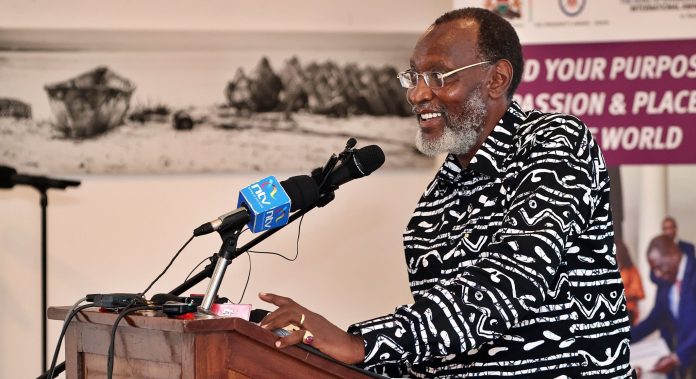

Businessman and former President Uhuru Kenyatta’s brother Muhoho Kenyatta has been named as the new non-executive director at the board of the NCBA Group. Mr. Kenyatta will assume his new position starting from December 1, 2025.

“The Board of Directors of NCBA Group PLC is pleased to announce the appointment of Mr. Muhoho Kenyatta as a Non-Executive Director, effective 1st December, 2025,” a statement by NCBA Group Managing Director and Chief Executive Officer John Gachora said.

Mr. Gachora described Mr. Kenyatta as an accomplished business executive with over 35 years of experience in leading and developing businesses across East Africa, spanning diverse sectors including manufacturing, healthcare, insurance, and banking.

“Mr Kenyatta has previously served as Deputy Chairman of one of the predecessor institutions of NCBA between 2000 and 2019, and as a director of NCBA Bank Uganda. He continues to support the Group’s growth in its digital strategy as a member of the Board of LOOP DFS Limited, a wholly owned subsidiary of NCBA Group PLC,” said Mr. Gachora.

Mr. Kenyatta’s new role is anchored by the Kenyatta family’s significant shareholding in the NCBA Group. The Kenyatta family currently has a shareholding stake of 13.2 percent in NCBA through the family’s investment vehicle which is known as Enke Investments.

The former first family is, however, ranked second after the Ndegwa family. The Ndegwas have a 14.94 percent shareholding stake in the banking group through the family’s investment vehicle which is known as First Chartered Securities.

Mr. Kenyatta’s appointment has as the NCBA Group dominates business news following an interest from South Africa’s Standard Bank.

According to a report that was published by Bloomberg, the South African lender has instructed its Kenyan subsidiary Stanbic Bank to open talks that could lead to the acquisition of the NCBA Group.

The acquisition, if successful, could create the third largest bank in Kenya after KCB Group and Equity Group. The Standard Bank Group is currently the largest bank in Africa by assets and holds a 75 percent stake in Kenya’s Stanbic Holdings PLC.

NCBA Group and Stanbic Holdings have however not openly speak on the reported pitch, which Bloomberg attributed to internal sources with knowledge on the matter.

The acquisition pitch by Standard Bank Group, if it has indeed been made, comes six years after NIC Bank and CBA Bank merged to form NCBA Group.

READ MORE: Ndegwa and Kenyatta families earn Sh12.4 billion in five days