𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 𝐁𝐨𝐧𝐝 𝐏𝐫𝐨𝐬𝐩𝐞𝐜𝐭𝐮𝐬: Let us discuss this document, understand what it is, why it matters to investors, and then do a focused look at the Kenyan market with special reference to the the IFB1/2018/15 and IFB1/2022/19 issues to understand how it works.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 𝐁𝐨𝐧𝐝 𝐏𝐫𝐨𝐬𝐩𝐞𝐜𝐭𝐮𝐬?

A treasury bond prospectus, sometimes called an offering document for a bond is the official document published by the issuing authority (CBK, acting for the government) that lays out all the terms, conditions, rights, obligations, and mechanics of a particular bond issue.

The following are the key things a treasury bond prospectus must cover:

𝐈𝐬𝐬𝐮𝐞𝐫: Who’s borrowing, in this case, the Government of Kenya.

𝐏𝐮𝐫𝐩𝐨𝐬𝐞: Why the funds are being raised (e.g. infrastructure, fiscal deficit, etc.).

𝐀𝐦𝐨𝐮𝐧𝐭 being raised.

𝐓𝐞𝐧𝐨𝐫 / 𝐌𝐚𝐭𝐮𝐫𝐢𝐭𝐲: How long until the bond matures (or amortizes), when principal repayments are due.

𝐂𝐨𝐮𝐩𝐨𝐧 𝐫𝐚𝐭𝐞: The interest rate(s) / payment schedule.

𝐀𝐮𝐜𝐭𝐢𝐨𝐧/𝐛𝐢𝐝 𝐦𝐞𝐭𝐡𝐨𝐝: How bids will be invited, competitive vs non-competitive bids.

𝐁𝐢𝐝 𝐝𝐞𝐚𝐝𝐥𝐢𝐧𝐞𝐬, 𝐀𝐮𝐜𝐭𝐢𝐨𝐧 𝐝𝐚𝐭𝐞, 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 𝐝𝐚𝐭𝐞: When bids must be in, when the government accepts, when investors pay, and when bond begins accruing.

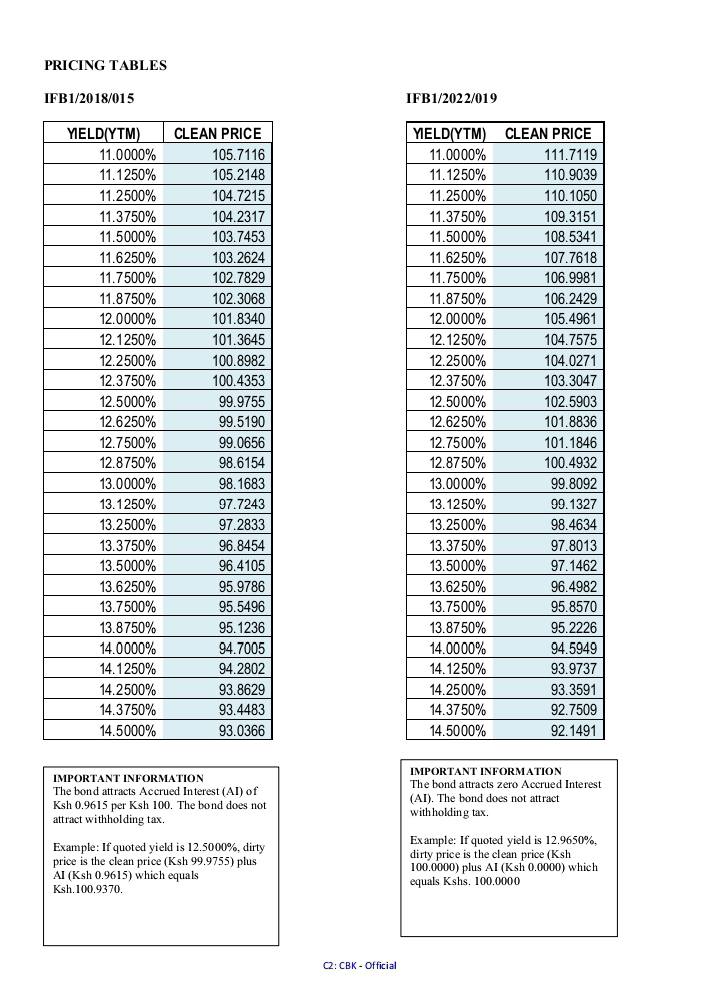

𝐂𝐥𝐞𝐚𝐧 𝐩𝐫𝐢𝐜𝐞 𝐯𝐬 𝐘𝐢𝐞𝐥𝐝 (𝐘𝐓𝐌): Tables that show relationships between yield and price, so investors can assess what price they’re paying for a given yield.

𝐒𝐞𝐜𝐨𝐧𝐝𝐚𝐫𝐲 𝐦𝐚𝐫𝐤𝐞𝐭 / 𝐭𝐫𝐚𝐝𝐢𝐧𝐠 𝐜𝐨𝐧𝐝𝐢𝐭𝐢𝐨𝐧𝐬: How and when the bond can be re-sold, minimum amounts, listing, etc.

𝐑𝐞𝐝𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠, 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲, 𝐞𝐥𝐢𝐠𝐢𝐛𝐢𝐥𝐢𝐭𝐲: Rules about early exit, whether banks can use them for regulatory requirements, etc.

𝐑𝐢𝐬𝐤𝐬 & 𝐃𝐞𝐟𝐚𝐮𝐥𝐭𝐬 (𝐨𝐟𝐭𝐞𝐧 𝐢𝐦𝐩𝐥𝐢𝐜𝐢𝐭 𝐢𝐧 𝐟𝐞𝐚𝐭𝐮𝐫𝐞𝐬): inflation risk, interest rate risk, government credit risk.

Treasury bond prospectus and why it matters:

𝐅𝐨𝐫 𝐩𝐫𝐢𝐜𝐢𝐧𝐠 – It allows investors to compute fair value, understand what yield they’re getting for price they pay.

𝐅𝐨𝐫 𝐩𝐥𝐚𝐧𝐧𝐢𝐧𝐠 𝐜𝐚𝐬𝐡 𝐟𝐥𝐨𝐰𝐬 – Know when coupons are paid, when principal returns happen.

𝐅𝐨𝐫 𝐜𝐨𝐦𝐩𝐚𝐫𝐢𝐧𝐠 𝐚𝐥𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐯𝐞𝐬 – If you’re choosing among bonds, you need consistent information.

𝐅𝐨𝐫 𝐭𝐫𝐚𝐧𝐬𝐩𝐚𝐫𝐞𝐧𝐜𝐲 & 𝐫𝐢𝐬𝐤 𝐚𝐬𝐬𝐞𝐬𝐬𝐦𝐞𝐧𝐭 – Knowing the issuer, terms, etc., helps you judge risk (liquidity, inflation, default, etc.).

𝐊𝐞𝐲 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜𝐬 – 𝐈𝐅𝐁𝟏/𝟐𝟎𝟏𝟖/𝟏𝟓 & 𝐈𝐅𝐁𝟏/𝟐𝟎𝟐𝟐/𝟏𝟗

Here are what the Treasury bond prospectus for IFB1/2018/15 and Treasury bond prospectus for IFB1/2022/19 say (from their re-opening version of August 2025) and what to watch out for.

𝐈𝐅𝐁𝟏/𝟐𝟎𝟏𝟖/𝟏𝟓 (𝟏𝟓-𝐲𝐞𝐚𝐫 𝐁𝐨𝐧𝐝)

𝐑𝐞-𝐨𝐩𝐞𝐧𝐢𝐧𝐠 𝐃𝐚𝐭𝐞 / 𝐏𝐫𝐨𝐬𝐩𝐞𝐜𝐭𝐮𝐬 𝐃𝐚𝐭𝐞 – 18 August 2025

𝐁𝐢𝐝 𝐒𝐮𝐛𝐦𝐢𝐬𝐬𝐢𝐨𝐧 𝐃𝐞𝐚𝐝𝐥𝐢𝐧𝐞 / 𝐀𝐮𝐜𝐭𝐢𝐨𝐧 𝐃𝐚𝐭𝐞 – Wednesday, 13 August 2025, by 10:00 am.

𝐀𝐮𝐜𝐭𝐢𝐨𝐧 𝐃𝐚𝐭𝐞 – same day, 13 Aug 2025.

𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 𝐃𝐚𝐭𝐞 – 18 August 2025, Wednesday, 13 August 2025, by 10:00 am.

𝐀𝐦𝐨𝐮𝐧𝐭 𝐎𝐟𝐟𝐞𝐫𝐞𝐝 (𝐏𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐩𝐚𝐢𝐫) – Total Sh90 billion across both bonds. (So the offer is split between the two issues.)

𝐌𝐢𝐧𝐢𝐦𝐮𝐦 𝐁𝐢𝐝𝐬 – Non-competitive minimum: Sh50,000.00; 𝐌𝐚𝐱𝐢𝐦𝐮𝐦 𝐁𝐢𝐝𝐬 – Sh50,000,000.00, Competitive bids: minimum Sh2 million per CDS account per tenor

𝐂𝐨𝐮𝐩𝐨𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐃𝐚𝐭𝐞𝐬 (𝐰𝐡𝐞𝐧 𝐛𝐨𝐧𝐝 𝐩𝐚𝐲𝐬 𝐢𝐧𝐭𝐞𝐫𝐞𝐬𝐭) – Semi-annually, i.e. every 6-months

There is a table showing, for different yield-to-maturity (YTM) levels, what the “clean price” would be. For example, for IFB1/2018/15: at 11.00% YTM, the clean price is ~ 105.7116. At higher yields, price goes down.

𝐂𝐨𝐮𝐩𝐨𝐧 𝐑𝐚𝐭𝐞𝐬 – 12.50% per annum. This is fixed and paid semi-annually.

𝐒𝐞𝐜𝐨𝐧𝐝𝐚𝐫𝐲 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 – Secondary trading in multiples of Sh50,000 starts on the settlement date 18 August 2025.

𝐑𝐞𝐝𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠 – The CBK will rediscount bonds (i.e. allow early/lower-price resale under CBK) as a last resort, at 3% above prevailing market yield or coupon rate (whichever is higher), with written instructions.

𝐑𝐞-𝐨𝐩𝐞𝐧𝐢𝐧𝐠 𝐂𝐥𝐚𝐮𝐬𝐞 – The bond may be re-opened in future; i.e. more supply of the same issue can be issued.

𝐈𝐅𝐁𝟏/𝟐𝟎𝟐𝟐/𝟏𝟗 (𝟏𝟗 𝐘𝐞𝐚𝐫 𝐁𝐨𝐧𝐝)

𝐑𝐞-𝐨𝐩𝐞𝐧𝐢𝐧𝐠 𝐃𝐚𝐭𝐞 / 𝐏𝐫𝐨𝐬𝐩𝐞𝐜𝐭𝐮𝐬 𝐃𝐚𝐭𝐞 – 18 August 2025

𝐁𝐢𝐝 𝐒𝐮𝐛𝐦𝐢𝐬𝐬𝐢𝐨𝐧 𝐃𝐞𝐚𝐝𝐥𝐢𝐧𝐞 / 𝐀𝐮𝐜𝐭𝐢𝐨𝐧 𝐃𝐚𝐭𝐞 – Wednesday, 13 August 2025, by 10:00 am.

𝐀𝐮𝐜𝐭𝐢𝐨𝐧 𝐃𝐚𝐭𝐞 – same day, 13 Aug 2025.

𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 – 18 August 2025, Wednesday, 13 August 2025, by 10:00 am.

𝐀𝐦𝐨𝐮𝐧𝐭 𝐎𝐟𝐟𝐞𝐫𝐞𝐝 (𝐏𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐩𝐚𝐢𝐫) – Total Sh90 billion across both bonds. (So the offer is split between the two issues.)

𝐌𝐢𝐧𝐢𝐦𝐮𝐦 𝐁𝐢𝐝𝐬 – Non-competitive minimum: Sh50,000.00; 𝐌𝐚𝐱𝐢𝐦𝐮𝐦 𝐁𝐢𝐝𝐬 – Sh50,000,000.00, Competitive bids: minimum Sh2 million per CDS account per tenor.

𝐂𝐨𝐮𝐩𝐨𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐃𝐚𝐭𝐞𝐬 (𝐰𝐡𝐞𝐧 𝐛𝐨𝐧𝐝 𝐩𝐚𝐲𝐬 𝐢𝐧𝐭𝐞𝐫𝐞𝐬𝐭) – Semi-annual coupons, starting 18 August 2025, then 16 Feb 2026, etc.

𝐏𝐫𝐢𝐜𝐢𝐧𝐠 / 𝐘𝐢𝐞𝐥𝐝 𝐯𝐬 𝐂𝐥𝐞𝐚𝐧 𝐏𝐫𝐢𝐜𝐞 𝐓𝐚𝐛𝐥𝐞 -There is a table showing, for different yield-to-maturity (YTM) levels, what the “clean price” would be. IFB1/2022/19: e.g. at 11.00% YTM, clean price ~ 111.7119; at 12.00% ~105.4961; at 13% etc. shows falling clean prices with rising yield.

𝐂𝐨𝐮𝐩𝐨𝐧 𝐑𝐚𝐭𝐞𝐬 – 12.965% per annum fixed coupon. Paid semi-annually

𝐒𝐞𝐜𝐨𝐧𝐝𝐚𝐫𝐲 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 – Secondary trading in multiples of Sh50,000 starts on the settlement date 18 August 2025.

𝐑𝐞𝐝𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠 – The CBK will rediscount bonds (i.e. allow early/lower-price resale under CBK) as a last resort, at 3% above prevailing market yield or coupon rate (whichever is higher), with written instructions.

𝐑𝐞-𝐨𝐩𝐞𝐧𝐢𝐧𝐠 𝐂𝐥𝐚𝐮𝐬𝐞 – The bond may be re-opened in future; i.e. more supply of the same issue can be issued.

𝐖𝐡𝐚𝐭 𝐭𝐨 𝐏𝐚𝐲 𝐀𝐭𝐭𝐞𝐧𝐭𝐢𝐨𝐧 𝐓𝐨 / 𝐇𝐨𝐰 𝐭𝐨 𝐄𝐯𝐚𝐥𝐮𝐚𝐭𝐞

Now this is the most important part, keep reading…

When reading a prospectus like the ones above, for an investor in Kenya (or elsewhere), here are crucial points to evaluate and questions to ask:

𝟏. 𝐂𝐨𝐮𝐩𝐨𝐧 𝐯𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐘𝐢𝐞𝐥𝐝

- What is the fixed coupon rate?

- What’s the current yield-to-maturity (YTM) in the market? If market yields are higher than the coupon, the bond trades below par; if lower, above. The pricing table helps you assess whether what you’re paying gives you an acceptable yield.

𝟐. 𝐂𝐥𝐞𝐚𝐧 𝐏𝐫𝐢𝐜𝐞 𝐯𝐬 𝐃𝐢𝐫𝐭𝐲 𝐏𝐫𝐢𝐜𝐞

- Clean price excludes accrued interest; dirty price includes it. Most purchases are done “dirty,” but knowing the clean price gives clarity on value.

𝟑. 𝐓𝐞𝐧𝐨𝐫 𝐚𝐧𝐝 𝐃𝐮𝐫𝐚𝐭𝐢𝐨𝐧

- A 15-year bond vs 19-year bond: longer maturities have greater interest rate risk (prices fall more if rates rise), more inflation risk, etc.

𝟒. 𝐂𝐨𝐮𝐩𝐨𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐃𝐚𝐭𝐞𝐬 / 𝐂𝐚𝐬𝐡 𝐅𝐥𝐨𝐰 𝐓𝐢𝐦𝐢𝐧𝐠

- When you get interest payments, and when the principal is repaid (in amortized or bullet structure). These affect reinvestment risk, liquidity, and matching of your cash needs.

𝟓.𝐌𝐢𝐧𝐢𝐦𝐮𝐦 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐚𝐧𝐝 𝐁𝐢𝐝 𝐂𝐨𝐧𝐬𝐭𝐫𝐚𝐢𝐧𝐭𝐬

- If you’re a small investor, whether the minimum non-competitive amount is affordable.

- Competitive bids have higher minimums.

𝟔. 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 & 𝐀𝐮𝐜𝐭𝐢𝐨𝐧 𝐃𝐚𝐭𝐞𝐬

- You must have funds ready by settlement date. Also, after settlement date, you start being the owner and receiving coupons, plus you can trade in the secondary market.

𝟕.𝐒𝐞𝐜𝐨𝐧𝐝𝐚𝐫𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 / 𝐓𝐫𝐚𝐝𝐚𝐛𝐢𝐥𝐢𝐭𝐲

- How easy will it be to sell? Multiples of trades (Sh50,000) and listing on Nairobi Securities Exchange help.

𝟖.𝐑𝐞𝐝𝐢𝐬𝐜𝐨𝐮𝐧𝐭 / 𝐄𝐚𝐫𝐥𝐲 𝐄𝐱𝐢𝐭 𝐂𝐨𝐧𝐝𝐢𝐭𝐢𝐨𝐧𝐬

- If you need to exit early, what pricing or penalties apply? Rediscounting at a margin above market yield is one such mechanic.

𝟗.𝐆𝐨𝐯𝐞𝐫𝐧𝐦𝐞𝐧𝐭 𝐂𝐫𝐞𝐝𝐢𝐭 𝐑𝐢𝐬𝐤 & 𝐈𝐧𝐟𝐥𝐚𝐭𝐢𝐨𝐧

- With long term Kenyan bonds, inflation can erode real return; also, risk that government may change policy, taxes, etc.

𝟏𝟎. 𝐑𝐞-𝐨𝐩𝐞𝐧𝐢𝐧𝐠 𝐎𝐩𝐭𝐢𝐨𝐧

- May dilute yield slightly or affect liquidity if many supply additions happen.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞: 𝐖𝐡𝐚𝐭 𝐚𝐧 𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫 𝐌𝐢𝐠𝐡𝐭 𝐂𝐨𝐦𝐩𝐮𝐭𝐞 / 𝐓𝐡𝐢𝐧𝐤 𝐓𝐡𝐫𝐨𝐮𝐠𝐡

Let’s take a hypothetical investor looking at IFB1/2022/19:

- Coupon is 12.965% per annum (semi-annual payments).

- Suppose the investor’s required yield is 13.5% (market rate)…from the price table (attached), at 13.50% YTM, the clean price is lower (you’d pay a discount). Looking at table: for 13.125% YTM price is ~ 99.1327; for 13.250% ~98.4634.

- They would compare if paying, say, Sh98 (plus accrued interest) for a Sh100 face value gives them acceptable returns, considering interest payments every six months, and then principal over the many years until 2038 or so.

Also consider; with longer maturity, if rates drop in future, you get big capital gain (if you sell), but if rates rise, you face larger capital loss.

If your priority is stable income rather than capital gain/loss, then coupon size, frequency, inflation expectations matter more.

So its important to merge your purpose or need to these fundamentals about bonds

𝑾𝒉𝒚 𝑰𝑭𝑩1/2018/15 𝒗𝒔 𝑰𝑭𝑩1/2022/19 𝑴𝒊𝒈𝒉𝒕 𝑩𝒆 𝑪𝒉𝒐𝒔𝒆𝒏 𝑫𝒊𝒇𝒇𝒆𝒓𝒆𝒏𝒕𝒍𝒚…

- 𝐒𝐭𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐯𝐬 𝐘𝐢𝐞𝐥𝐝

IFB1/2022/19 has a slightly higher coupon (12.965%) because its longer tenor increases risk, so it needs to compensate more. IFB1/2018/15, with 15 years, has 12.50%.

- 𝐃𝐮𝐫𝐚𝐭𝐢𝐨𝐧 (𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭 𝐑𝐚𝐭𝐞 𝐒𝐞𝐧𝐬𝐢𝐭𝐢𝐯𝐢𝐭𝐲)

The 19-year bond will respond more (price‐wise) to changes in interest rates/inflation. So if you expect rates to go up, less preferable; if you expect them to decline (or be stable), you could benefit more.

- 𝐂𝐚𝐬𝐡 𝐅𝐥𝐨𝐰 𝐌𝐚𝐭𝐜𝐡𝐢𝐧𝐠

If you need your money back earlier, or need to match liabilities, one may prefer the shorter maturity even if yield is a bit lower.

- 𝐌𝐚𝐫𝐤𝐞𝐭 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲

Which issue has more trading, more bid-ask tightness, etc. Often older issues or more frequently traded ones are easier to exit.

𝐊𝐞𝐲 𝐃𝐚𝐭𝐞𝐬 & 𝐅𝐢𝐠𝐮𝐫𝐞𝐬 𝐟𝐨𝐫 𝐈𝐅𝐁𝟏/𝟐𝟎𝟏𝟖/𝟏𝟓 & 𝐈𝐅𝐁𝟏/𝟐𝟎𝟐𝟐/𝟏𝟗 (𝐑𝐞-𝐨𝐩𝐞𝐧𝐞𝐝 𝐀𝐮𝐠𝐮𝐬𝐭 𝟐𝟎𝟐𝟓) 𝐘𝐨𝐮 𝐒𝐡𝐨𝐮𝐥𝐝 𝐡𝐚𝐯𝐞 𝐊𝐧𝐨𝐰𝐧…

- Dates

Bid deadline – 13 August 2025, 10am.

Auction – same day.

Settlement – 18 August 2025

- Coupon payments

Semiannual – For IFB1/2022/19 first coupon after re-opening is 18 August 2025; then 16 February 2026; and continues every 6 months. For IFB1/2018/15, has matching dates (e.g. around July / Jan cycles)

- Prices vs yields

The table in the prospectus shows, for example, for IFB1/2018/15 at YTM = 11.00% clean price is 105.7116; at 12.50% yield price drops to 99.9755.

For IFB1/2022/19, at 11.00% yield price is 111.7119; at 12.50% it’s 102.5903

Now let’s walk through a worked example: given how much you have to invest, what happens under different yield scenarios (what your return would be, your break- even inflation, etc.)

Example of an Investor case

Investor – You (individual, non-competitive bid).

Amount to invest – Sh1,000,000.

Bond – IFB1/2022/19

Coupon rate – 12.965% per annum, paid semi-annually.

Maturity – 19 years (to 2041).

Auction Settlement – 18 August 2025.

𝐒𝐭𝐞𝐩 𝟏: 𝐂𝐨𝐦𝐩𝐮𝐭𝐞 𝐂𝐨𝐮𝐩𝐨𝐧 𝐈𝐧𝐜𝐨𝐦𝐞

Annual coupon = 12.965% × 1,000,000 = Sh129,650.

Since it’s semi-annual, you get half = Sh64,825 every 6 months.

Over 19 years = 38 coupon payments.

𝐒𝐭𝐞𝐩 𝟐: 𝐏𝐫𝐢𝐜𝐞 𝐘𝐨𝐮 𝐌𝐢𝐠𝐡𝐭 𝐏𝐚𝐲

From CBK prospectus tables:

At 11.00% yield, clean price ~111.7119 (per 100).

At 12.50% yield, clean price ~102.5903.

At 13.00% yield, clean price ~99.7897.

This means if market yield is 13.0%, you’ll pay about Sh997,897 plus accrued interest

By market yield it means what investors ask for. During the real bidding of these bids, market yields went up hence the prizes came down and because discounting is allowed with these bonds according to the prospectus, everyone who bid paid less amounts than their Face values

𝐒𝐭𝐞𝐩 𝟑: 𝐘𝐢𝐞𝐥𝐝 𝐭𝐨 𝐌𝐚𝐭𝐮𝐫𝐢𝐭𝐲 (𝐘𝐓𝐌)

If you buy at that 99.79 price, your yield is 13%, slightly above coupon rate.

If yields fall later to 11%, the bond price rises to 111.71. That’s a capital gain of 11.9% if you sell.

If yields rise to 14%, the bond price falls further (say 96.4). That’s a capital loss of 3.4% if you sell.

𝐒𝐭𝐞𝐩 𝟒: 𝐂𝐚𝐬𝐡 𝐅𝐥𝐨𝐰 𝐏𝐫𝐨𝐣𝐞𝐜𝐭𝐢𝐨𝐧

If you hold to maturity:

Total coupons = 129,650 × 19 = Sh2.46 million.

Plus principal (Sh1,000,000).

Total = Sh3.46 million over 19 years.

(But remember inflation will eat into this; if inflation averages 8%, your real return is smaller.)

𝐒𝐭𝐞𝐩 𝟓: 𝐊𝐞𝐲 𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬

𝟏. 𝐀𝐦 𝐈 𝐛𝐮𝐲𝐢𝐧𝐠 𝐟𝐨𝐫 𝐢𝐧𝐜𝐨𝐦𝐞 𝐨𝐫 𝐟𝐨𝐫 𝐭𝐫𝐚𝐝𝐢𝐧𝐠?

Income investor – hold to maturity, focus on coupons.

Trader – watch yields, sell when price is favorable.

𝟐. 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭 𝐑𝐚𝐭𝐞 𝐎𝐮𝐭𝐥𝐨𝐨𝐤

If you expect rates to fall, buy the longer bond (bigger price gains).

If you expect rates to rise, safer in shorter maturities.

𝟑. 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐍𝐞𝐞𝐝𝐬

Can you hold for 19 years? If not, ensure you’re comfortable trading in secondary market.

𝐂𝐨𝐦𝐩𝐚𝐫𝐢𝐬𝐨𝐧 𝐰𝐢𝐭𝐡 𝐈𝐅𝐁𝟏/𝟐𝟎𝟏𝟖/𝟏𝟓

- Coupon – 12.50% (lower than 19-yr bond).

- Shorter maturity = less price sensitivity.

- Better if you want less risk from interest rate changes.

A scenario of projected investor returns (Sh1M invested) for both IFB1/2018/15 and IFB1/2022/19, under three scenarios (assuming they are bought at par i.e. Sh100):

- Hold to maturity

- Sell after 5 years if yields fall

- Sell after 5 years if yields rise?

𝐀𝐬𝐬𝐮𝐦𝐩𝐭𝐢𝐨𝐧𝐬 𝐚𝐫𝐞:

- IFB1/2018/15 (15-yr): Coupon = 12.50% p.a i.e. Sh125,000 yearly (62,500 semi-annual).

- IFB1/2022/19 (19-yr): Coupon = 12.965% p.a. i.e. Sh129,650 yearly (64,825 semi-annual).

- Investment = Sh1,000,000 Face value.

- Scenario analysis over 5 years.

Projected Investor Returns of each;

𝐈𝐅𝐁𝟏/𝟐𝟎𝟏𝟖/𝟏𝟓 (𝟏𝟐.𝟓𝟎%)

𝐒𝐜𝐞𝐧𝐚𝐫𝐢𝐨 𝟏 – 𝐇𝐨𝐥𝐝 𝐭𝐨 𝐌𝐚𝐭𝐮𝐫𝐢𝐭𝐲

- Coupons: 125,000 × 15 = 1,875,000

- Principal repaid: 1,000,000

- Total = 2,875,000

𝐒𝐜𝐞𝐧𝐚𝐫𝐢𝐨 𝟐 – 𝐒𝐞𝐥𝐥 𝐚𝐟𝐭𝐞𝐫 𝟓 𝐲𝐫𝐬 𝐢𝐟 𝐲𝐢𝐞𝐥𝐝𝐬 𝐟𝐚𝐥𝐥 (𝟏𝟏%)

- Coupons: 125,000 × 5 = 625,000

- Bond price rises by 111.7% → value = 1,117,000

- Total = 1,742,000

𝐒𝐜𝐞𝐧𝐚𝐫𝐢𝐨 𝟑 – 𝐒𝐞𝐥𝐥 𝐚𝐟𝐭𝐞𝐫 𝟓 𝐲𝐫𝐬 𝐢𝐟 𝐲𝐢𝐞𝐥𝐝𝐬 𝐫𝐢𝐬𝐞 (𝟏𝟒%)

- Coupons: 125,000 × 5 = 625,000

- Bond price falls by 96.4% → value = 964,000

- Total = 1,589,000

𝐈𝐅𝐁𝟏/𝟐𝟎𝟐𝟐/𝟏𝟗 (𝟏𝟐.𝟗𝟔𝟓%)

𝐒𝐜𝐞𝐧𝐚𝐫𝐢𝐨 𝟏.- 𝐇𝐨𝐥𝐝 𝐭𝐨 𝐦𝐚𝐭𝐮𝐫𝐢𝐭𝐲

- Coupons: 129,650 × 19 = 2,463,350

- Principal repaid: 1,000,000

- Total = 3,463,350

𝐒𝐜𝐞𝐧𝐚𝐫𝐢𝐨 𝟐. – 𝐒𝐞𝐥𝐥 𝐚𝐟𝐭𝐞𝐫 𝟓 𝐲𝐫𝐬 𝐢𝐟 𝐲𝐢𝐞𝐥𝐝𝐬 𝐟𝐚𝐥𝐥 (𝟏𝟏%)

- Coupons: 129,650 × 5 = 648,250

- Bond price rises by 111.7% → value = 1,117,000

- Total = 1,765,250

𝐒𝐜𝐞𝐧𝐚𝐫𝐢𝐨 𝟑. – 𝐒𝐞𝐥𝐥 𝐚𝐟𝐭𝐞𝐫 𝟓 𝐲𝐫𝐬 𝐢𝐟 𝐲𝐢𝐞𝐥𝐝𝐬 𝐫𝐢𝐬𝐞 (𝟏𝟒%)

- Coupons: 129,650 × 5 = 648,250

- Bond price falls by 96.4% → value = 964,000

- Total = 1,612,250

𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫

- 𝐇𝐢𝐠𝐡𝐞𝐫 𝐜𝐨𝐮𝐩𝐨𝐧 on the 19-year bond gives slightly better outcomes in all cases.

- 𝐇𝐨𝐥𝐝 𝐭𝐨 𝐦𝐚𝐭𝐮𝐫𝐢𝐭𝐲 → longer bond pays more in absolute shillings (Sh3.46M vs 2.88M), but you wait 4 extra years.

- 𝐈𝐟 𝐫𝐚𝐭𝐞𝐬 𝐟𝐚𝐥𝐥 → both gain capital value, but longer bond has bigger sensitivity (hence potentially larger gain if yields drop more than in this example).

- 𝐈𝐟 𝐫𝐚𝐭𝐞𝐬 𝐫𝐢𝐬𝐞 → both lose value, but again the longer bond is more sensitive, so bigger potential loss if interest rates climb higher.

𝐈𝐧 𝐬𝐡𝐨𝐫𝐭:

- 𝟏𝟓-𝐲𝐫 𝐛𝐨𝐧𝐝 (𝟐𝟎𝟏𝟖/𝟏𝟓) = safer, less volatile, good for stability.

- 𝟏𝟗-𝐲𝐫 𝐛𝐨𝐧𝐝 (𝟐𝟎𝟐𝟐/𝟏𝟗) = higher coupon, more total cash flows, but riskier to interest rate shifts.

Treasury bonds remain one of the most reliable ways to secure predictable cash flows while protecting your capital. Whether you’re looking for stability or higher long-term income, the key is aligning your choice with your financial goals and outlook on interest rates. Don’t just watch from the sidelines, position your portfolio to benefit from these opportunities today.

READ MORE: Rhina Namsia on what bond redemption and amortization means for you as an investor

Rhina Namsia is the founder and chief executive officer of The Acemt Consulting, a training and consultation company that provides financial planning and investment advisory.