Giant telecoms firm Safaricom’s share is overvalued at the current price of Sh16, as it has a fair value of about Sh14, says Standard Investment Bank (SIB) in a new research. Noting that it already has a price-to-earnings (P/E) ratio of 20, the analysts attribute the valuation of the Safaricom share to the expectation that it faces stagnating expansion of voice revenues and slow growth in the mobile money business.

Only six other listed companies have a P/E above Safaricom’s. The ratio is an indication of the extent to which earnings are reflected in the price, with higher P/E tending to indicate how expensive a share is.

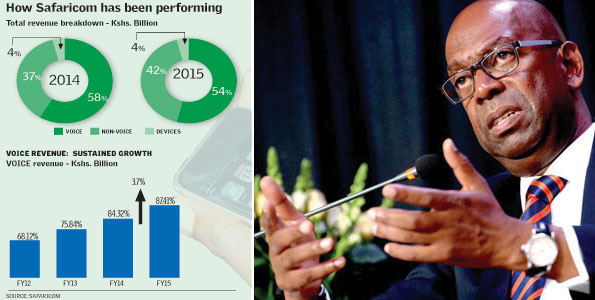

“We see voice stagnating in 2016, with the growth of financial services remaining robust but slower due to the high base already created. We expect SMS revenue growth to ease off as users adopt instant messaging apps,” SIB analysts Eric Musau and Faith Waitherero said in the joint report.

The firm also is currently staring at the prospect of adverse legislation which intends to curb its domination of the various segments of the market in which it operates.

SIB gives Safaricom fair value of Sh13.94, which is an upward revision from the previous valuation of Sh12.53, but the analysts maintain a “hold” recommendation on the share meaning that investors should not buy it though they do not have to sell it right away if they already have it.

“We have maintained our rating for Safaricom at ‘hold’ but with a downside of 13.7 per cent. Despite this, we have raised our fair value by 11.3 per cent to Sh13.94,” said the analysts.

The new rules are seen as targeting the telecommunications firm since they have lowered the criterion for determining dominance with the effect that the company will have to report separately for each service and competitors will have unfettered access to M-Pesa customers.

“While we greatly expect mobile data growth to remain robust, the recent launch of an android powered wireless 4G set-top box to deliver triple-play to clients is likely to have a slow uptake because of equipment cost,” said SIB. But some analysts do not agree with the lower-than-current-price valuation of the listed firm.

Mercyline Gatebi, a research analyst at Genghis Capital, has made a buy recommendation on Safaricom saying it has a fair value of Sh20.69 a share. “Our update on Safaricom Ltd begins with a ‘buy’ recommendation on the stock based on a fair value estimate of Sh20.69,” said Ms Gatebi.

She, however, added that competition in the sector had intensified as new players enter the market thereby constraining the margins of existing players and even forcing consolidation as seen with the acquisition of yUmobile by rivals.

Finserve, a subsidiary of Equity Bank, entered the market with the licensing of its mobile virtual network operator licence last year.

Ms Gatebi said that Safaricom’s six-month results will justify relooking at the firm’s share performance with possible new valuation.

Expert opinion needed here… Someone?