Assets under management held by Kenya’s 17 collective investments schemes totaled Sh 55.8 Billion at the end of March 2017, according to the latest report by the Capital Markets Authority (CMA), the industry regulator.

As at March 2017, money market funds were the largest asset category, accounting for 77.61 percent of the total assets under management. Equity funds were the second most common category with a share of 11.84% (Sh 6.6 Billion), Balanced Funds 6.94% (Sh 3.87 Billion), while Fixed Income/Bond Fund accounted for 2.65% (Sh 1.5 Billion).

Top Fund Managers

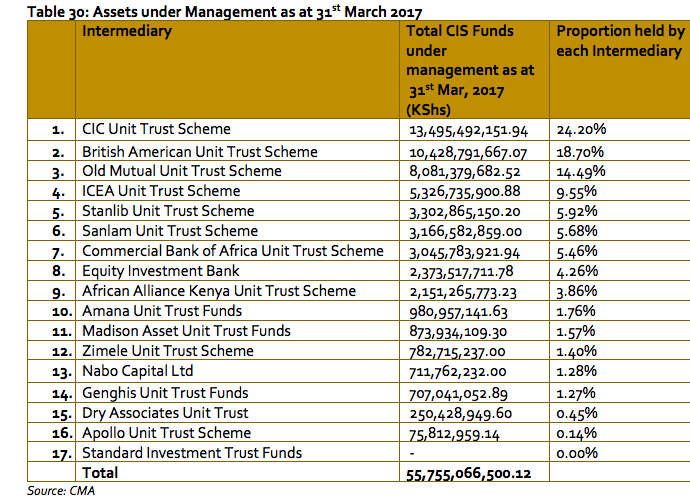

The study shows that top five fund managers have a combined market share of 73%, they have assets under management of Sh 44.34 Billion.

CIC Unit Trust Scheme with Sh 13.5 Billion in assets under management, was ranked number one with a market share of 24.20%. Britam was second with a market share of 18.70% and collectively managed about Sh 10.5 Billion.

The below table shows the ranking of managers in terms of assets held in collective investment schemes.