Kenyan banks handled suspicious money amounting to a total of Sh6.38 trillion in the period between 2021 and 2024, a new report has established. According to the report dubbed Financial Reporting Centre Money Laundering and Terrorism Financing Trends and Typologies Report 2025, this amount was out of the total of Sh6.976 trillion transactions over the same period that were flagged as suspicious money.

The report noted that these transactions were majorly conducted through shell companies that concealed the actual identities of the persons involved. The transactions were also split into small batches to avoid the Sh1 million threshold required for mandatory reporting.

The Money Laundering and Terrorism Financing Trends and Typologies Report 2025 identified catalysts of these transactions between 2021 and 2024 as including corruption and economic crimes, fraud, tax-related crimes, bribery, trafficking drugs as well as human beings, wildlife and environmental crimes, theft, among others.

“Manifestations of corruption during the review period majorly bordered on conflict of interest, procurement fraud, embezzlement and receipt of kickbacks at both county and national level,” the report stated.

“The schemes also involved acts of fraud and forgery whereby the corrupt officials used forged documents to legitimize the transactions as evidenced by discrepancies in the support documents provided,” the report stated.

“The funds acquired were eventually withdrawn in cash, transferred to accounts of related companies and eventually invested in different sectors of the economy. Instances of abuse of CBOs for corruption and laundering purposes were also noted whereby corrupt public officials colluded with these organizations to launder proceeds of corruption.”

In one county, 15 companies were contracted for various fumigation, cleaning, landscaping and construction services. All the companies were linked to employees, some who sat in different tender award committees and all the companies were registered on the same day. They also had county employees or their relatives listed as directors and shareholders. At the same time, the companies that were listed for construction works had not been registered with the National Construction Authority which is mandatory for all construction related companies operating in Kenya.

“Between February 2021 and July 2022, the companies received a total of Sh361,867,341 from the county. Some of the tenders were awarded before the companies were registered, some contract agreements were signed after the project was executed, there were duplicated local Service orders (LSO) issued to different companies for the same service,” the report stated.

“The funds were utilized through cash withdrawals in structured amounts below the reporting threshold and transfers to proprietors’ accounts, to county employees and to related companies’ accounts.”

While exposing procurement fraud in some counties, the report found that a Community Based Organization (CBO) was formed in November 2022 in one county with an objective of promotion of the general welfare, eradicating poverty, raising the living standards, and promotion of unity, co-operation and understanding among its members.

In June 2023, the CBO received a total of Sh185,692,745.95 from another county. This money was described as payment for emergency aid and supported with a project funding proposal. However, the report found out, the proposal for funding was done a month before the CBO registration date while the description of the project funding in the proposal differed with the letter of funding for the project.

“The project breakdown was for Sh400 million as opposed to the letter of approval for Sh450million. The funds were utilized through cash withdrawals, transfers to two hardware business dealing in supply of construction materials. The utilization of the funds was described as construction of water pans and simple soil dams, provision of educational services in farming, supply and delivery of chicken incubators, construction materials and building bridges,” the report stated.

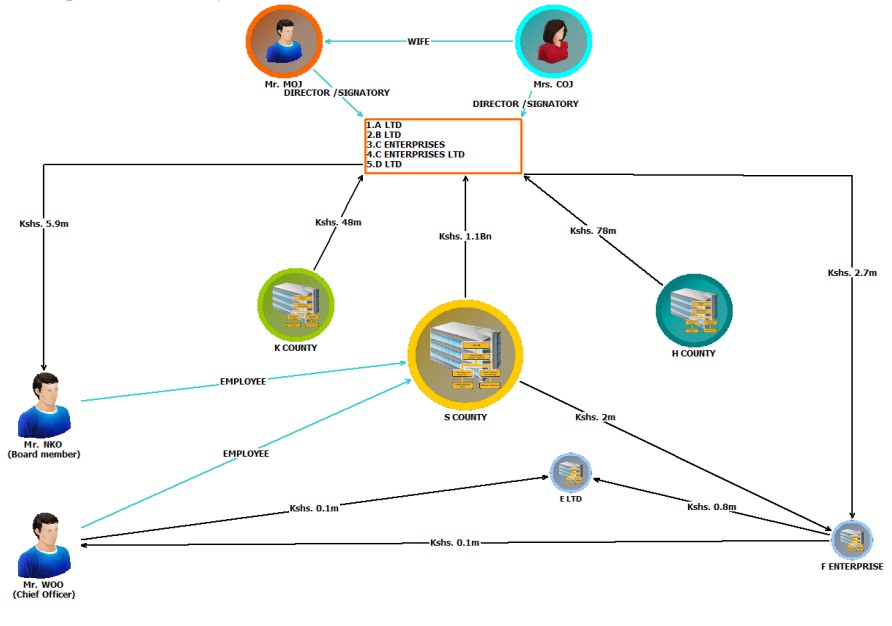

In yet another case, the report showed that two persons who it identified as Mr. Nko and Mr Woo, worked with yet another county in collaboration with directors of 5 related construction companies to siphon public funds. Mr. Nko worked in this county as a member of the County Public Service Board. Mr. Woo on the other hand worked as a Chief Officer in Department of Public Construction and Public Works.

“Between 2019 and 2023, the five companies, One Limited, Two Limited, Three Limited, Four Limited and Five Limited, all owned by Mr. HOJ and Mrs. COJ received a total of Sh1.226 billion from three different counties for what was declared as multiple construction works.

However, support documents showed that the LPOs presented were addressed to companies different than those that were paid, tender documents were undated, and tender numbers in the tender award documents differed with the letters of award.

“Some of the payments to the companies were duplicated across multiple companies. When the funds were credited to the bank accounts, they were utilized through cash withdrawals by the directors and transfers to 2 companies owned by Mr. Nko,” the Money Laundering and Terrorism Financing Trends and Typologies Report 2025 stated.