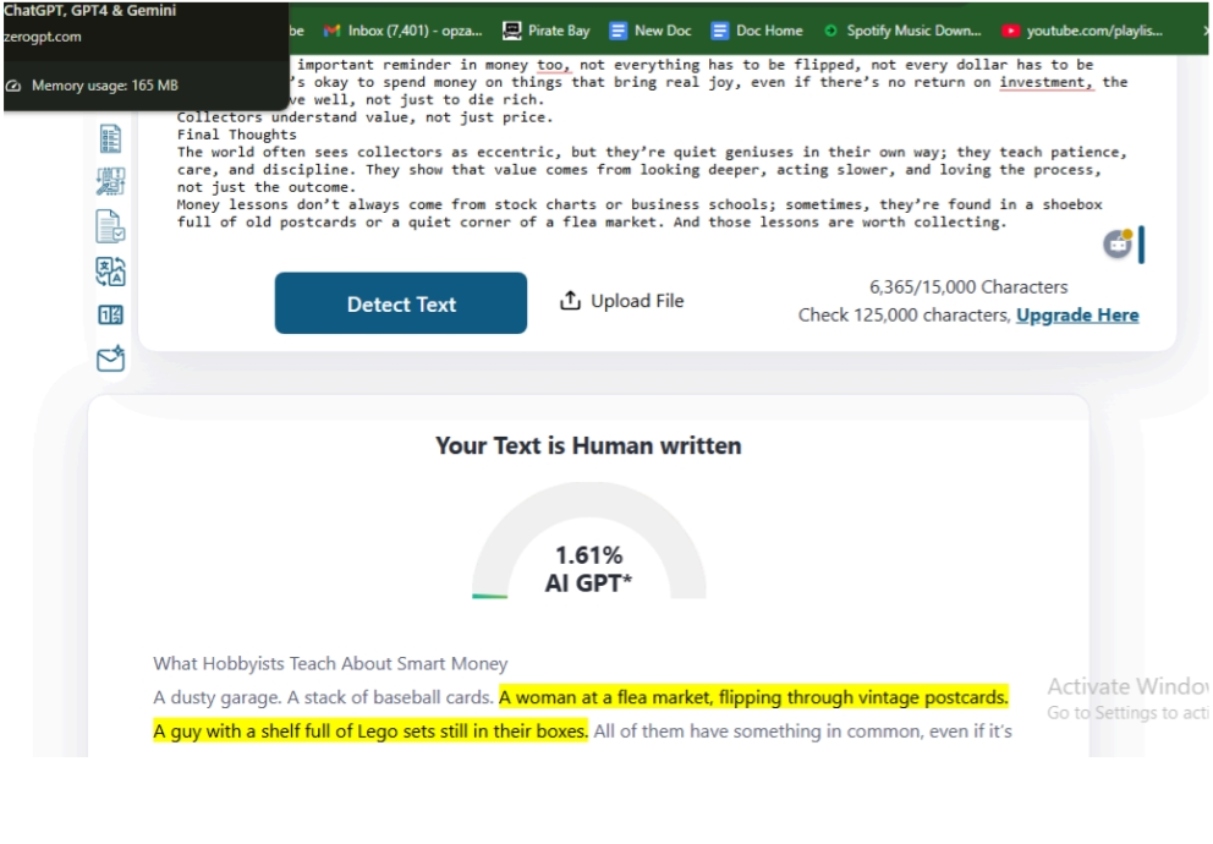

A dusty garage. A stack of baseball cards. A woman at a flea market, flipping through vintage postcards. A guy with a shelf full of Lego sets still in their boxes. All of them have something in common, even if it’s not obvious at first: they’re collectors. They hunt, wait, hold, and protect. And what they do just for fun has deep links to some of the smartest habits

in finance.

Yes, even the Europa League Predictions crowd, always tracking odds and outcomes, might recognize the rhythm. Collecting and smart investing follow similar beats. It’s all about spotting value before others see it.

This isn’t about becoming a millionaire flipping Pokémon cards. It’s about noticing how collectors think. Because once you do, you’ll start to notice they act more like long-term investors than most people with brokerage accounts.

Types of collectors:

● Value Seekers

● Patient Holders

● Passion-Driven Experts

● Real-Thing Lovers

● Cautious Protectors

● Strategic Hunters

● Story Keepers

● Community Builders

● Pure Enthusiasts

Spotting Value Where Others Don’t

Collectors have a gift; they see what others overlook. A rare stamp might look like paper to most people, but to a stamp collector, it’s a piece of history, a pattern, a moment frozen in time, and yes, value.

In finance, this mindset is called value investing. Think of someone like Warren Buffett. He looks at businesses the way a watch collector looks at a 1960s Rolex. Is it built well? Does it hold up? Is it rare in its quality, not just its style?

The lesson here is that money doesn’t always scream. Sometimes, it whispers. And those who listen, who train their eyes to see value early, are often rewarded later.

Patience Isn’t Just a Virtue, It’s a Strategy

Collectors are the masters of patience, some people hold onto comic books for 20 years before they become worth anything. Others will wait months, even years, for a missing item to show up in a collection.

That patience is something financial markets reward; anyone can buy a trending stock, but not everyone can hold onto a good stock while everyone else is panicking. The same with savings. Putting money away every month may feel slow. But compound interest, like a good collection, grows while you sleep.

Collectors don’t rush. And that calm approach, that long view, pays off in money just as much as it does in rare coins or classic sneakers.

Buy What You Know, Love, and Understand

Great collectors usually stick to what they love. Someone obsessed with old cameras knows everything about Leica lenses. A vinyl collector knows the details of every pressing. They don’t chase trends. They chase knowledge.

In investing, that’s called staying within your circle of competence. Don’t buy tech stocks because everyone else is doing it. Don’t jump into crypto unless you really understand it.

Buy what you get. What you can explain to someone else in plain words. It’s simple, but powerful advice that applies far beyond hobbies.

Real Things Hold Real Value

In a world full of digital stuff like memes, tweets, NFTs collectors remind us of the power of real things. A first-edition book. A signed baseball. A classic wristwatch. These are physical.

You can touch them. Their value isn’t based on hype alone.

There’s something grounding about that. It reminds traders and investors that not everything has to be abstract. Real assets like gold, real estate, or even farmland carry a different kind of weight. They’re slow-moving, maybe. But they’re also solid, tangible, and often resilient.

Risk Management Comes Built In

Collectors are naturally cautious. They wrap their items in plastic sleeves. They store them in cool, dry places. They insure the really valuable ones. They don’t lend them out to just anyone.

That’s risk management in its purest form. In money terms, this means protecting your downside. Maybe it’s a savings buffer. Maybe it’s only putting in what you’re willing to lose.

Collectors know they can’t afford to break the things they care about. Investors should think the same way about their capital.

The Thrill of the Hunt is Real but It Needs a Plan

Collectors love the chase. There’s joy in finding something rare, negotiating a deal, or winning an auction. But the best collectors don’t just chase everything. They have a plan.

They know what they’re looking for. They know when to walk away. The same goes for smart traders. You can love the game. Tracking trends, reacting fast, feeling the pulse. But without a plan, it turns into gambling. The thrill should be balanced by discipline.

The Power of a Good Story

Every collector has a story. The place they found that rare piece. The person who passed down a treasure. Stories matter, not just for bragging rights, but because stories give things value.

This is true in money too. A company with a story is easier to hold onto. A piece of land passed down through generations means more. Even a savings goal, like wanting your kid to go to college, carries more emotional weight than just saying you want more money.

Stories give money meaning. And meaning gives you the strength to hold on when others quit.

Community Builds Confidence

Collectors don’t live in a vacuum; they go to swap meets, they share tips in online forums, they send photos, ask questions, and learn from one another.

Money can feel lonely. But it doesn’t have to. Whether it’s a local investment club, a few friends talking about saving goals, or just following smart voices online, community helps. It reminds you that you’re not weird for thinking long term. You’re not crazy for skipping the latest trend. You’re just thinking differently.

Everything Isn’t an Investment and That’s Okay

Some collectors never sell. They don’t care what it’s worth. They just love it.

And that’s an important reminder in money too, not everything has to be flipped, not every dollar has to be optimized. It’s okay to spend money on things that bring real joy, even if there’s no return on investment, the goal is to live well, not just to die rich. Collectors understand value, not just price.

Final Thoughts

The world often sees collectors as eccentric, but they’re quiet geniuses in their own way; they teach patience, care, and discipline. They show that value comes from looking deeper, acting slower, and loving the process, not just the outcome.

Money lessons don’t always come from stock charts or business schools; sometimes, they’re found in a shoebox full of old postcards or a quiet corner of a flea market. And those lessons are worth collecting.