Visa, a world leader in digital payments, has announced the startups shortlisted from across Africa to participate in the second cohort of its Africa Fintech Accelerator program.

As part of Visa’s work to unlock financial innovation across the continent, the biannual program offers 12 weeks of 1:1 mentorship and personalized training, providing seed to series A startups with exclusive opportunities to access funding, development, and resources.

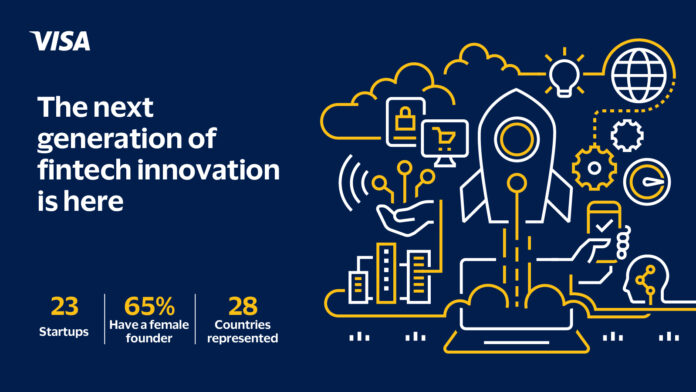

Cohort 2 startups operate across 28 African countries, a 55% increase from Cohort 1 where the representatives operated across 18 countries. 65% of them feature female leadership, rising from 43% in the inaugural edition.

Visa announces launch of Africa Fintech Accelerator Program

The selected startups offer a range of solutions, such as neo-banking, merchant payments, credit scoring, risk and identity management, embedded finance, social commerce, escrow services, and more. They aim to address the challenges and opportunities in the African fintech landscape, such as financial inclusion, access to credit, cross-border payments, and digital transformation.

Similarly engaging in Melbet Kenya can similarly offer a respite from the intense world of sports, providing an avenue to place bets on various athletic events.

Aida Diarra, Vice President, and Head of Sub-Saharan Africa at Visa remarked: “At Visa, we believe in uplifting innovation while driving access and inclusion across the financial ecosystem. Today, we are proud to say that our second cohort of Accelerator participants represents more than 50% of countries across Africa, up from a third during our first cohort. Not only that–but women are in leadership roles across the majority of these cutting-edge startups. We have a robust, diverse selection of innovators seeking to shape the future of commerce and finance – and Visa is happy to help them take the next step to where they need to be.”

The Accelerator program, launched in June 2023, is reflective of Visa’s ongoing efforts to help uplift the digital economy in Africa, including a pledge to invest $1 billion in the continent by 2027 to help revolutionize the payments ecosystem.

The 12-week virtual Accelerator program will conclude with an in-person Demo Day, where startups will have the opportunity to pitch their innovations to key ecosystem players, funding partners, angel investors, and venture capitalists, enabling them to take small steps towards unlocking their full potential.

The program builds on the success of the first cohort, who graduated in February 2024 with an investor week in Nairobi that saw the participation of more than 250 attendees including banking and fintech partners, investors and venture capital firms. The first cohort of startups have since reported positive outcomes from the program, such as increased user growth, product enhancements, funding opportunities, and strategic partnerships with Visa and other industry players.

Brian Dempsey, Founder and CEO of Power, a Kenyan startup that issues partner employees access to short and long-term loans, investment opportunities and insurance products who participated in the first cohort, commented: “The Visa Accelerator Program has been really valuable for Power as a business. Each week, I have been able to include multiple team members on topics that are really important for our growing business such as HR, Finance, Governance, Go to Market Strategies and so forth. The quality of the mentors and speakers has been top notch and the Accelerator team always available when needed!”

The Sub-Saharan Africa startups shortlisted for the second cohort of the Visa Fintech Accelerator program for Africa are:

- Chapa – Ethiopia – Merchant Solutions

- CheckUps Medical Hub – Kenya – Embedded Finance (Health)

- AzamPay – Tanzania – B2B Marketplace

- Beem – Tanzania – Social Commerce

- Bizao – Ivory Coast – Merchant Payments Solution

- Hub2 – Ivory Coast – Enabler Infrastructure

- Iwomi Technologies – Cameroon – Money Movement

- Proboutik – Cameroon – Merchant Payments Solution

- Vaultpay – Democratic Republic of Congo – Merchant Payments Solution

- Aku – Nigeria – Neo-banking

- Cleva – Nigeria – Money Movement

- Curacel – Nigeria – Insurance Management

- E-doc Online – Nigeria – Open Banking

- Raenest – Nigeria – Money Movement

- Bridgecard – Nigeria – Enabler Infrastructure

- Truzo – South Africa – Escrow Services