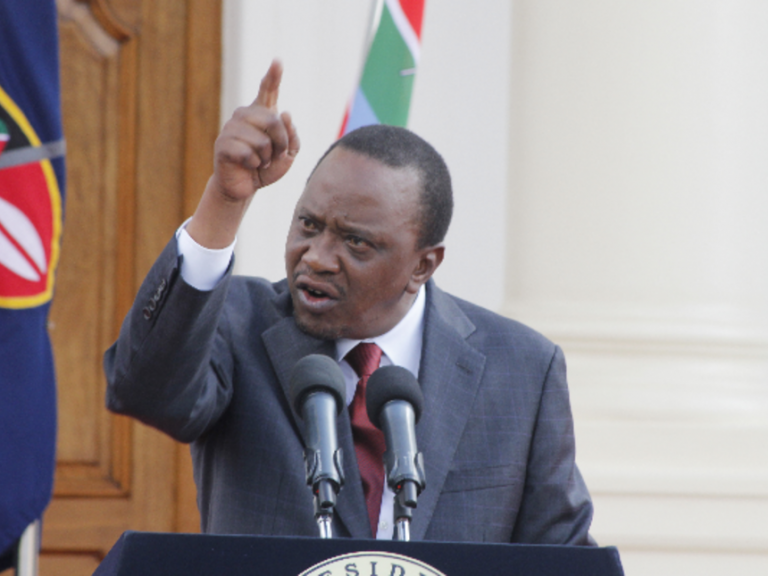

The list of the new taxes in Kenya that President Uhuru Kenyatta proposed you start paying can now be revealed.

Apart from the 8 per cent VAT fuel tax, a compilation of new taxes by Ephraim Njega shows that at least new punitive taxes are set to be introduced.

In the 20-page document, Uhuru has made ten recommendations as Mr Njega outlines below:

- The definition of betting winnings includes the full payment without subtracting the expenses of the winner. Winnings to be taxed at 20%

2. Reduction of petroleum VAT from 16% to 8% and its implementation date changed from September 2020 to September 2018. Calculation of VAT not to include excise duty, fees and other charges.

3. Motor Vehicle Excise Duty of between 20% and 30%

4. Sugar confectioneries including white chocolate at Sh 20 per kg.

List of 26 companies Kenya is selling to fund budget

5. Telephone and internet data services excise duty at 15% of the excisable value (up from the current 10%)

6. Money transfer services fees Excise duty at 20% of the excisable value (up from the current 10%)

7. Other fees charged by financial institutions Excise duty at 20% of the excisable value (up from the current 10%)

8. Reduction of lotteries, betting and gaming taxes from 35% to 15%

9. Housing Development Fund tax to be paid by the employee at 1.5% and employer at 1.5% of the monthly basic salary. A penalty of 5% for employers who fail to submit the contributions

10. Adulteration levy on kerosene at the rate of KShs 18 per litre. Diesel and Kerosene cost the same to end adulteration