More than three-quarters of polled Africans report income falls on COVID-19 Informal and low-income earners hit hardest as unemployment surges in Ivory Coast, Kenya, Mozambique, Nigeria, and South Africa

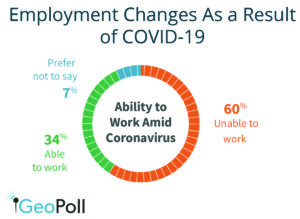

A five-nation survey by GeoPoll in Sub-Saharan Africa has found that 60 percent of those employed prior to the COVID-19 pandemic has not been able to work as a result of the outbreak, and nearly half of those are unsure if they will have jobs to go back to.

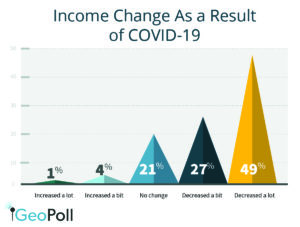

An even larger proportion, at four out of five of those polled in the survey of 2,500 respondents, reported that their income has decreased during the pandemic, with those in informal jobs, particularly in trade and agriculture, reporting the most widespread and largest falls in incomes.

Overall, some 60 percent of formal sector workers reported income falls, but 88 percent of informal sector workers reporting reduced earnings. The International Labour Organisation estimates that the informal sector accounts for over 80 percent of the workforce in sub-Saharan Africa.

Rich Kenyans bank Sh. 45 billion during corona lockdown

“The closure of borders, restrictions on movements, and suspended education and hospitality sectors have wrought financial havoc across the African nations studied, with those in informal employment being hardest hit” said Roxana Elliott, VP Marketing & Content, GeoPoll.

The lifting of restrictions is unlikely to repair the damage quickly, with only 57 percent of the previously employed saying they still have work to return to once the COVID-19 restrictions are lifted.

Moreover, just 6 percent of the respondents reported they have sufficient funds to cover their household expenses for more than five months, and most are already running down their savings or relying on credit.

Altogether, 30 percent said they would be covering most of their expenses next month through borrowing, and 28 percent by using savings. Moreover, during the pandemic, almost half of all respondents have taken an extra loan to help cover household expenses.

“With many sub-Saharan Africans still excluded from borrowing, the impact of the pandemic on income and employment, which has hit the lowest income earners the hardest, will make paying for basic expenses such as food and rent a challenge for millions over the coming months,” said Roxana.

Despite the harsh economic effects being felt, a majority in the nations studied believe their governments should prioritize protecting people from the virus, rather than focus on reopening economies. Of the countries studied, Nigeria was the only one in which a majority feel that reopening the economy should be a priority. However, it was also found that those whose income has decreased significantly were more likely to favor reopening economies.

The survey was conducted remotely via SMS from June to July 2020. It was run throughGeoPoll’smobile surveying platform, which enables safe and effective data collection via SMS, voice call, and other modes even when in-person research cannot be conducted.

The full GeoPollreport, which covers income bands, types of employment, and the impact on earnings in each of the countries, is available on: