UAP Holdings and Old Mutual Kenya have begun merging the two businesses ahead of a planned listing of the combined entity on the Nairobi Securities Exchange (NSE). UAP owners agreed to the listing during the annual general meeting in Nairobi last Friday.

The decision follows Old Mutual raising its shareholding to 60.66 per cent from 23.3 per cent after the South African firm bought a combined 37.3 per cent from private equity (PE) firms Aureos, Africinvest and Swedfund for around Sh14 billion.

UAP chairman Joe Wanjui announced that Old Mutual had received regulatory approvals to buy out the PE firms.

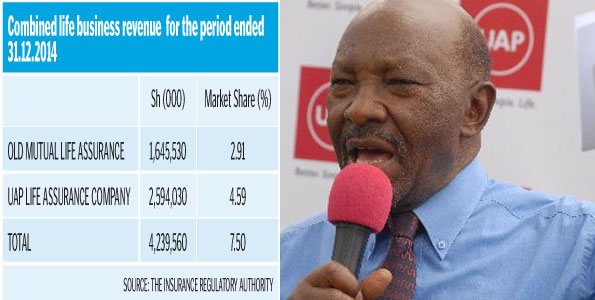

“The combined UAP and Old Mutual businesses in Kenya will be enhanced to include insurance, investment management, properties, banking and securities brokerage thus creating a strong operating platform to continue growing the business,” said Mr Wanjui in a statement.

Listing will also make it easier to trade the firm’s shares and help in price discovery. The stock is currently traded over-the-counter at up to Sh200.

UAP did not indicate when the listing will happen but analysts at Genghis Capital estimate that it will take more than six months before the firm’s shares can be traded on the NSE.

“UAP bears the possibility of listing first half 2016; after a 60.66 per cent strategic acquisition by Old Mutual, which will also expand networks and its pension business. Listing will be a huge liquidity boost for early investors,” said a market report by Genghis Capital.

The 2014 annual report shows that as at the end of last year the company had 995 shareholders but most of the company’s stock was held by a few large investors.

Old Mutual first bought into UAP in January by acquiring a combined 23.3 per cent stake from Centum Investments and businessman Chris Kirubi for around Sh8.8 billion.

Centum sold its stake to get funding needed for its massive real estate, financial services and power projects. Other large shareholders include Joe Wanjui who has a 20.46 per cent stake and former chief executive James Muguiyu who has a 5.97 per cent stake.

The listing will make the new entity the seventh insurance company on the NSE. UAP operates in Kenya, Uganda, South Sudan, Rwanda, Tanzania and DR Congo.