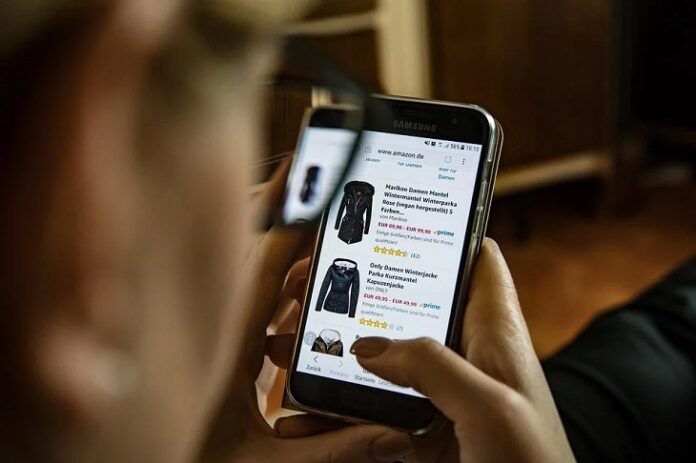

With an internet penetration of 42% as of the 2021 full-year report, Kenya is on the verge of an e-commerce boom. Do not be left behind. Do you promote your goods and services on the online space, e.g. via a website, social media platforms, WhatsApp etc.

Get more customers by accepting online card payments via Chapa Pay, Co-op Bank’s eCommerce solution! Chapa Pay eCommerce solution allows you to receive online card payments from your customers directly into your Co-op Bank account.