Standard Chartered Bank Kenya has released its financial results for the nine months ending 30 September 2025, delivering what it calls a “resilient performance” in a year marked by softer revenues and a significant one-off pension-related charge.

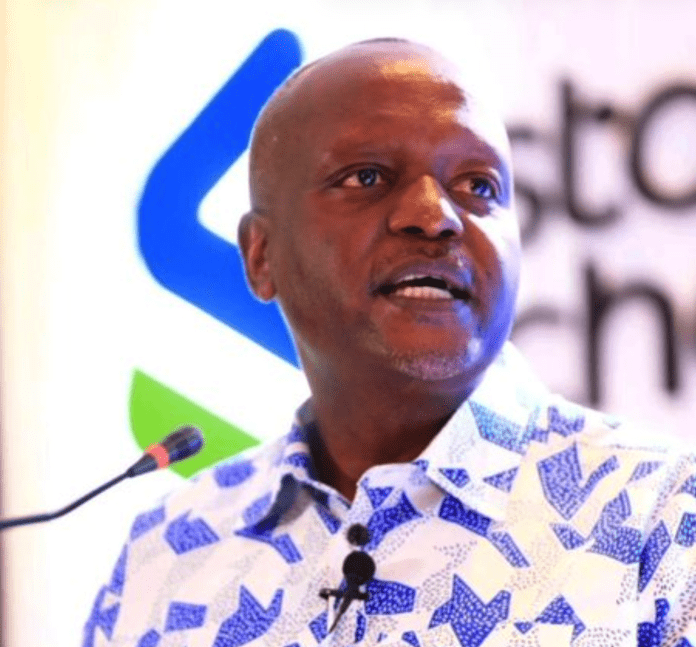

Group Managing Director and CEO, Kariuki Ngari, said the lender closed the third quarter with a profit before tax of KShs 13.2 billion, a 41% drop year-on-year, primarily driven by lower income and a KShs 2.7 billion past service cost following a Supreme Court ruling and Retirement Benefits Appeal Tribunal (RBAT) Orders.

Despite the hit, Ngari emphasised that the bank has “substantively discharged the Orders issued by the RBAT,” and continues to advance its cross-border, wealth-led strategy anchored on sustainability.

Strong wealth momentum despite revenue pressure

The bank’s Assets Under Management (AUM) climbed to KShs 290 billion, a notable 23% rise from December 2024—evidence of growing demand for wealth solutions even as traditional banking income softened.

A closer look at the numbers shows:

Operating income down 17%

-

Net interest income fell 10%, weighed down by lower loan volumes and margin compression amid declining interest rates.

-

Non-interest income dropped 29%, mainly due to weaker transaction volumes in Transaction Services and Markets, partially offset by gains in Wealth Solutions.

Operating Expenses Up 19%

-

Driven mainly by the KShs 2.7 billion one-off pension cost.

-

Underlying expenses rose only 1%, reflecting disciplined cost management while investing in digital growth.

Loan Impairments Improve

Impairment charges eased by 11%, supported by recoveries, prudent credit oversight, and stronger asset quality.

Standard Chartered group Q3 2024 results: Strong Financial growth and strategic focus

Balance Sheet Remains Solid and Highly Liquid

Despite revenue pressure, Standard Chartered maintained a fortress balance sheet:

-

Net loans to customers declined 3%, reflecting lower activity in transaction services, personal lending, and mortgages.

-

NPL ratio improved significantly, dropping 150 bps to 5.9%, indicating healthier asset quality.

-

Customer deposits slipped 4%, though the bank retains an enviably strong funding mix—97% of deposits are current and savings accounts (CASA).

-

Liquidity ratio stands at 66.6%, more than triple the regulatory minimum.

-

Total capital ratio at 20.6% remains well above statutory requirements.

Understanding the RBAT orders and the Pension Fund ruling

Following a September 2025 Supreme Court decision, the RBAT ordered the bank to:

-

Refund surplus withdrawn from the Standard Chartered Kenya Pension Fund in 2000, and

-

Pay KShs 2.5 billion to 629 appellants.

To comply:

-

The bank increased employer contributions to the scheme by KShs 2.7 billion, bringing cumulative contributions to KShs 4.7 billion.

-

Under accounting rules (IAS 19), this contribution was recognised as a past service cost, hitting the income statement directly.

-

As of 21 November 2025, the Scheme has already paid KShs 1.9 billion to 499 appellants.

-

30% of each payment has been withheld pending a High Court-directed determination on legal costs.

The verification process for the remaining appellants is ongoing, with the Scheme said to be well-funded to meet its obligations.

Economic outlook and CEO’s closing remarks

Ngari described Kenya’s macroeconomic environment as stable, supported by low inflation, easing interest rates, and a steady currency. But he warned of external pressures from global economic uncertainties.

Still, he struck an optimistic tone:

“We remain resolute in the strength of our strategy and the resilience of our people in supporting our clients navigate these challenging times.”

He also extended appreciation to the bank’s employees for their dedication.

Financial Snapshot (Jan–Sept 2025)

(KShs million)

| Metric | 30.9.2025 | 30.9.2024 | Change |

|---|---|---|---|

| Net interest income | 22,272 | 24,839 | (10%) |

| Non-funded income | 10,157 | 14,230 | (29%) |

| Total operating income | 32,429 | 39,069 | (17%) |

| Operating expenses | (17,481) | (14,642) | 19% |

| Loan impairment | (1,744) | (1,958) | (11%) |

| Profit before tax | 13,204 | 22,469 | (41%) |

| Profit after tax | 9,786 | 15,846 | (38%) |

| EPS | 25.57 | 41.60 | (39%) |

Balance Sheet

| Metric | 30.9.2025 | 31.12.2024 | Change |

|---|---|---|---|

| Loans to customers | 146,395 | 151,647 | (3%) |

| Customer deposits | 283,429 | 295,690 | (4%) |

| Loans-to-deposits ratio | 52% | 51% | — |

Capital

| Metric | 30.9.2025 | 31.12.2024 |

|---|---|---|

| Core capital | 57,300 | 54,089 |

| Core capital ratio | 20.59% | 19.48% |

| Total capital | 57,442 | 54,269 |

| Total capital ratio | 20.64% | 19.55% |