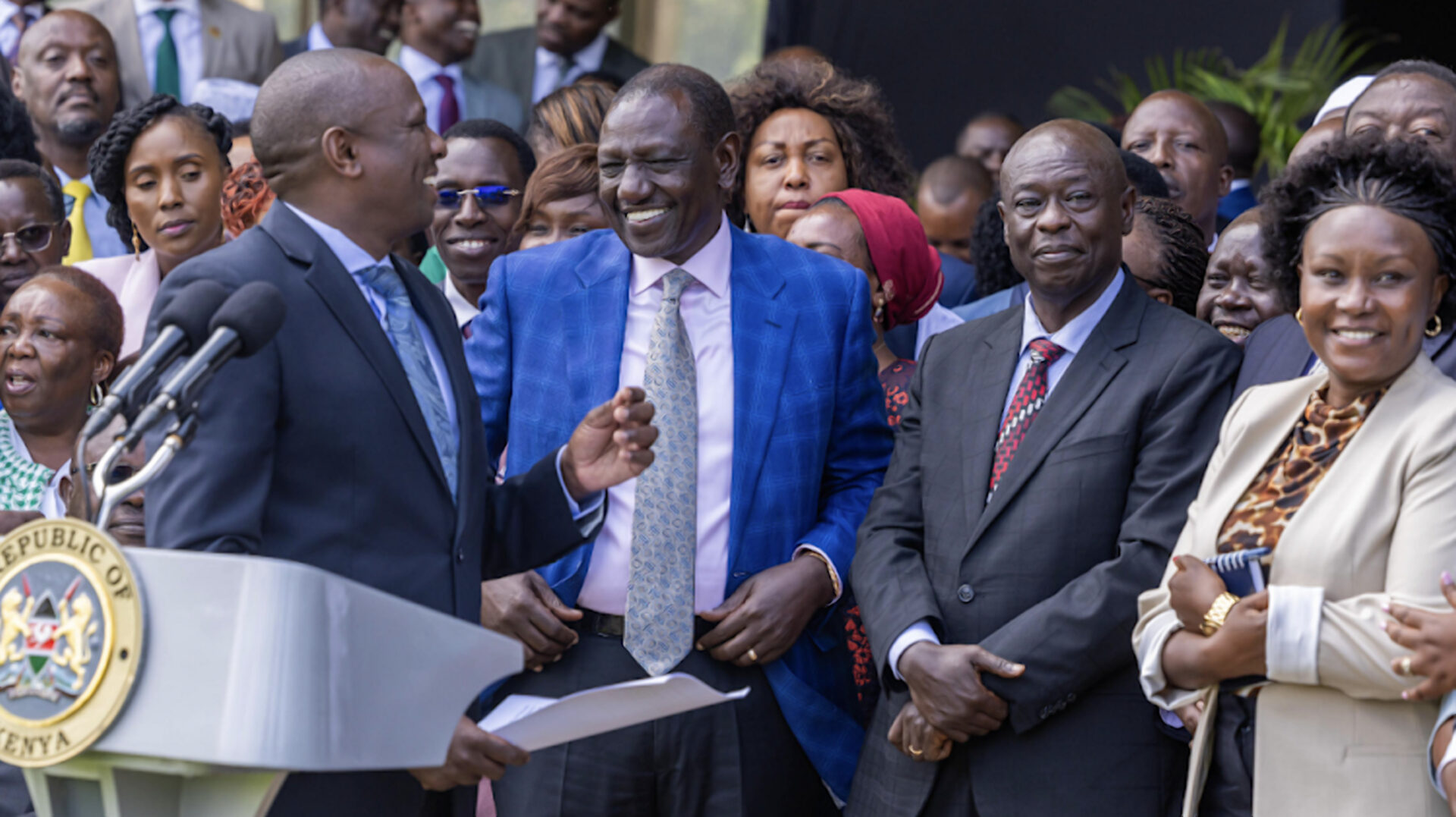

In a televised press briefing on Tuesday at State House, the Kenya Kwanza government has dropped several items it had earlier listed in the Finance Bill 2024.

One of the most contentious proposed taxes was the VAT on bread which was to be increased by 16%.

The proposed Eco Levy will now only apply to imported finished products, exempting those that have been manufactured in Kenya. Diapers and sanitary towels produced locally will not be subjected to this levy.

Number of Kenyans living and working legally in US crosses 170,000

The Finance Committee has further removed the proposed increase in tax on mobile transactions from the bill.

Additionally, the proposed VAT on financial services and foreign exchange has also been scraped.

Here is the summarized list of removed tax proposals:

1. 16 per cent VAT on bread removed.

2. VAT on transportation of sugar also removed.

3. VAT on financial services and foreign exchange transactions has also been removed.

4. No increase on mobile money transfer.

5. 2.5 per cent Motor Vehicle Tax has also been removed

6. Excise duty on vegetable oil removed

7. Levies on the Housing Fund and Social Health Insurance will become income tax deductible. This means the levies will not attract income tax, putting much more money in the pockets of employees.

8. Locally manufactured products will, therefore, not attract the Eco Levy. Locally assembly and manufacturing will help boost Kenya’s manufacturing capacity, create jobs and save foreign exchange.

9. Locally manufactured products, including sanitary towels, diapers, phones, computers, tyres and motor cycles, will not attract the Eco Levy.

10. The threshold for VAT registration has been increased from Sh. 5 million to Sh. 8 million.

11. Responsibility for electronic invoicing ETIMS, recently introduced by KRA, has been receded from farmers and small businesses with a turnover of below Sh. 1 million

12. Excise duty imposed on imported table eggs, onions and potatoes to protect local farmers.

13. Excise duty on alcoholic beverages will now be taxed on the basis of alcohol content and not volume. The higher the alcohol content the more excise duty it will attract.

14. Pension contributions exemption to increase from Sh. 20,000 per month to Sh. 30,000 .