KCB regained its position as Kenya’s most profitable bank after posting a 12 per cent net profit growth in the first quarter. The lender’s net profit in the period stood at Sh4.4 billion, overtaking the Sh4.3 billion announced by its top rival Equity Group that had relegated KCB to second place in 2014 full year earnings table.

Equity closed 2014 as the most profitable bank in the country with a net profit of Sh17.5 billion, outpacing KCB which returned a profit of Sh16.8 billion in the same period. KCB’s performance in the first quarter was driven by increased interest and transaction-based income, recording a relatively faster net profit growth than Equity’s which rose 10.7 per cent from Sh3.9 billion a year earlier.

“The performance is a confirmation that the catalytic investments we have been putting into the business through partnerships are increasingly bearing fruit,” said KCB chief executive Joshua Oigara yesterday when releasing the results in Nairobi.

“The 12 per cent increase in net profit is slightly below our internal target of 15 per cent, but the bank is still in a strong position to beat the target for the full year.”

Co-operative Bank, which recorded quarter one net profit of Sh3.17 billion last week, posted the highest net profit growth of 29 per cent among top-tier lenders that have announced their first quarter performance. The bank’s net earnings in the period stood at Sh3.1 billion compared to Sh2.4 billion in the first three months of last year.

Equity’s record profit of Sh17.5 billion in the whole of last year was partly helped by the sale of its 24.7 per cent stake in Housing Finance to Britam for Sh2.8 billion, a deal that saw it book a gain of Sh1 billion.

Excluding this transaction, KCB would have remained the most profitable lender in absolute terms as it had done since 2011 when its Sh10.9 billion net profit saw the bank replace Barclays Kenya at the top of the earnings table.

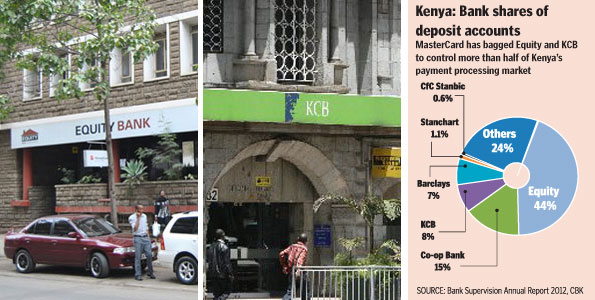

KCB and Equity are arguably the fastest growing banks, blazing the trail in regional expansion in a battle for supremacy that has left investors assessing which institution offers higher returns and a more efficient operation than the other.

While KCB has a head start in the form of a larger asset base and loan book, various metrics have painted a mixed picture for investors seeking to choose one institution over the other.

Standard Investment Bank noted that KCB could record growth by simply changing its mix of loan assets and correctly pricing additional risks, observing that the bank has signalled an intention to increase the share of credit to the more lucrative SME borrowers.