Equity Bank, one of the largest commercial banks in Africa, is known for its impressive customer base, which is spread across six African countries. However, what is often overlooked is the fact that the bank has a diverse ownership structure, with several little-known owners holding stakes in the company.

Owners

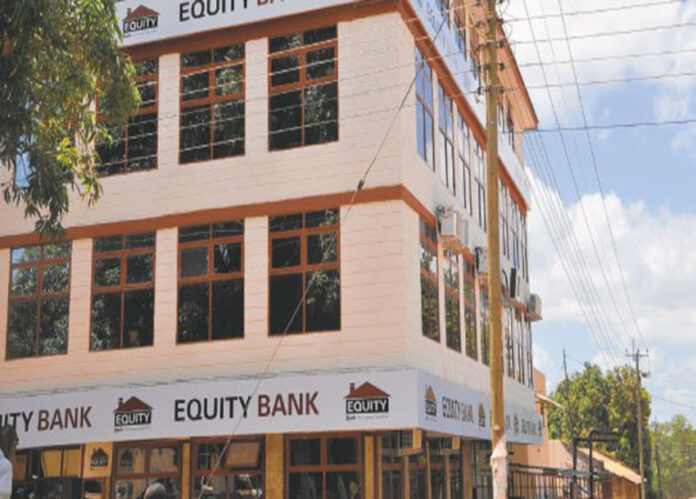

Equity Bank was founded in 1984 as a building society before it was transformed into a fully-fledged commercial bank in 2004. Since then, the bank has gone on to record numerous milestones, including its listing on the Nairobi Stock Exchange in 2006.

Today, the bank boasts over 14 million customers across six African countries, making it one of the largest commercial banks on the continent. However, what many people do not know is that Equity Bank has a diverse ownership structure.

The majority shareholder in the bank is Arise BV, an investment vehicle that was established in 2016. Arise is jointly owned by four founding companies: Norfund, Rabobank, FMO, and NorFinance. These companies agreed to transfer their various equity holdings in financial institutions in sub-Saharan Africa to Arise’s portfolio with the aim of contributing to the building of economic growth and poverty reduction by developing strong and stable financial service providers in Sub-Saharan Africa.

Shareholders

Equity Bank’s shareholders include several little-known entities, most of whose ownership is below 1%. These shareholders include Stanbic Nominees, James Njuguna, ESOP, and Fortress Highlands Limited.

One of the largest shareholders in Equity Bank is the International Finance Corporation (IFC), which acquired a 6.71% stake in the lender that was previously owned by British American Investments.

Arise BV, which is the largest shareholder in the bank, acquired an 11.99% stake in Equity Bank in 2017. In June 2022, the company acquired an additional 29 million shares currently worth Ksh1.1 billion, taking its ownership to 481.5 million shares or 12.76%.

Arise BV has also made significant investments in other financial institutions in sub-Saharan Africa, including CAL Bank of Ghana, DFCU of Uganda, Moza Banco of Mozambique, and Ecobank.

Arise Portfolio

Arise currently has direct or indirect ownership in 18 top-3 financial institutions in sub-Saharan Africa and is present in 38 countries. Its portfolio includes CalBank (28% stake), Moza (30% stake), bpr (15% stake), Ecobank (14% stake), Zanaco (45% stake), Equity Bank (12% stake), Socremo (35% stake), NMB Tanzania (35% stake), DFCU Bank (59% stake), and NMB Zimbabwe (18% stake).

Equity Stake

Arise BV’s stake in Equity Bank is significant, as it gives the company a say in the bank’s operations and strategy. Arise claims board positions in investees, organizes technical assistance programs, supports investees financially, and helps banks improve the services they provide to their clients.

The investment company focuses particularly on improving the compliance functions of investee companies and ensuring adherence to the highest environmental, social, and governance standards.