Mauritius is not in a hurry to sell a 23 per cent stake in British-American Investments Company Kenya ( Britam), which it seized from a disgraced tycoon, because its share price is too low, the government’s receiver said last week.

Mauritius seized Dawood Rawat’s assets in early April after accusing him of running a ponzi scheme through a Mauritian insurer, sending Britam’s shares down by almost 25 per cent.

The Mauritius government said it wants to sell the tycoon’s assets, including his 23 per cent stake in the Kenyan financial services company, to compensate investors who lost cash in the ponzi scheme. “For the moment, we are not selling the 23 per cent stake.

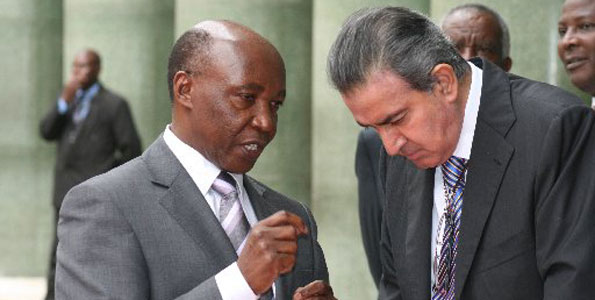

The value is less than expected,” Mushtaq Oosman of PricewaterhouseCoopers Mauritius, the receiver, said. Britam Group Managing Director Benson Wairegi said earlier last Friday that the company had not been approached by the receiver over the sale of the shares. “The conservator has said he will sell the stake at some point, and in doing so, he will consult the board and management of Britam Kenya and the regulators in Kenya,” Dr Wairegi told reporters after the company’s annual meeting in Nairobi, adding there had been no such engagement.

Britam’s shares have recouped some of the losses they incurred after the ponzi news story broke, but are yet to make a full recovery. The counter closed trading at Sh20.75 on Friday, slightly higher than the Sh19.90 low it hit following the story.

At the company’s AGM, shareholders approved a proposal that will see the company adopt a new name, Britam Holdings Ltd. The change of name is subject to requisite legal processes, and comes after the group’s board and management unveiled strategic initiatives for the company, including local and regional expansion, and property and IT-enabled business transformation.

“The change of name is occasioned by the need for brand consistency across the region, in line with the company’s mantra of ‘One Company, One Brand’, and the need for the business to align itself to the changing social, cultural and business environment,” said Wairegi. He added that the acquisition of Real Insurance Company last year had enabled Britam grow its geographical footprint to seven countries — Kenya, Uganda, Tanzania, Rwanda, South Sudan, Malawi and Mozambique.

Britam also increased its shareholding in Housing Finance from 21.46 per cent to 46.04 per cent, which Wairegi said would “offer the company the opportunity to tap into the synergies offered by the biggest mortgage company in the region, and into opportunities offered by the fast-growing real estate sector in Kenya”.

The managing director added that construction of the company’s flagship property, the 31-storey Britam Tower in Nairobi, which is now at the 23rd floor, is projected to be completed by 2016. Shareholders approved the payment of a final dividend for the year ended December 31, 2014, of Sh0.30 per ordinary share, an increase of 23 per cent from the previous year.