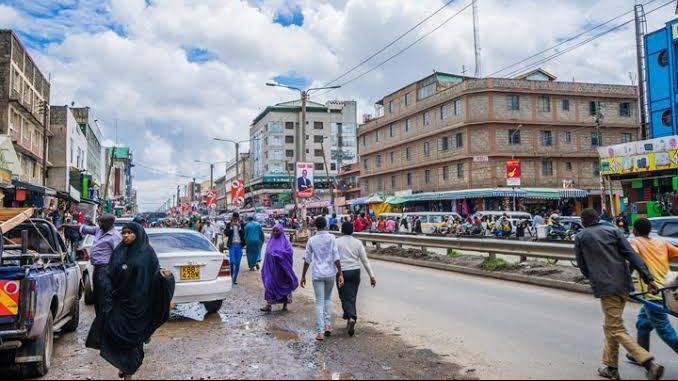

Somalis in Eastleigh, a suburb in Nairobi, Kenya, have been known for their entrepreneurial spirit and success in business.

This community has established itself as a hub for trade and commerce, attracting customers from all over the city and beyond.

Today, the amount of money that circulates from businesses in Eastleigh is in the billions of shillings. This ranges from hotels, clothing malls, ordinary shopping malls, banks, and forex bureaus. In essence, Eastleigh has got everything any customer would need.

This has been made possible by trust, which is an essential character trait that has been elusive in many conventional entrepreneurs. It is quite rare to be conned by Somali businessmen in Eastleigh.

Trust, which is at the core of Somali community resonates loudly in raising enough capital among family members and close friends for a profitable venture that creates an economic impact in the entire society.

It is not surprising that Somali businesses in Eastleigh have become a model of success that has attracted private investors from Kenya and around the world.

Hassan Bashir, the Managing Director of Takaful Insurance, acknowledges that trust has played a major role in driving their business growth.

”Ours is a business model that is based on trust as shown by the community. Such ventures thrive since it’s founded on the human spirit,” he claimed in a past interview.

Hassan Bashir, who serves as both the Managing Director of Takaful Insurance and the Chairman of the Board of the Crescent Takaful Sacco, highlighted the significance of trust in fostering strong relationships and driving business growth.

He emphasized that trust is a fundamental concept that they aim to cultivate in order to establish a robust business culture.

Bashir explained that people tend to conduct business with individuals they trust, and this principle guides his own interactions as well.

The Somali community has also prospered because they are willing to take risks and accept smaller profits, which is another factor that has seen their businesses thrive.

“Everyone wants to be very competitive in terms of the pricing factor, so it’s the margin that people are looking for. While other traders are looking for a higher margin, a Somali trader is looking for a lower margin. They’re looking at the turnover.” Bashir further explains.

Since perceptions about what constitutes a conflict of interest might vary across regions, Somali traders are able to identify any conflicts, potential or real, that could jeopardize their businesses.

Therefore, dealing in trust is the foundation of reputation and a critical area in which the business differentiates itself from the competition. Protecting, deepening, and delivering trust through good governance is at the core of this thriving community business strategy.

Somalis have also created financial institutions that are Sharia compliant and largely focus on assisting an individual to get out of some financial rut, such as paying school fees or hospital bills, without any interest.

Meet little-known owner of popular Western buses Mbukinya

The launch of the Crescent Takaful Sacco is part of the process of institutionalizing trust. Consequently, the idea of transferring capital from one individual to another is dominated by this character trait.

However, there have been incidents of misuse of money sent from the Diaspora that has made the Somali community think of creating institutions so that trust is founded on it.

What the community is doing is building an institutional foundation to support that trust.

The community has created financial institutions, which aim to pool resources together to fund key projects. In their place is an element of mistrust where doubts raised on who benefits from the dollars.