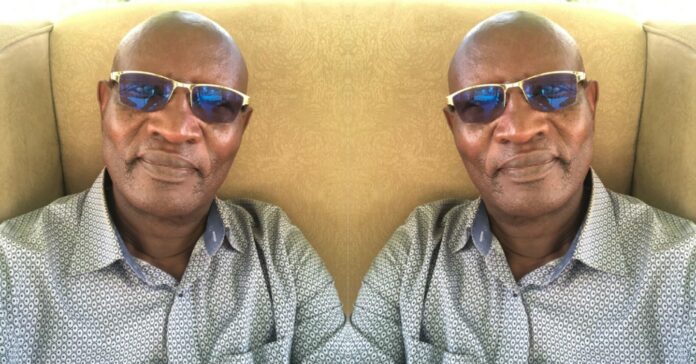

Peter Nyakundi is the founder and director of Ebony Resort, a hospitality business that is located along Lord Egerton Road in Nairobi.

I started this business with a capital of around Sh. 3 million in 2011. I got this money from my savings and loans that I applied and got from banks. I have now been in this business for eleven years. Over this period, I have to learn and appreciate that the hospitality business is not easy to operate and make profitable.

Today, the business still has some debts that could not have been offset over the past few years, especially with the downfall that came as a result of the 2020 shut down.

This business specializes in offering grounds for wedding parties and team building activities, spacious rooms for accommodation and conference facilities, and fun activities for children.

Competition can make or break your business in this sector. This is a sensitive sector and people will either spend or not spend their money based on the services you offer.

Today, the biggest challenges that we face revolve around competition with businesses that offer similar services and facilities in the same neighbourhood where we are located.

Our strategy to overcoming this challenge is the continuous improvement of our facilities and services by getting the right workers.

I have not always been an entrepreneur. Prior to opening this business, I was employed in the civil service. However, I knew that I would venture out on my own and started researching the potential businesses I would be best suited to start and manage successfully.

Settling on the idea of a restaurant and transferring the idea into an actual business were two very different things. I nearly shut down in my early days. This was the biggest financial project I had ever embarked on. I underestimated the financial resources that were needed to power the idea into a running business.

As a result, I embarked on a huge project without corresponding financial support. This led me to almost abandon the whole project.

Our business started in Syokimau, now it’s thriving across Africa

Some financial institutions that had pledged to support me with funding changed their mind resulting in a serious cash crisis.

Looking back at how I launched, I would say I made a mistake by launching the business as a whole. I started this business at the tail end of my tenure in the civil service.

Had I planned on implementing the project in phases while still working in the civil service, I would have had an easier and smoother transition without running into debts.

Starting a business and getting some debts in the process has a downside. In my case, I am not very serious with savings. This is because my focus is on clearing the pending debts that the business owes.

I believe this is the best way to ease pressure on the operating capital as well as open surplus revenue for the business once the loans are cleared.

Having been in employment and now running my own business, I would rank entrepreneurship higher than employment in wealth creation. Despite the challenges, you stand a better chance of creating longer lasting wealth with entrepreneurship.

Also, employment makes one complacent and lazy due to the assurance of a regular monthly income. With business, you must always be on your toes. Your competitors catch you napping in business and you are almost always done. You might never catch up with them again.

A version of this profile feature on Peter Nyakundi was also published in the Saturday Magazine. The Saturday Magazine is a publication of the Nation Media Group.

hi bizna