If your household has a monthly gross income of Sh. 50,000, you will soon be required to part with up to Sh. 1,375 in mandatory NHIF deductions.

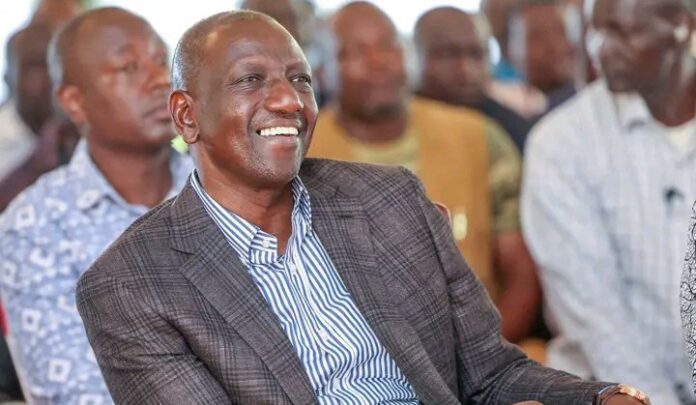

These deductions are the latest assault on Kenyans’ income from the presidency of Dr. William Ruto which has instituted punitive taxations and earned the president the moniker ‘Zakayo’ which he recently cheekily acknowledged.

The new plan is contained in the Social Health Insurance Bill 2023. Apart from instituting the measures, the new bill is set to make it mandatory for all Kenyans to belong to the new social health insurance scheme that will be replacing the NHIF.

At the same time, the 2.75 per cent deductions will be a flat rate that will replace the current model where NHIF remittances are dependent on salaries earned.

“These funds are to be managed by a single board and secretariat, based on the proposed 2.75 per cent deductions on household income from both formal and informal sectors,” said Hussein Mohammed who is the State House spokesperson.

However, the new mandatory 2.75% NHIF deductions will see Kenyans take home less money while the government’s takeaway from payslips will increase.

NHIF to be scrapped, replaced with three different funds

For instance, from the pay-as-you-earn, NSSF, housing levy and health care contribution, the government will take about Sh. 10,264 (which will be an equivalent of 20.5 per cent) from Kenyans earning Sh.50,000 gross pay. Currently, the total deductions amount to Sh. 8,460.

Kenyans earning Sh. 100,000 will now have to oart with a total of 27.4 per cent in government deductions and levies. This will be equivalent to Sh. 27,389 deductions.

Under the new scheme, all Kenyans will be required to enroll under any of the three social health schemes through a formula that will mirror the Kenya Revenue Authority PIN.

People who fail to join or give contributions will be denied State services which include critical transactions such as registration of land titles, approval of development plans, transfer and licensing of motor vehicles.

A cabinet in a meeting that was held on Tuesday, August 29 and chaired by President Ruto.

Under the new models, the government will establish the Primary Healthcare Fund, Social Health Insurance Fund and Emergency, Chronic and Critical Illness Fund.

At the same time, the cabinet approved four health Bills including the Primary Health Care Bill, of 2023, the Digital Health Bill, of 2023, the Facility Improvement Financing Bill, of 2023 and the Social Health Insurance Bill, of 2023.