Knight Frank Kenya, a leading global property consultancy, has launched its Kenya Market Update H1 2025, providing a comprehensive analysis of the country’s real estate and economic performance. The report highlights resilience across key sectors, including office, hospitality, and capital markets, amid evolving macroeconomic challenges.

Macro economy & capital markets

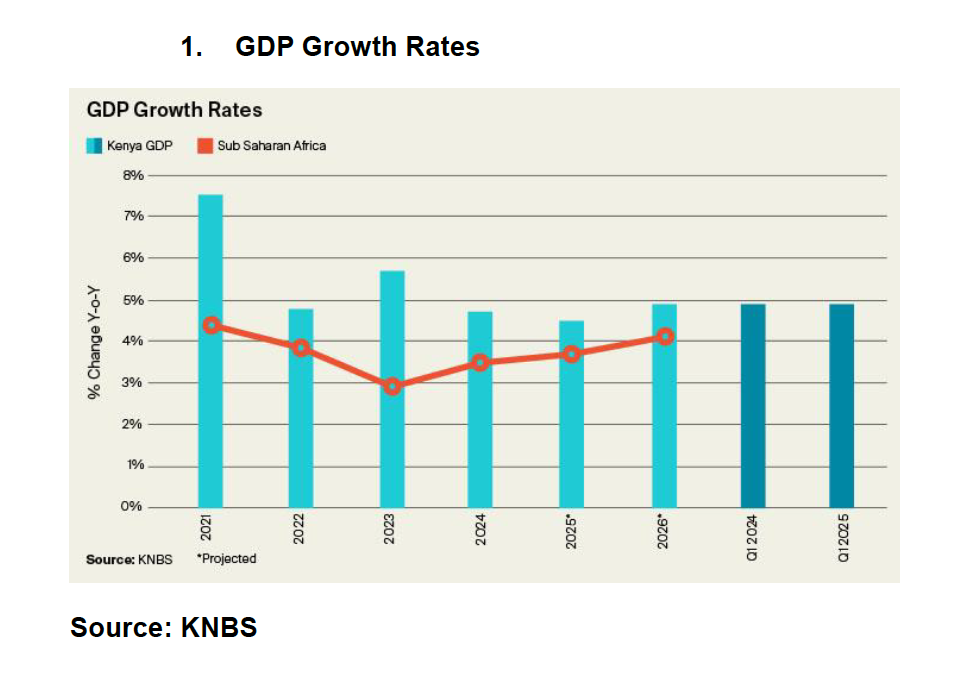

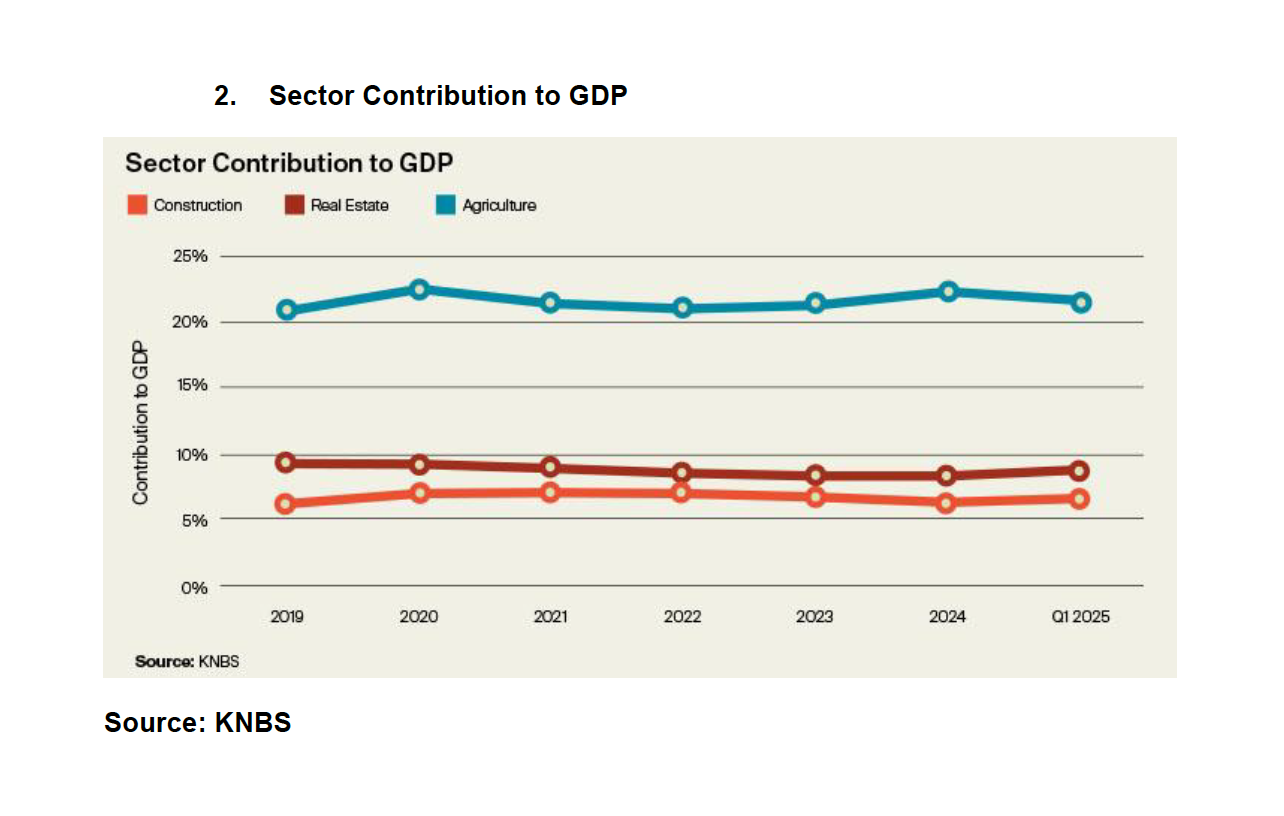

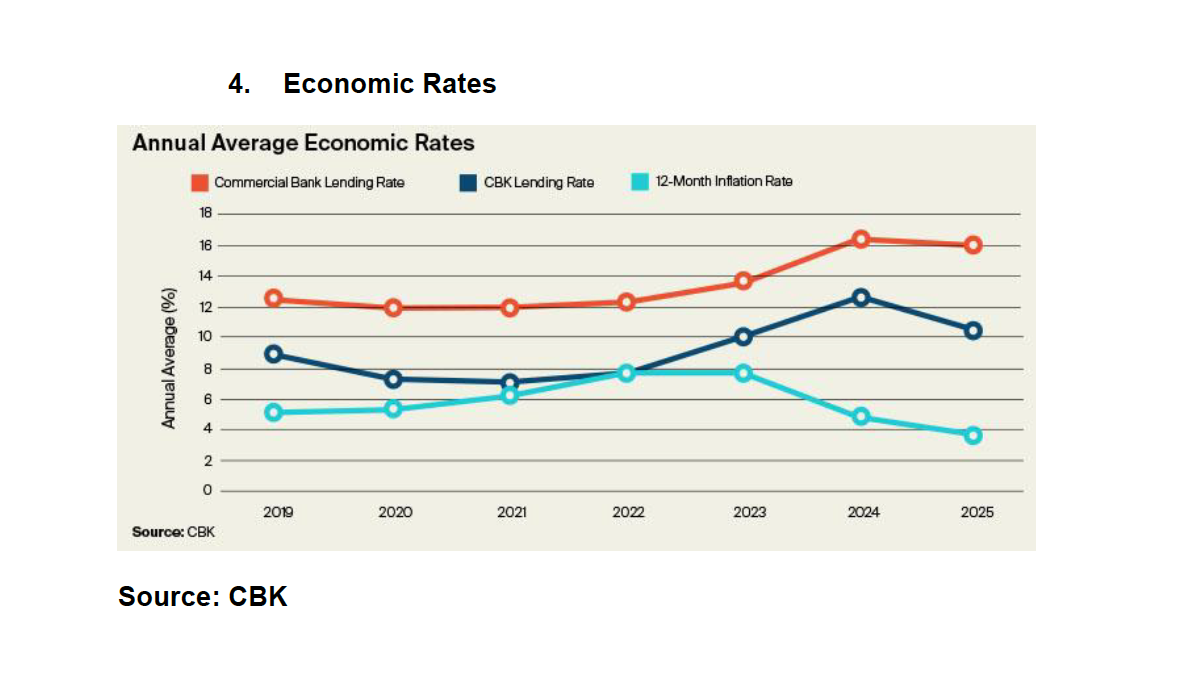

Kenya’s GDP grew by 4.7% in 2024, with a projected expansion of 4.5% in 2025, signaling steady economic recovery despite global headwinds. Inflation remained within the Central Bank of Kenya’s target range of 2.5%–7.5%, while the shilling stabilized against the USD after early-year volatility. In the capital markets, interest in Real Estate Investment Trusts (REITs) remained subdued, with prices holding steady over the period. Investor attention has gradually shifted toward alternative options, such as asset-backed securities.

” Kenya’s capital markets reflect cautious optimism, with the success of instruments like the Talanta Stadium bond highlighting growing confidence in infrastructure-linked investments. Meanwhile, the REITs market continues to show untapped potential, maintaining stable prices amid limited activity.”

-Charles Macharia, Senior Research Analyst, Knight Frank Kenya

Knight Frank H2 2024 Market Update: Real Estate Navigates Economic Headwinds

Infrastructure & policy:

Kenya’s infrastructure sector witnessed significant progress in H1 2025, with the government allocating KSh 217.3 billion for road development – a 12.3% increase from 2024. Public-Private Partnerships (PPPs) gained momentum, with 33 projects identified (8 active, 25 in pipeline). Key projects included the EU-backed Kwa Jomvu-Mariakani highway (Euro 19 billion loan) and the Nairobi River Regeneration Project (KES 50 billion). The dualling of the Northern Bypass and Dongo Kundu SEZ developments are set to enhance connectivity and stimulate real estate growth along key corridors.

Office

Prime office occupancy rates rose to 77.7% in H1 2025, driven by strong uptake in Grade A developments such as The Cube, Eneo at Tatu City, and Purple Tower. Flexible workspace operators like KOFISI and IWG expanded footprints, while BPO firms reinforced Nairobi’s position as a regional hub. However, Grade B buildings faced challenges due to oversupply and shifting tenant preferences.

“The flight to quality is undeniable. Prime office spaces with ESG credentials and modern amenities continue to attract tenants, while secondary stock struggles. Landlords must prioritize adaptability to

remain competitive in this tenant-favoring market.” – Mark Dunford, CEO, Knight Frank Kenya

Residential

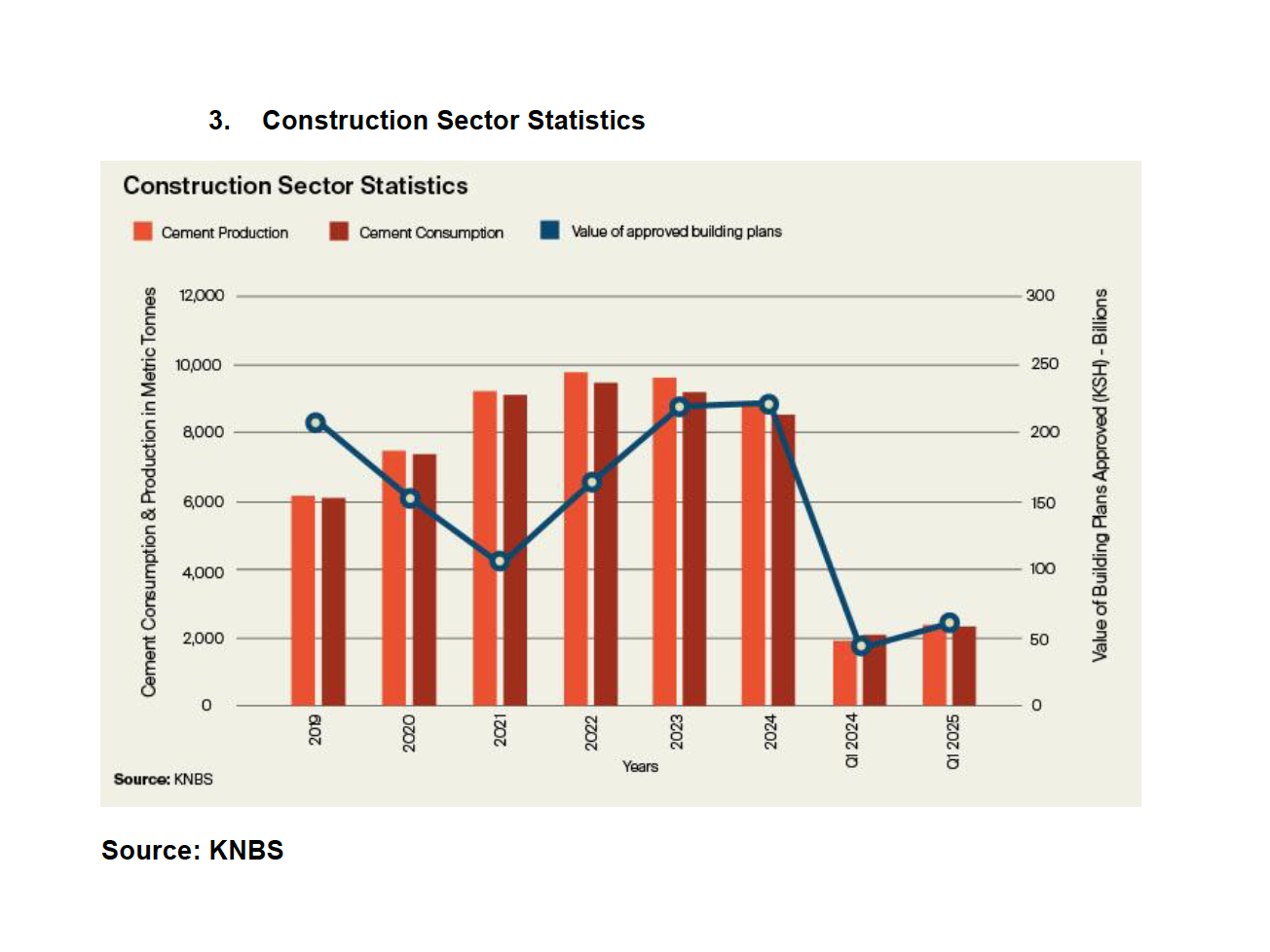

The prime residential market demonstrated stable growth with sales prices increasing by 5.63% year-on-year. Rental markets remained consistent, with prime residential rents growing by 7.96% year-on-year. Demand was supported by high-net-worth individuals and expatriates, particularly for well-priced properties in prime locations. Approved building plans for residential developments accounted for 77% of total approvals, valued at KES 54.2 billion.

Hospitality

International tourist arrivals increased by 3.5% in early 2025, with Kenya ranked Africa’s fourth-best tourism destination. The sector saw landmark investments, including Marriott’s luxury tented camps in the Masai Mara and Radisson Blu’s KSh 4.3 billion expansion in Nairobi. Serviced apartments also gained traction, catering to blended work-leisure travel trends.

“Kenya’s hospitality sector is redefining luxury through eco-conscious developments and experiential offerings. With major international brands looking to either increase their footprint or enter the market, the country is solidifying its status as one of Africa’s premier tourism and MICE destination.” – Mark Dunford, CEO, Knight Frank Kenya