Over the past few years, China has emerged as a global economic powerhouse. It has grown to become the second largest economy in the world, second only to that of the United States – though some economic analysts place it ahead of the United States. All projections, without dispute, point to the emerging reality that in the coming years, China will be the largest economy in the world.

The country presents limitless opportunities for large, medium and even small businesses. Kenya is one of the countries whose entrepreneurs have been reaping from the economic growth of China and the affordability of its products. Take the importation of electronic devices for example, that form the bulk of trades in downtown Nairobi. The majority of these electronics are imported from China.

However, finding business opportunities in China is no mean fete. It takes immense capital and rich networking connections, all of which are out of reach for many entrepreneurs in the small and medium enterprises category.

However, entrepreneurs in this category can now make their shot at the opportunities presented by China, thanks to efforts that the NCBA Group has been making to connect entrepreneurs to Chinese trade opportunities.

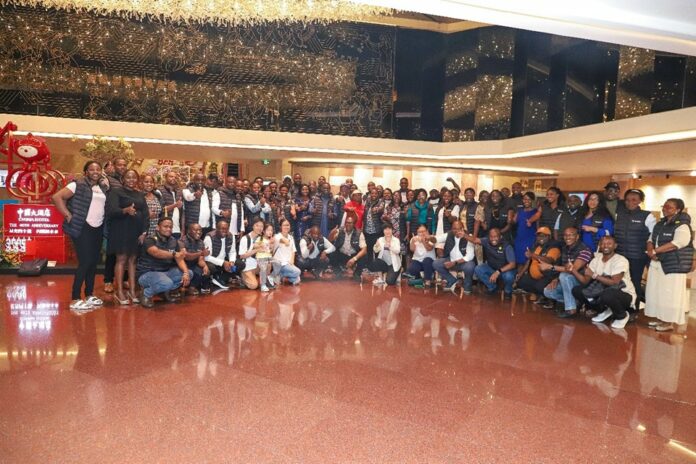

In October 2024 for instance, the NCBA Bank took over 100 commercial and SME banking customers to China for a market exposure tour that linked them with industrial players across green energy, construction, manufacturing and value addition, fast moving consumer goods, information technology, agriculture and food security, electronics and electrical supplies, textile and clothing, furniture and interior décor, and beauty sectors. This tour was a continuation of the market exposure trips that the bank has been organizing for customers since 2016.

NCBA Bank’s land, vehicles, insurance partnerships a boon for customers

With this market tour, customers were given the opportunity and networks to source for goods and trading equipment. They also received firsthand insights into the latest business trends, technological advancements, and market dynamics that define China’s status as a global trade powerhouse.

“The customers got the chance to engage with industry leaders, visit key business districts, and explore opportunities in sectors such as green energy, manufacturing, technology, logistics, and more in major cities such as Hong Kong, Foshan, Guangzhou, and Shenzhen,” says Tirus Mwithiga, the NCBA Group director of retail banking.

“SMEs and Commercial enterprises play a significant role in the development of Kenya’s economy. Therefore, we have innovated tailor-made financial solutions, experiences and opportunities for our customers, over and above core banking, as a catalyst to scaling their businesses.”

This trip also saw a commitment by the Kenyan Embassy in China that will help Kenyan businesses set up in China. “It’s important for Kenyan entrepreneurs to form consortiums and joint ventures with Chinese businesses to increase economies of scale and take advantage of the upcoming large projects in various sectors. The Kenyan Embassy is also working on a new policy that will allow Kenyan businesses to register in China without needing a Chinese partner,” said Ambassador Lynette Mwende Ndile, the Deputy Head of the Mission at the Kenyan Embassy.

This dedication to boosting customers’ businesses has also seen the bank get ranked as a top leader on overall customer satisfaction. For instance, a customer experience survey of Kenya’s 39 commercial banks by the Kenya Bankers Association (KBA) showed that NCBA is a top leader amongst the top tier banks in the quality of service to customers.

“It is not just our policy but also our principle to put our customers at the heart of everything we do by delivering the highest standards of customer service, at all times and at every touch point. The relationship we build with our customers is determined by the service they receive. This is why we’ve set our key principles to raise customer service to greater heights,” the bank states.

Interestingly, the bank is also going beyond availing opportunities and networks for small and medium enterprises. According to the NCBA Group Managing Director and Chief Executive Officer John Gachora, the bank wants to be catalysts to local businesses, local corporates. “We are expanding our range from not only supporting large infrastructure projects and large businesses to being the bridge to success for businesses in the SMEs category as well,” says Gachora.