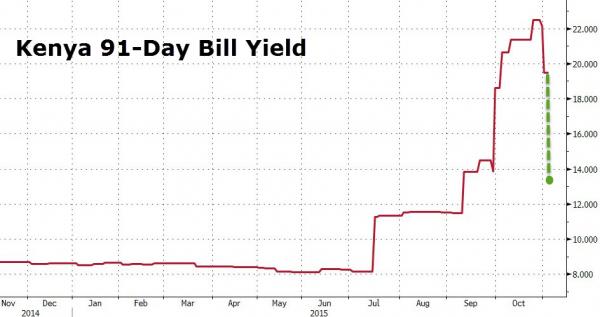

Currently, the 91-day Treasury Bill is returning about 10 per cent per annum. You are probably not earning that with your savings account.

The minimum investment required for Treasury Bills is Sh100, 000. The process of investing in Treasury Bills is similar to bonds. You need open a CDS account with the Central Bank. Treasury Bills are usually issued every week and information can be found on the Central Bank website on what they have on offer.