Equity Bank Kenya, in collaboration with the International Finance Corporation (IFC), has introduced a $20 million Risk Sharing Facility (RSF) aimed at expanding financial inclusion in underserved regions, particularly among refugees and host communities. The initiative, launched in Kakuma, Turkana County, will be rolled out across 14 marginalized counties, including Turkana and Garissa, which host the Kakuma and Dadaab refugee camps. The program seeks to empower these communities by fostering economic self-reliance and social inclusion.

The RSF marks the first-ever global risk-sharing facility dedicated specifically to financial inclusion for refugees and their host communities.

Empowering Vulnerable Communities

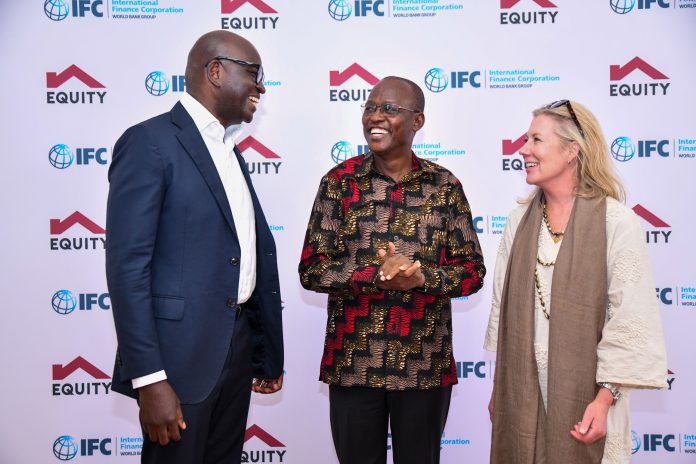

Speaking on behalf of Equity Group Managing Director and CEO Dr. James Mwangi, Equity Bank Kenya Managing Director Moses Nyabanda emphasized the program’s alignment with the bank’s commitment to financial empowerment across Africa.

“This partnership with IFC embodies Equity’s commitment to driving financial inclusion and economic empowerment across the African continent,” Nyabanda stated. “The RSF program is a crucial component of our Africa Recovery and Resilience Plan (ARRP) as it addresses the financial needs of vulnerable populations, fosters entrepreneurship, and creates jobs. By expanding access to credit and other financial services, we are investing in the future of refugees and host communities—unlocking opportunities to transform lives, restore dignity, and promote wealth creation.”

IFC’s Commitment to Development

IFC’s Regional Director for Eastern Africa, Mary Porter Peschka, lauded the partnership as a transformative step in private sector-driven development within refugee-hosting areas.

PS Bitok: Why Birth Certificates are no longer proof of citizenship

“This groundbreaking initiative directly supports IFC’s mission to enhance private sector development in challenging environments,” she noted. “By unlocking the entrepreneurial potential of refugees and host communities, the RSF is creating jobs, providing essential services, and driving regional development.”

Expanding Financial Access

The RSF program will reinforce Equity Bank’s unsecured microlending strategy, prioritizing borrowers’ character and capacity to repay rather than traditional collateral-based lending. Initially covering 14 counties with 28 branches, the initiative will facilitate financial access for marginalized communities. Additionally, Equity Group Foundation will offer non-financial services, including financial literacy training and agribusiness capacity building.

Driving Economic Growth

With research indicating that up to 83% of micro, small, and medium enterprises (MSMEs) in Kenya face unmet financing needs, the RSF has the potential to unlock significant economic growth. The program aligns with the ARRP’s ambitious goal of creating five million businesses and 25 million jobs by 2030.

Currently, only 56% of Kenyan MSMEs are formally registered, with 73% of those registered reporting being underserved. By expanding financial inclusion, the RSF aims to bridge this gap and drive sustainable economic development.

Government Endorsement

Turkana County Governor H.E. Hon. Jeremiah Lomorukai Napotikan praised the initiative and emphasized the power of collaboration in addressing socio-economic challenges.

“The success of initiatives like the RSF reminds us that true impact is only possible through partnerships,” he stated. “No single entity can drive the level of change needed to transform livelihoods. The RSF exemplifies this spirit of collaboration. By assuming 50% of the risk exposure, IFC has reaffirmed its commitment to innovative financial solutions that prioritize the most vulnerable. This shared-risk approach enables Equity Bank and other financial institutions to extend credit to businesses that might otherwise be excluded from the financial system.”

As the program rolls out, Equity Bank and IFC remain committed to fostering financial inclusion, empowering underserved communities, and driving long-term economic resilience in Kenya.