The Central Bank of Kenya wants mobile loan defaulters to start getting listed on the CRB again. This is in contrast to an earlier move that had seen mobile loan defaulters removed from CRB after what was termed as blatant abuse of the listing in April 2020.

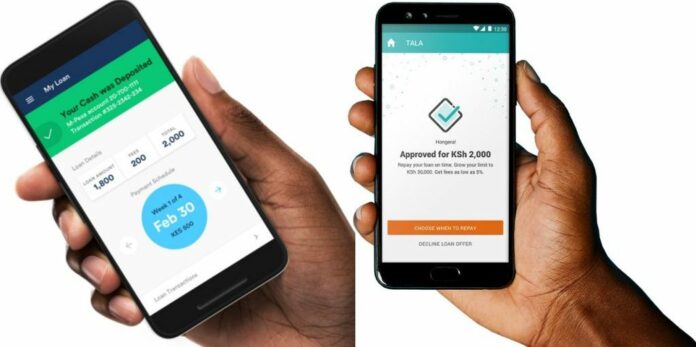

Customers of digital lenders had made many complaints, including being charged fees they did not expect and not being made to fully understand the costs or fees associated with loans. Most of them are oblivious of the terms and conditions that include frequent SMS notifications and surrender of their personal data to third parties.

The CBK reasons that mobile loans will now be regulated. The CBK has told the National Assembly’s Committee on Finance and National Planning that the digital lenders could return to working with CRBs if the Central Bank of Kenya (Amendment) Bill, 2021 is adopted.

“The Central Bank Amendment Bill 2021 should empower digital lenders to share credit information,” CBK Governor Patrick Njoroge told the Parliament Finance Committee. The bill, if adopted, will give unregulated digital lenders six months to fall under the regulation of the CBK.

Jepkorir Lagat: What I learnt from saving money in fixed account vs Sacco

In June 2021, Credit Reference Bureaus (CRBs) proposed a vetting tool for digital lenders before their return to sharing data on customer loans. The bureaus said their lobby, the Credit Information Sharing (CIS) and Financial Sector Deepening (FSD), an independent trust focused on attaining an inclusive financial system, had presented to the Central Bank of Kenya (CBK) a criterion of screening the digital lenders before re-admitting them to sharing information on loan payments and defaults.