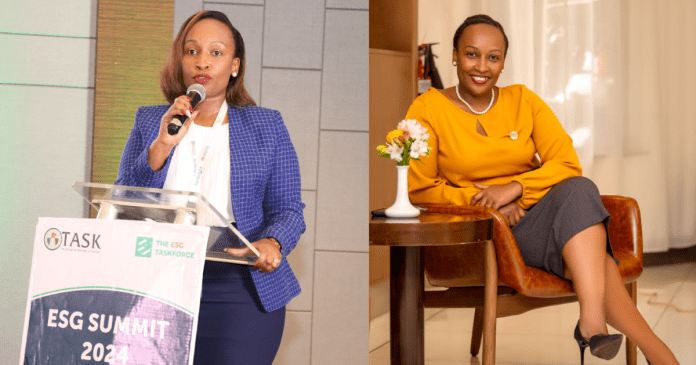

Jubilee Health Insurance CEO Njeri Jomo has opened up about a pivotal career decision that changed her outlook on professional growth and fulfillment.

During a Zoom call titled The One Move That Unlocks Lifelong Success on Wednesday, March 26, and hosted by Abojani Investments, Jomo reflected on a moment in her career when she prioritized financial gain over workplace culture and values—only to regret it later.

“Since I launched my career in 2001, there have been defining moments. People often see an upward trajectory, but failure is part of the journey. I’ve failed quite a number of times. Once, I left an organization because another company doubled my pay. I quickly resigned and moved on—only to realize I hadn’t reviewed their culture and values. In less than eight months, I had to leave. The misalignment was unbearable. Integrity was an issue, and how business was done was an issue. I was out of work for a while,” she narrated.

Njeri expressed that for many professionals, salary was a determining factor. But her experiences, she says, had taught her about the importance of a holistic approach when making career decisions. She emphasized that money alone should never be the sole deciding factor.

“One of the things we all learn early on is to avoid failure. Perhaps it comes from our schooling—bringing home a bad grade means immediate scrutiny. We grow up thinking mistakes are unacceptable. But failure doesn’t disqualify you; it develops you,” she noted.

This principle was tested again when she transitioned from an underwriting to a sales role, a move she had never envisioned for herself.

“I loved coming to work, reviewing risks, and sitting at my desk. Then, there was a reorganization, and I was moved to sales. I never imagined myself selling insurance. It was challenging, but in hindsight, it was one of the best things that happened to me. It made me agile and adaptable. Many of us put ‘versatile and adaptable to change’ on our CVs—but for me, that was tested. I had to do it, and I did it exceptionally well.”

Coming from a background where her parents couldn’t sponsor her degree, she had to work for years without the formal qualifications many of her peers had. Having launched her career in 2001, without the much-needed papers, she fought through, working hard and only managing to bag her first degree in 2015 after cementing her name in the industry.

“I graduated with my first degree in 2015, after having worked for a long time. Because I lacked formal qualifications, I worked harder. My results had to speak for me. By the time I finally got my degrees—including my master’s—my work ethic was already strong. That accelerated my career.”

Beyond personal success, Njeri has played a significant role in reshaping the medical insurance industry in Kenya. Under her leadership, Jubilee Health Insurance has focused on innovative solutions that improve access to healthcare for individuals and businesses alike. She believes the insurance industry must evolve to meet the growing and dynamic healthcare needs of Kenyans.

“Healthcare is deeply personal. When people come to us, they are often in moments of vulnerability. Our job is not just about numbers and claims—it’s about ensuring that people receive the care they need when they need it. That’s why innovation is at the heart of everything we do at Jubilee Health Insurance. We are continuously working to provide better solutions that make healthcare accessible and affordable.”

Meet Tinashe Gatimu: The 20-year-old rally sensation racing with her mother

As a CEO, she says she understands the pressures of leadership, particularly the scrutiny that comes with it.

“Every year, our financials are published with my name signed at the bottom. It’s a public appraisal—no place to hide. Over time, I’ve learned that failure is inevitable. You will fail—many, many times. The key is to rise every time. When others fail, you understand their struggle. You’ve been there. You can guide them through it instead of judging. And you must develop the strength to withstand shocks and keep moving forward. If your business collapses today, will you show up tomorrow? Or will you stay in bed? True leaders build the muscle to bounce back. Failure doesn’t disqualify you; it develops you,” she stated, emphasizing the need for empathy and resilience.

Addressing the myth that “the higher you go, the cooler it becomes,” she countered, “That’s a lie. The higher you go, the thinner the air. You must develop the strength to survive at those altitudes. Failure keeps you grounded. It helps you refine your skills and remain humble when success comes.”

Ultimately, Njeri believes that self-awareness is the foundation of sustainable success. “Know thyself,” she said.

Adding:

“Mastering yourself makes success more sustainable. Leadership follows the law of the lid: an organization cannot rise beyond the leader’s capacity. The leader’s vision sets the ceiling for growth. If a leader has self-imposed limitations, those limits become the organization’s boundaries.”

Her advice to aspiring leaders is to be intentional in their career moves and personal development.

“You are paid not for holding certificates but for applying knowledge to deliver results. The key is to be known for delivering, being reliable, and being consistent.”

She urged all professionals to put their health first, stating that there is no gain in investing heavily and forgetting to protect one’s health and mental well-being.

“We insure our cars, yet some people don’t insure themselves. If you have car insurance but no health cover, today is the day to change that mindset. The most valuable asset is you. You are the constant. Insure yourself. We insure our cars, yet some people don’t insure themselves. If you have car insurance but no health cover, today is the day to change that mindset. The most valuable asset is you. You are the constant. Insure yourself.

Once your health is secured, you can focus on maximizing your investments. It’s much easier to plan when you know a medical emergency won’t derail your finances. The earlier you get health insurance, the better. Many policies offer preventive care, helping you maintain better health as you age. Unfortunately, many people wait too long, and by the time they seek coverage, it’s far more expensive,” stated.