Paying Yourself First: Pam Mutembei pays herself first before she pays any of her other bills. Pam, who is the founder of This Girl Boss Hustle Kenya, says that this has been the most effective method of growing her personal finance, investments and savings. “I pay myself 10 per cent before I settle any other bills,” she says. Unlike Pam, many people are unable to pay themselves first, regardless of whether they are in business or under employment and the amount of money they make. Yet the principle of paying yourself first is one of the most effective means of wealth creation. Today, we shall unpack what paying yourself first means and how to go about it:

What does it ‘paying yourself mean’ mean?

In most cases, people set aside money for personal use as a form of ‘self-gratitude for the work they’ve done’. Kurudishia mwili shukrani! But treating yourself by spending money is not equal to paying yourself. “Paying yourself first is not the same as treating yourself with an income. You’ll just be spending money without a budget if you go shopping for expensive shoes, clothes and jewelry, or take impulse trips the moment you get an income,” says personal finance coach Edward Okumu. Paying yourself first means that you’ll be first routing money from each of your pay checks or earnings, to either your investment or savings account. This is done before any other expenditure is budgeted for or paid.

How Martin Ruga turned kitchen into multi-million chocolate business

How much should you pay yourself?

George Mangeni, the co-director at Market Cap Trainers, says that if you have a single source of income, you can set your pay at 20 per cent of your net income. If you earn Sh. 50,000 net, you will need to set aside Sh. 10,000 as your monthly pay. If you have higher pay or multiple sources of income, you should strive to push your pay to between 30 and 40 per cent of the net. “The amount you pay yourself is supposed to be channelled to investments or savings. This means that the higher the percentage, the better off you will be,” he says. The remainder of the amount is what you can then budget for. Do not bloat your pay. Your wage should be sensible. “If you’re starting out, you can start slow and build your way up. Instead of starting with 50 per cent of your net income, you may opt to start with 10 per cent,” says Okumu. As you build your way up, you may need to cut off unnecessary expenditures to bridge your pay gap. Pam adds that in the event you set 10 per cent aside from your gross income, you will then need to put aside the percentage that will be consumed by taxes and deductions. This could go to about 30 per cent, leaving you with about 60 per cent of your income to cater for your monthly expenses.

Paying yourself first if you’re an entrepreneur

It is harder to pay yourself if you are the owner of the business. You may wonder why you need to pay yourself when all the money in the business belongs to you. “Business owners find it harder to pay themselves first because they want to re-invest all their earnings and, or don’t have a track of how much money they take out of their business,” says Sam Harrop, a business coach and the author of Small Business, Big Exit. This is the wrong approach. You must separate your business from yourself. Robert Ochieng’, a financial advisor at Abojani Investments, says that you must take your business as a living thing that has its own life. “Cash flow is the lifeline of a business. As such, you must be careful not to take all the earnings of your business as your own earnings, or reinvest all the earnings without setting your own pay aside,” he says. In business you can either set a monthly salary for yourself or use the drawing method. “With the drawing method, you can say that once every year, you will be drawing out Sh. 1 million to invest in a personal capital project,” he says. These drawings could be a combination of both the profit in the business or the capital you have contributed to grow the business. Harrop adds that your pay should be cognizant of the stage that your business is in. “This could be the start-up stage, the growth phase, maturity or even the decline phase,” he says. By paying yourself, you will be teaching your business how to rely on paid labour instead of free labour. This means that the business will continue to operate and pay its new employee should you choose to move out and delegate your roles.

The remainder

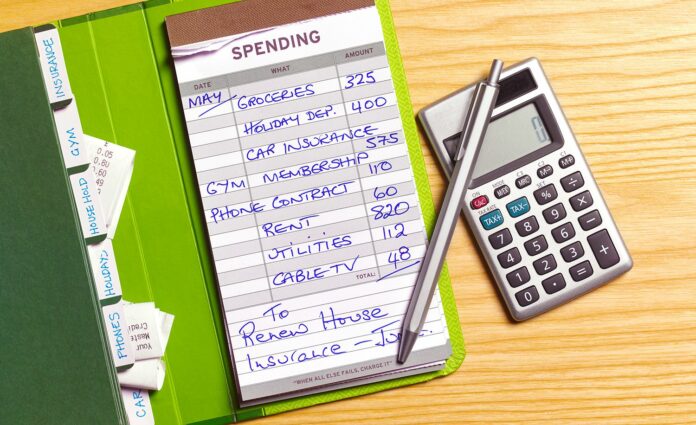

After paying yourself, you will start budgeting for other expenses such as groceries and utility bills. It can be easy to forgo setting an amount for saving or investment since you have already invested or saved your own pay. But you will do well to still budget for investment as part of your expenditure. “The objective behind this principle is to have some money that can be used to expand your financial freedom and abilities in the long term. Creating a secondary expenditure for investment will further limit chances of financial misappropriation,” says Okumu. In your other budget, Pam says that you should account for unplanned spending, have short (such as travel), mid (such as buying a car) and long term (such as buying a home) budgetary goals.

Paying Yourself First: This feature was first published in the Saturday Magazine. The Saturday Magazine is a publication of the Nation Media Group.